Bitcoin Miners Just Sold $485M in 12 Days — Should We Worry? ⚡💰

-

Key takeaways:

️ Bitcoin miners sold $485 million worth of BTC between Aug. 11–23 — their fastest offloading pace in 9 months.

️ Bitcoin miners sold $485 million worth of BTC between Aug. 11–23 — their fastest offloading pace in 9 months. Despite the selling, Bitcoin’s network hashrate and fundamentals remain rock-solid.

Despite the selling, Bitcoin’s network hashrate and fundamentals remain rock-solid.The Sell-Off Story

Bitcoin (BTC $111,254) has clawed its way back above $112K, rebounding from a six-week low earlier this week. But traders aren’t entirely at ease: miners have been selling coins at a pace not seen since December 2024.

In the past 12 days, miners dumped 4,207 BTC (~$485M). For context:

In the past 12 days, miners dumped 4,207 BTC (~$485M). For context:Between April–July, miners were in accumulation mode, adding 6,675 BTC.

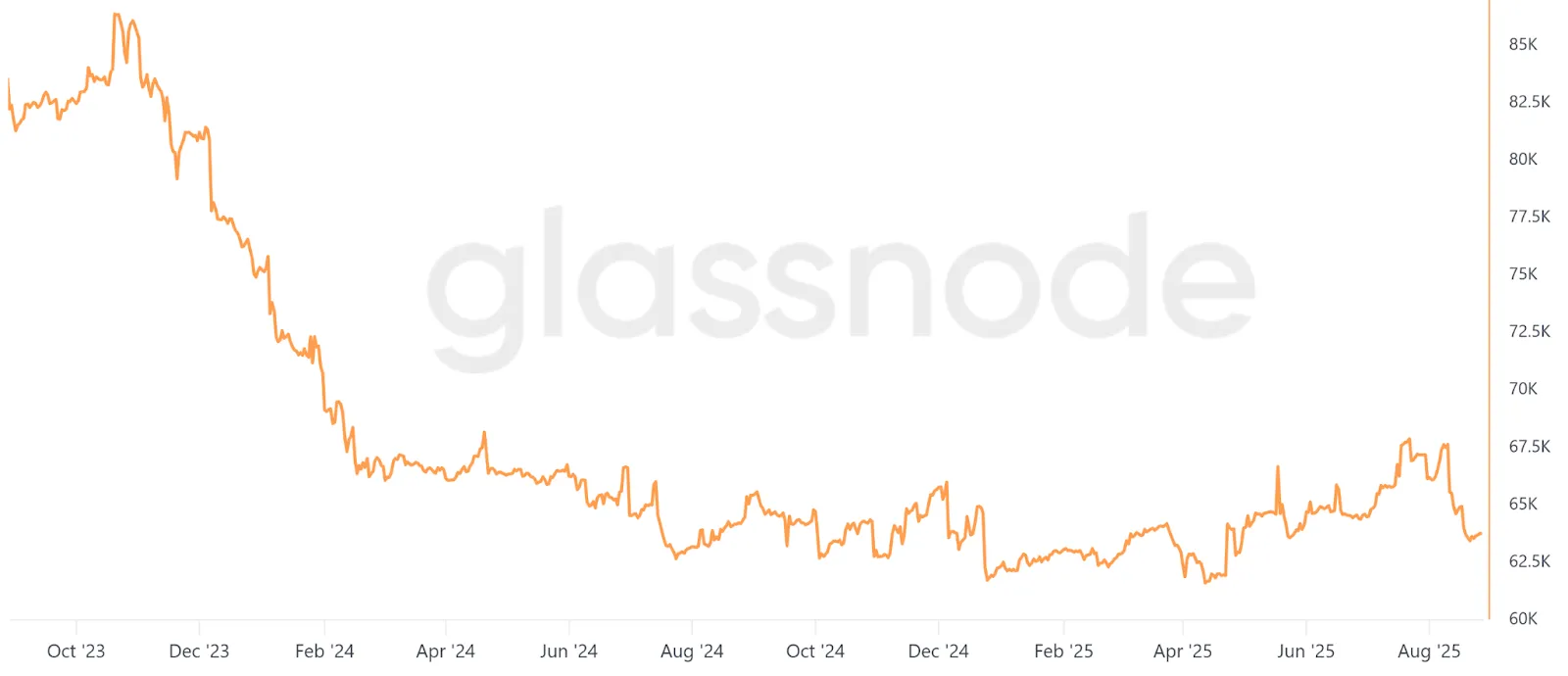

Now, balances stand at 63,736 BTC (~$7.1B).

While these flows are peanuts compared to the likes of MicroStrategy or Metaplanet, miner activity tends to spark outsized FUD because it’s seen as a barometer of confidence (or stress).

Why Sell Now?

According to HashRateIndex:

BTC is up 18% in 9 months

Miner profitability is down 10%

Factors:

Higher mining difficulty (the network keeps adjusting to maintain 10-minute blocks).

Lower on-chain transaction demand = weaker fee revenue.

The hashprice index (profitability per PH/s) is at 54 PH/s, down from 59 PH/s a month ago. Still, even rigs like the Bitmain S19 XP remain profitable at $0.09/kWh, so it’s not exactly panic mode.

Enter AI: The New Rival

️

️

Another wrinkle: miners are eyeing AI data centers as a juicier use of their infrastructure.

TeraWulf (WULF) struck a $3.2B deal with Google (14% equity stake) to fund an AI campus.

Iren (ex-Iris Energy) is going heavy on Nvidia GPUs in Texas & Canada.

Hive is putting $30M into GPU expansion in Quebec.

The narrative is shifting: hashrate vs. GPU clusters. But the Bitcoin network itself? Still thriving.

Fundamentals: Still Bulletproof

Bitcoin’s hashrate: ~960M TH/s, near ATH.

Up 7% in 3 months.

No clear evidence of miners being under liquidation stress.

In other words: the network is shrugging off miner sales. Corporate and institutional demand (think MSTR, ETFs, etc.) can easily soak up the selling.

The Bottom Line

Yes, miners sold off big — but fundamentals suggest this isn’t the start of a miner capitulation spiral. Instead, it looks more like cash flow balancing + AI pivot hype than systemic weakness.

What’s your take?

What’s your take?Normal miner rebalancing?

Or early signs of stress in the mining sector as AI competition heats up?

-

Makes sense — miners selling here looks more like treasury management than panic. With hashrate still strong and difficulty holding, I’d call this routine rebalancing. The AI pivot narrative just adds fuel for why some miners might diversify cash flow. Doesn’t look like capitulation yet.

-

Interesting take, but I’m leaning more cautious. Yes, miners often sell to cover costs, but the scale + timing with AI hype suggests pressure is real. Energy costs are climbing, margins are thinning, and if BTC doesn’t keep pushing up, we could see stress accelerate into a bigger wave of miner selling.