Can Crypto Mortgages Help Young Americans Buy Homes?

-

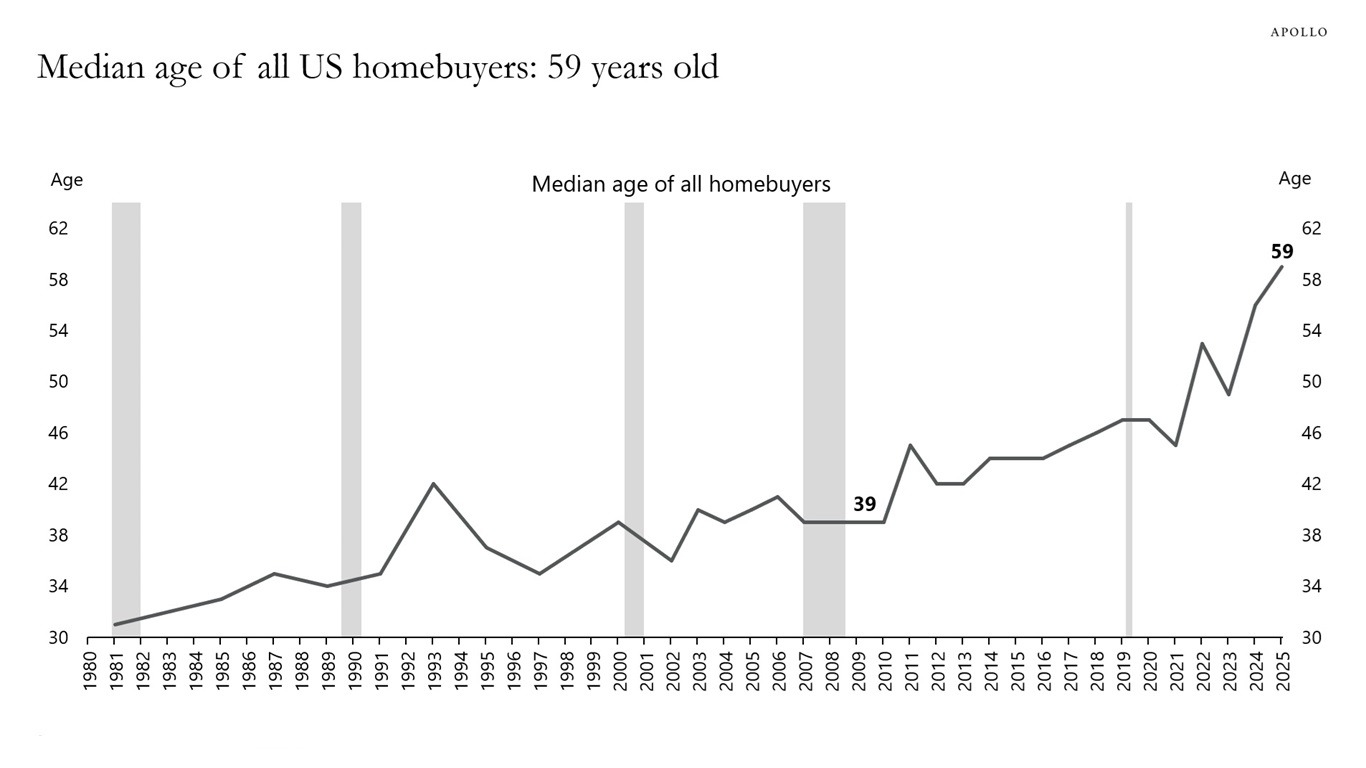

The median age of US homeowners is nearly 60 years old. Source: Apollo, National Association of RealtorsUS homeownership rates have hovered between 60% and 70% for decades, but the age of homeowners has changed dramatically. The median homeowner age has climbed to nearly 60, highlighting how Millennials and Gen Z are being priced out of the market. Because most crypto holders are under 44, allowing digital assets to count toward mortgage applications could marginally improve access for younger buyers — especially as institutional investors continue to concentrate single-family housing supply.

Still, significant caveats remain. Lenders are likely to apply steep valuation haircuts to crypto assets to manage volatility, and acceptance may be limited largely to Bitcoin rather than altcoins. Political support has also split sharply, with figures like Elizabeth Warren and Bernie Sanders warning about systemic risk, while supporters such as Cynthia Lummis push legislation to formalize crypto’s role in mortgages. Ultimately, crypto-backed home loans will rise or fall not on ideology, but on whether lenders decide the risk makes business sense.

-

wild how housing keeps aging up while everyone under 40 just watches from the sidelines