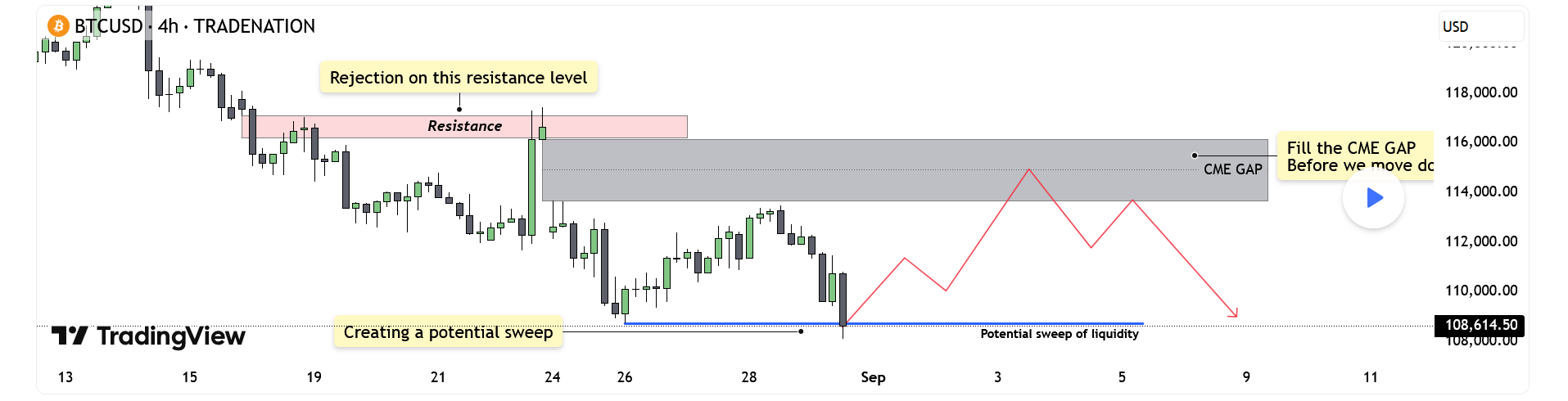

Bitcoin – Next Week Outlook: Liquidity Sweep Then Gap Fill

-

Bitcoin has been trading inside a broader downtrend, with repeated rejections at key resistance levels confirming bearish pressure. Recently, we saw price reject strongly at a 4H resistance zone, which set the stage for another leg down. However, before extending lower, there is still an unfilled CME gap above, and history shows that these gaps are often targeted before the market makes its next decisive move.Liquidity Sweep

The most recent drop into the 108,500 zone appears to have created a potential liquidity sweep. Price dipped below a short-term low, likely grabbing stop losses and inducing traders into shorts, which could fuel a reversal back upward. This kind of move often signals accumulation before the market retraces higher.CME Gap Dynamics

The CME gap between 114,000 and 116,000 remains unfilled, making it a strong magnet for price. Bitcoin has a clear tendency to revisit and fill these inefficiencies, and until that gap is resolved, I am leaning toward another upward push. The gap aligns with the rejection area from the previous resistance, so it would be a logical point for price to revisit before resuming the downward move.Short-Term Scenarios

If Bitcoin holds above the recent liquidity sweep and builds strength on lower timeframes, I expect a climb back toward the CME gap. Once that gap is filled, the reaction from 115,000–116,000 will be key. If sellers defend that level again, the market could set up for another decline, targeting the lows around 109,000 and potentially lower. On the other hand, a clean break and acceptance above 116,000 would challenge the bearish bias, but for now that is less likely given the trend context.Expectations and Targets

The primary expectation is for Bitcoin to rally back into the 114,000–116,000 zone to fill the CME gap. From there, I anticipate sellers to step in again, driving price back down toward 110,000 and possibly retesting the sweep lows. This sequence of liquidity sweep, gap fill, and bearish continuation would align with the current market structure.Conclusion

In summary, Bitcoin has swept liquidity at the lows and now has unfinished business above with the CME gap. A move up into that gap looks probable before we see continuation to the downside. As long as price respects the 4H resistance zone after the gap is filled, I will maintain a bearish outlook with eyes on new lows afterward. -

Great analysis! The liquidity sweep around 108,500 really does look like a classic trap to grab stops before reversing higher. The CME gap at 114K–116K is a strong magnet, and Bitcoin’s history of filling those inefficiencies makes your upside target very realistic. I agree that the bearish continuation only makes sense after that gap is filled. Clear, structured, and logical breakdown — well done!

-

Solid breakdown. What I like most is how you tied the liquidity sweep to CME gap dynamics. Historically, BTC almost always revisits these gaps, so your expectation for a rally back into 114K–116K is spot on. From a macro angle, with rate cut expectations rising, it’s reasonable to see a short-term pump before sellers step in again. I’d watch funding rates closely to confirm if retail longs pile in around that gap. Great work!

-

Really sharp insights! I think your scenario perfectly highlights why traders need patience. Shorting into the liquidity sweep was risky, but waiting for a gap fill around 115K–116K creates much better risk/reward for bears. The invalidation above 116K is also well placed — no need to fight the market if it breaks structure. This is exactly the type of disciplined roadmap traders should follow. Thanks for sharing!

-

Excellent take! I agree the CME gap is a key magnet, but I’d add one caution — if BTC fails to build momentum after the sweep and stalls under 112K–113K, we could see a rare case where the gap remains open. Unlikely, but worth keeping in mind. That said, your roadmap (sweep → gap fill → rejection) is the highest probability play right now. Very practical and easy to follow idea!