El Salvador Moves Bitcoin to 14 Wallets Over Quantum Security Concerns 🛰️🔐

-

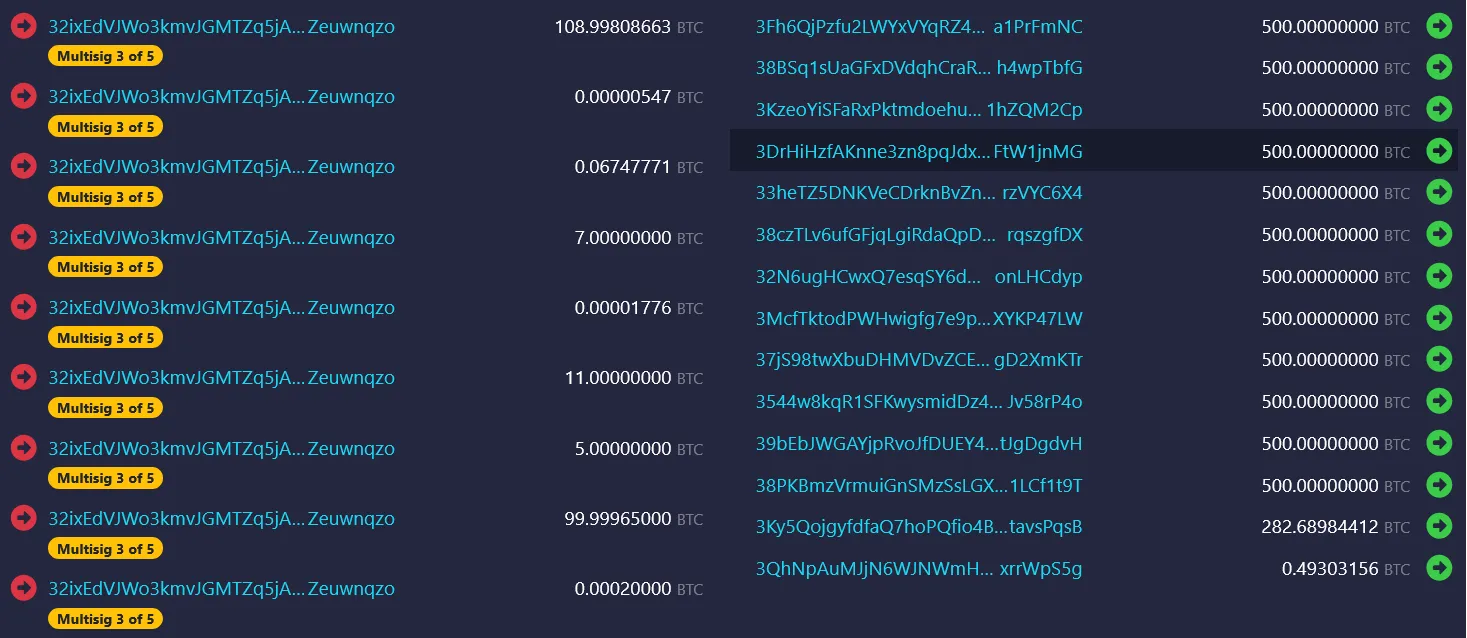

El Salvador has quietly redistributed its Bitcoin reserves into 14 separate wallet addresses — a move its Bitcoin Office says is aimed at reducing potential risks from future quantum computing attacks.

🪙 What Changed

El Salvador previously held 6,274 BTC (~$678M) in a single address.

El Salvador previously held 6,274 BTC (~$678M) in a single address.On Friday, those funds were split into 14 new wallets, each capped at 500 BTC.

The Bitcoin Office explained: once funds are spent, their public keys are revealed, making them theoretically vulnerable to quantum cracking down the line.

Why Quantum Matters (Eventually)

Why Quantum Matters (Eventually)Project Eleven estimates 6M+ BTC (~$650B) could be at risk if elliptic curve cryptography (ECC) were broken.

But for now, the risk is low: no quantum computer has cracked even a 3-bit key, far from Bitcoin’s 256-bit standard.

Michael Saylor (MicroStrategy) dismissed the panic in June:

“If quantum becomes real, Bitcoin just upgrades — like Microsoft, Google, or the US government do with software.”

IMF Tensions Still in Play

IMF Tensions Still in PlayAn IMF report in July claimed El Salvador hasn’t bought new BTC since February, raising doubts over its official narrative.

Bukele’s Bitcoin Office continues to post about ongoing purchases, but hasn’t directly addressed IMF claims.

El Salvador previously secured a $1.4B IMF funding package in late 2024, conditional on scaling back Bitcoin initiatives — a source of ongoing friction.

🧩 The Takeaway

El Salvador’s quantum-proofing move may be more about optics than urgent necessity, but it highlights:

Nation-states now treating Bitcoin custody with sovereign-level security strategies.

Nation-states now treating Bitcoin custody with sovereign-level security strategies. Quantum remains a future concern, not an immediate threat.

Quantum remains a future concern, not an immediate threat. IMF disputes suggest El Salvador’s Bitcoin experiment is still politically and financially contested.

IMF disputes suggest El Salvador’s Bitcoin experiment is still politically and financially contested. Do you think El Salvador’s move is forward-thinking risk management, or just a symbolic flex to signal long-term conviction in BTC?

Do you think El Salvador’s move is forward-thinking risk management, or just a symbolic flex to signal long-term conviction in BTC? -

Interesting move by El Salvador splitting their BTC into multiple wallets feels like a smart, forward-looking approach. Even if quantum threats are still far off, it shows they’re taking digital asset security seriously at a national level. Definitely a step toward treating Bitcoin like sovereign money.

-

I love how El Salvador continues to experiment with Bitcoin custody on a large scale. Whether it’s risk management or signaling long-term conviction, it’s fascinating to see a country think ahead about potential quantum risks while navigating IMF tensions. Bold, but thoughtful.

-

Honestly, I think this is a smart, forward-thinking move. Even if quantum risk isn’t immediate, why wait until it becomes a crisis? Splitting holdings across wallets is simple operational security, and it shows El Salvador is treating BTC like a true sovereign reserve. Optics aside, it’s better to be early than sorry.

-

To me this feels more like a symbolic flex than real security. Quantum computers are nowhere near breaking Bitcoin’s ECC today. El Salvador probably just wanted headlines that make them look like they’re ahead of the curve. Still, I guess symbolism matters in politics and markets.

-

The interesting part isn’t even the quantum narrative — it’s the IMF tension. Bukele is doubling down on “we’re in this for the long haul” while the IMF keeps pushing back. Redistributing wallets shows conviction, but also sends a message: Bitcoin is now part of El Salvador’s national identity, whether the IMF likes it or not.

-

It’s probably both: a symbolic move AND decent risk management. Yes, quantum is far off, but splitting reserves across wallets is good practice regardless. The bigger question is whether this strategy can withstand external pressure — the IMF funding conditions are still the elephant in the room for El Salvador’s Bitcoin experiment.