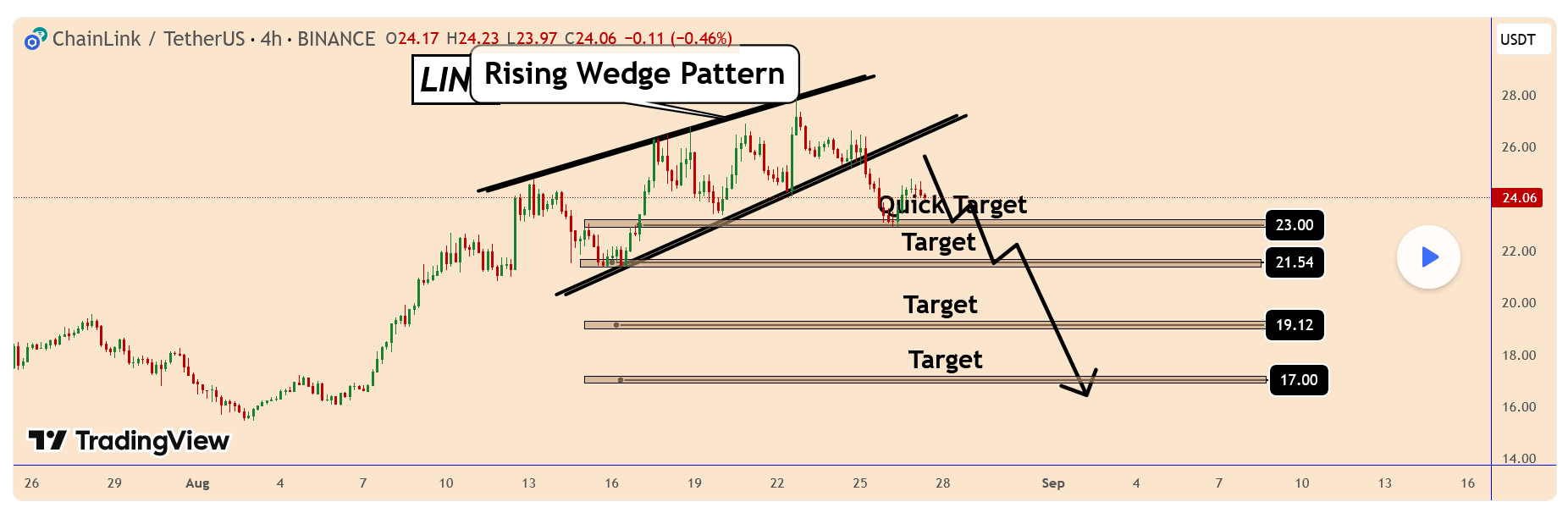

LINK: Bearish Setup: Rising Wedge Breakdown

-

This setup favors short positions or caution for long trades. The breakdown below the wedge provides a clear change in trend. If LINK fails to invalidate this pattern quickly, the path toward $17 looks increasingly probable.

LINK has already broken below the wedge, which confirms the bearish bias.

This breakdown suggests sellers are gaining control, and a deeper move is likely.Target 1: $23.00

Target 2: $21.50

Target 3: $19

Target 4: $17You may find more details in the chart!

Thank you and Good Luck!PS: Please support with a like or comment if you find this analysis useful for your trading day

-

Really solid breakdown! The wedge structure was getting weaker with every retest, and once LINK broke below it, the bearish bias became very clear. I agree that the sellers have the upper hand now, especially with momentum indicators pointing down and volume confirming the breakdown. The $23–21.5 range looks like the first logical stop, but I like that you’ve mapped out deeper levels at $19 and $17 — those line up nicely with historical support zones and liquidity pools. Definitely a setup to watch for traders who prefer confirmation over speculation. Thanks for sharing this with so much clarity!

-

I like how this connects policy, institutions, and ETH price action. Stablecoins are the killer app that forces TradFi adoption, and Ethereum is clearly positioned as the settlement backbone. The Genius Act + VanEck’s comments basically confirm that institutions are preparing to plug into Ethereum rails whether they like it or not. The part about ECM (Ethereum-compatible methodology) is important too — even if ETH isn’t the only chain, EVM standards will dominate. If ETH ETFs keep pulling inflows and banks start routing stablecoin payments onchain, $5K ETH could just be the beginning. Great analysis!

The wedge break is pretty clear on the chart. Agree that unless bulls step in fast, the $21.5–$19 zone looks very realistic before any bounce attempt

The wedge break is pretty clear on the chart. Agree that unless bulls step in fast, the $21.5–$19 zone looks very realistic before any bounce attempt