🌍 Raoul Pal: 4 Billion Crypto Users & $100 Trillion Market Cap by 2030?

-

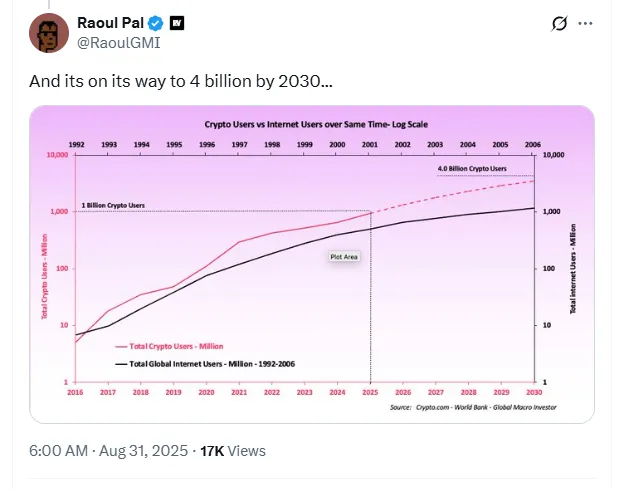

Crypto adoption is accelerating — and according to Raoul Pal (Global Macro Investor, Real Vision), the numbers could get massive within the next decade. Adoption vs. the Internet

Adoption vs. the InternetCrypto wallets are being compared to IP addresses during the early internet boom.

Pal notes crypto users have grown 137% annually for the last 9 years, hitting 659M by end of 2024.

By comparison, internet adoption back in 2000 was just 187M users (76% annual growth).

Projection: 1B users by 2030, scaling to as many as 4B users (1/2 the planet) in the longer term.

The Big Bull Case

The Big Bull CasePal forecasts crypto market cap → $100 trillion by 2032.

Catalysts:

Debasement → fiat losing value drives capital into scarce digital assets.

Adoption → network effects, more users = exponential growth.

His take: “Debasement explains 90% of price action; adoption explains 100% of outperformance.”

The Pushback

The PushbackCritics argue wallet count ≠ real user count.

Anyone can spin up thousands of wallets.

Many individuals keep multiple wallets (one user reported creating a new one every 6 months).

Andreessen Horowitz’s data suggests the real active monthly user base is closer to 30M–60M, not hundreds of millions.

Triple-A’s research estimated 560M users by end of 2024 — but again, definitions vary.

Takeaway for Investors

Takeaway for InvestorsIf Pal’s $100T market cap vision is anywhere close, crypto could 20–30x from today’s ~$3.5T cap.

Even if adoption slows and only 1B people use crypto by 2030, that’s still 1/8 of humanity in the asset class — an enormous shift.

Key alpha: adoption curves don’t need to be perfect — even a fraction of Pal’s scenario could make early positioning wildly profitable.

Question for the forum: Do you buy Pal’s “4B users, $100T cap” thesis — or is this just another case of bullish hopium that ignores messy real-world adoption?

Question for the forum: Do you buy Pal’s “4B users, $100T cap” thesis — or is this just another case of bullish hopium that ignores messy real-world adoption? -

Raoul Pal might sound overly bullish, but his internet adoption comparison is on point. If we even get HALF of his projection — say 1–2B users by 2030 — that’s still a financial revolution. $100T might be optimistic, but a multi-trillion expansion feels inevitable as institutions, governments, and consumers pile in.

Comparing crypto wallets to early internet IPs really highlights the potential network effect. Even a fraction of Pal’s adoption numbers would be massive for the market.

Comparing crypto wallets to early internet IPs really highlights the potential network effect. Even a fraction of Pal’s adoption numbers would be massive for the market.