Traders Absorb Losses as Transparency Concerns Mount

-

The fallout was widespread. More than 4,300 traders interacted with the NYC token, with roughly 60% ending up in the red. While most losses were under $1,000, dozens of traders reportedly lost five or six figures, highlighting how sudden liquidity shifts can trap participants in fast-moving markets and accelerate panic selling.

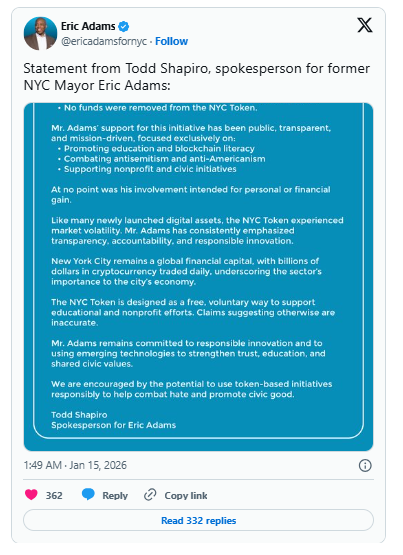

Adams’ team has denied any wrongdoing, with a spokesperson stating that the volatility was typical of newly launched digital assets and that no investor funds were misappropriated. Still, analysts warn that incidents like this erode trust across the memecoin ecosystem, underscoring the need for clearer communication around liquidity management and greater caution from investors navigating highly speculative token launches.