⚛️ Quantum Technology vs. Bitcoin: Threat or Overhype?

-

Quantum technology is advancing fast — promising computers that could solve problems in seconds that would take classical machines decades. But what does this mean for Bitcoin?

What Is Quantum Technology?

What Is Quantum Technology?Born from quantum mechanics (early 1900s physics of atoms & particles).

Already in use: lasers, MRI machines, transistors.

Quantum computers could be up to 300,000x faster than today’s best.

Fun fact: Einstein won his Nobel Prize for work on the photoelectric effect (a foundation of quantum theory), not relativity.

Fun fact: Einstein won his Nobel Prize for work on the photoelectric effect (a foundation of quantum theory), not relativity. ️ Why Bitcoin Could Be at Risk

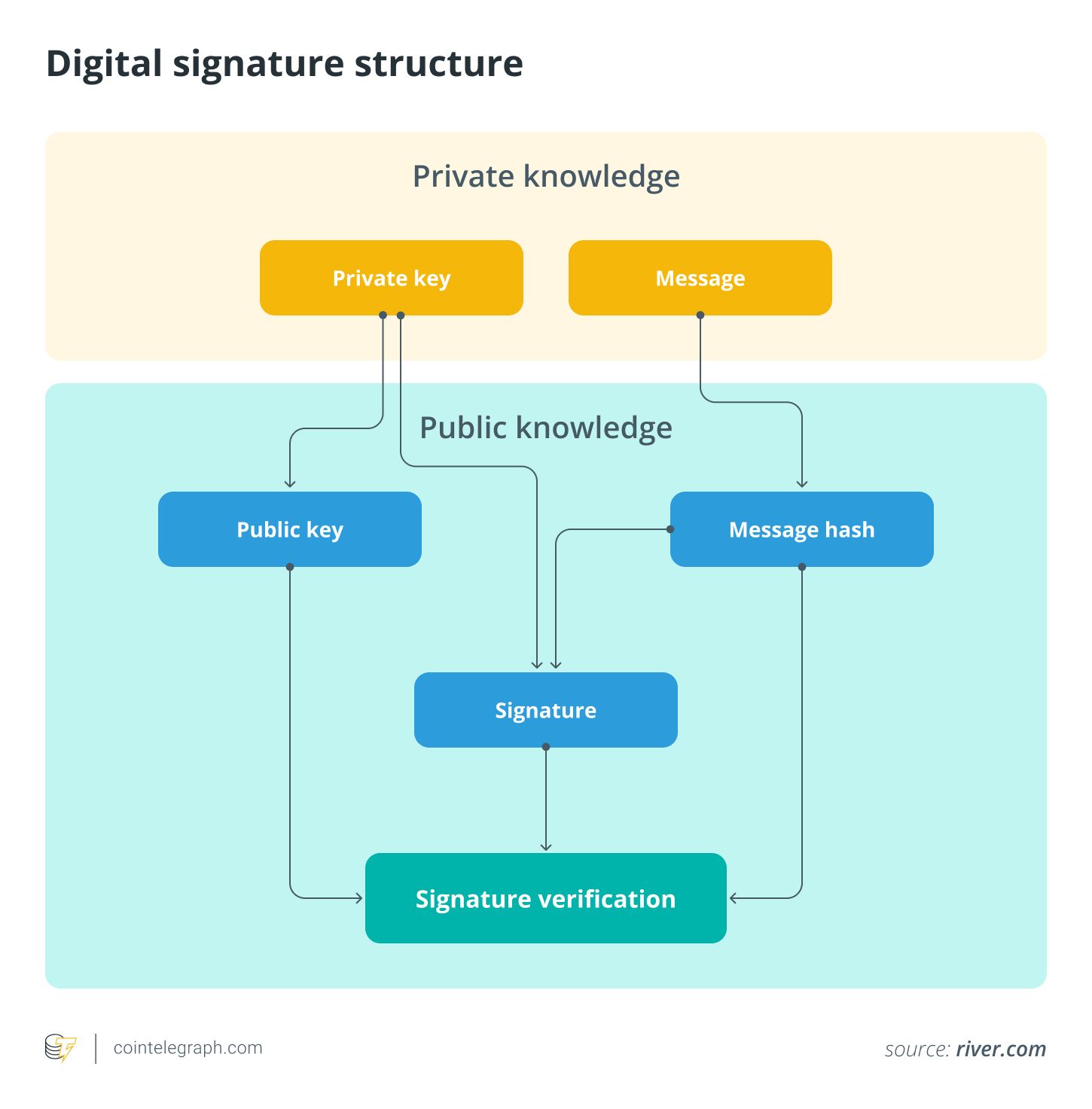

️ Why Bitcoin Could Be at RiskBitcoin security relies on the Elliptic Curve Digital Signature Algorithm (ECDSA):

Generates public-private key pairs.

