Pudgy Penguins Game Cracks App Store Top 10, But $PENGU Token Keeps Slipping 🐧📉🎮

-

The Pudgy Penguins franchise is soaring in mainstream visibility — but its token isn’t feeling the love.

Pudgy Party Game Launch

Pudgy Party Game LaunchNew battle royale game “Pudgy Party” launched on iOS & Android.

50,000+ downloads on Google Play.

50,000+ downloads on Google Play. Cracked the Top 10 most downloaded games on Apple’s App Store.

Cracked the Top 10 most downloaded games on Apple’s App Store. Token Price Action

Token Price Action$PENGU fell ~4% on Friday, despite the game’s strong debut.

Over the past 30 days, the token is down 20%+ (CoinMarketCap).

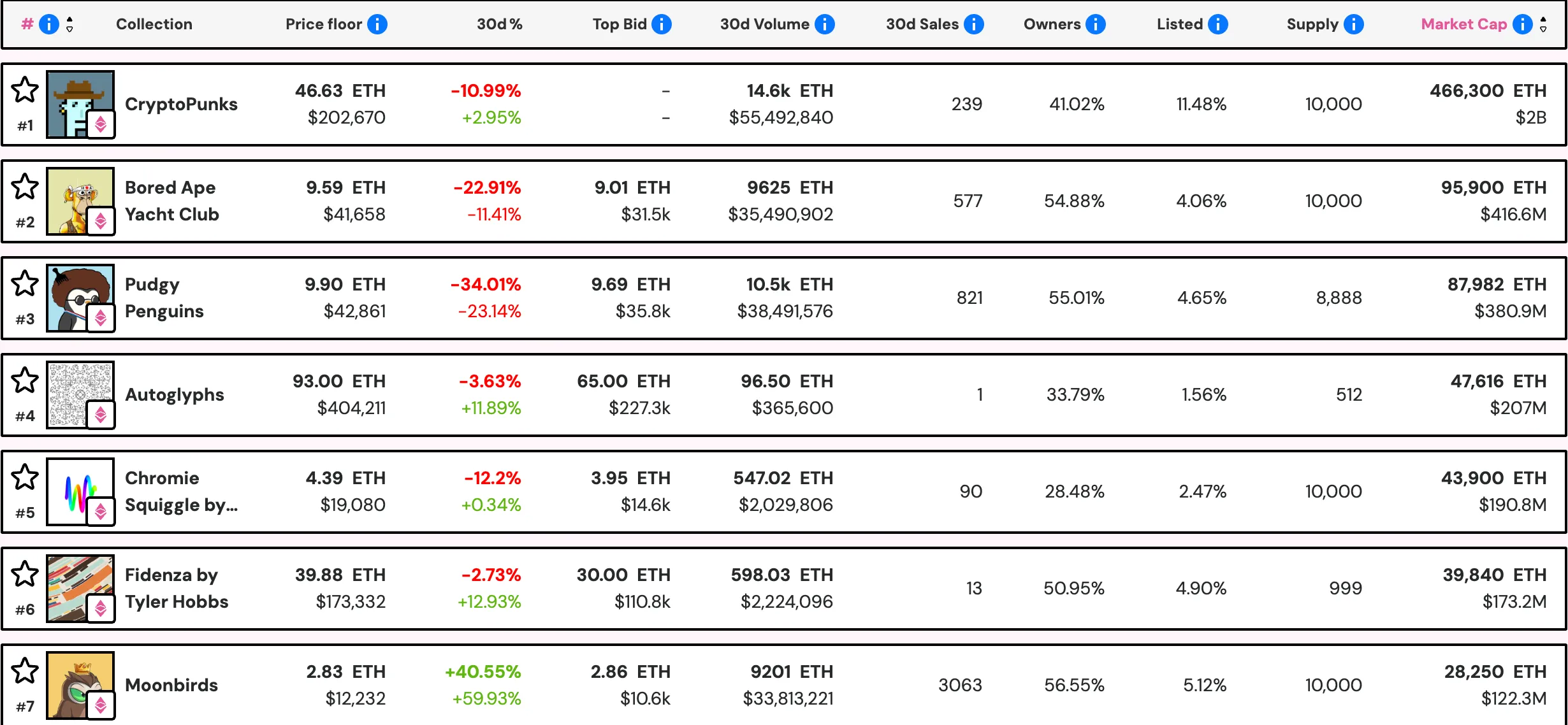

Reflects wider NFT market slump → Bored Ape Yacht Club (–11%), Doodles (double-digit drop).

Cultural Appeal vs. Market Reality

Cultural Appeal vs. Market RealityPudgy Penguins has become a cross-over brand:

NFTs + trading cards + plush toys + video games.

Strong resonance beyond Web3 → kids, collectors, and mainstream gamers.

Yet token value remains tied to NFT market cycles and broader ETH price action.

The NFT Market Backdrop

The NFT Market BackdropETH dropped from $4,957 ATH → $4,397, dragging NFT valuations lower.

NFT market cap:

$9.3B in early August → now $7.4B.

Exception: CryptoPunks +3% in August, showing relative resilience among blue chips.

🧩 The Takeaway

Pudgy Penguins may be winning the mainstream adoption game, but token holders are feeling the sting of the broader NFT downturn.

Question: Does Pudgy’s cultural brand expansion make $PENGU a long-term play — or will it always remain chained to ETH’s price swings and NFT market sentiment?

Question: Does Pudgy’s cultural brand expansion make $PENGU a long-term play — or will it always remain chained to ETH’s price swings and NFT market sentiment? -

Pudgy Penguins are proving that Web3 brands can break into mainstream culture in a big way — plush toys, games, and now top App Store charts are no small feat. The token may be struggling with market cycles right now, but the cultural footprint they’re building feels like a foundation for long-term strength.

-

The contrast is real — massive success on the cultural and gaming front, but price action reflecting the wider NFT downturn. Still, it’s rare to see an NFT brand resonate this deeply outside of crypto. If they keep delivering experiences that bring new audiences in, $PENGU might just outlast the usual market noise.

-

The Pudgy team has done what most NFT projects only dream about: break out of the Web3 bubble into toys, games, and culture. Kids don’t care about ETH cycles, they just want fun characters. That kind of IP strength doesn’t disappear with bear markets. If they keep expanding mainstream touchpoints, $PENGU could eventually decouple from NFT volatility.

-

Honestly, the cultural success doesn’t matter if tokenomics don’t capture value. The brand is growing, sure, but $PENGU isn’t structured like Disney stock. Until there’s a clear pipeline from toy/game revenue → token holders, the price will stay tied to ETH and NFT sentiment. Narrative alone won’t protect it.

-

The sell-off looks more about ETH weakness than Pudgy fundamentals. ETH lost 10%+ from ATH, NFT market cap dropped $2B+, and PENGU just moved with the tide. CryptoPunks held up better because they’re considered blue-chip art. Pudgy sits in the “growth brand” bucket — so when ETH dips, it bleeds harder.

-

I see this as a divergence between culture and market structure. On one side, Pudgy Penguins is crushing it with games, plushies, and downloads. On the other, $PENGU as a token is still chained to ETH liquidity and NFT cycles. Long-term play? Yes, if they figure out sustainable value capture. Short-term? Still a beta trade on ETH + NFTs.