Private keys = ownership; lose them, lose your BTC.

Security depends on the hardness of the elliptic curve discrete log problem (ECDLP).

Enter Shor’s algorithm (1994): A quantum algorithm that, once run on a powerful enough quantum computer, could reverse-engineer private keys from public keys — effectively breaking Bitcoin wallets.

Enter Shor’s algorithm (1994): A quantum algorithm that, once run on a powerful enough quantum computer, could reverse-engineer private keys from public keys — effectively breaking Bitcoin wallets. Current State of Quantum Progress

Current State of Quantum ProgressToday’s quantum machines: 100–1,000 qubits.

To break Bitcoin’s cryptography: estimates range from 13M–300M qubits.

Translation: still decades away — but progress is accelerating.

Even Michael Saylor and Adam Back say quantum isn’t an immediate threat.

The Real Dangers

The Real DangersWallets with reused/exposed public keys (e.g., old P2PK/P2PKH addresses) are the weak link.

Roughly 25% of Bitcoin sits in such addresses.

Lost wallets (2.3M–3.7M BTC = ~11–18% of supply) could theoretically be “revived” by quantum hacks.

Imagine Satoshi’s 1M BTC suddenly moving…

BlackRock even added a quantum risk warning in its 2025 IBIT filing.

️ Ethical & Economic Questions

️ Ethical & Economic QuestionsIf quantum unlocked lost Bitcoin:

Scarcity would be disrupted → market shock.

Some propose burning recovered coins to preserve integrity.

Others argue for redistribution to rebalance wealth.

🧰 How to Protect Your Bitcoin (Today)

Don’t reuse addresses → use wallets that auto-generate new ones.

Don’t reuse addresses → use wallets that auto-generate new ones. Prefer SegWit & Taproot wallets (better security).

Prefer SegWit & Taproot wallets (better security). Be wary of phishing (address poisoning, fake histories).

Be wary of phishing (address poisoning, fake histories). Stay updated on quantum-resistant wallets as they roll out.

Stay updated on quantum-resistant wallets as they roll out. Quantum Resistance Research

Quantum Resistance ResearchQRAMP protocol (2025) → proposed to protect BTC + enable cross-chain security.

Post-quantum cryptography → stronger signatures, unhackable wallets, scalability boosts.

Bitcoin’s open-source adaptability means the network can upgrade if needed.

The Takeaway

The TakeawayQuantum risk to Bitcoin is real, but not immediate.

The real danger today? Phishing & human error, not qubits.

Developers are already building quantum-resistant solutions to future-proof the network.

Think of quantum risk like climate change for Bitcoin: long-term, inevitable, but manageable if prepared early.

-

Good breakdown

People underestimate how adaptable Bitcoin really is. Post-quantum signatures (like lattice-based cryptography) are already being tested, and if/when quantum becomes a real threat, the network can hard fork or soft fork to upgrade. Bitcoin isn’t static—it’s battle-tested and built to evolve. The real weak link isn’t the code, it’s us humans falling for phishing links.

People underestimate how adaptable Bitcoin really is. Post-quantum signatures (like lattice-based cryptography) are already being tested, and if/when quantum becomes a real threat, the network can hard fork or soft fork to upgrade. Bitcoin isn’t static—it’s battle-tested and built to evolve. The real weak link isn’t the code, it’s us humans falling for phishing links. -

Quantum fear is real, but it’s not today’s problem. We’re still decades away from qubits that can break secp256k1. Right now, hackers don’t need quantum—they just need someone to sign a bad transaction. Education, multisig, and better wallet UX matter more in 2025 than worrying about a quantum computer that doesn’t exist yet.

-

Quantum risk is fascinating but often overblown. The real vulnerability isn’t active wallets — it’s those legacy addresses with exposed public keys. If Satoshi’s stash ever moved due to quantum, the psychological shock alone could be bigger than the actual inflationary effect.

-