🇻🇪 Venezuela: Crypto Becomes a Lifeline as Bolívar Collapses

-

As Venezuela’s economy spirals deeper into crisis, cryptocurrencies are moving from fringe to core — becoming a practical shield against hyperinflation, government controls, and banking restrictions. Everyday Crypto Usage

Everyday Crypto UsageFrom family shops to large retailers, merchants now accept crypto via Binance and Airtm.

Some companies even pay employees in stablecoins.

Universities are rolling out crypto courses.

Shopper Victor Sousa (paid in USDT):

Shopper Victor Sousa (paid in USDT):“The plan is to one day have my savings in crypto.”

Adoption Rankings

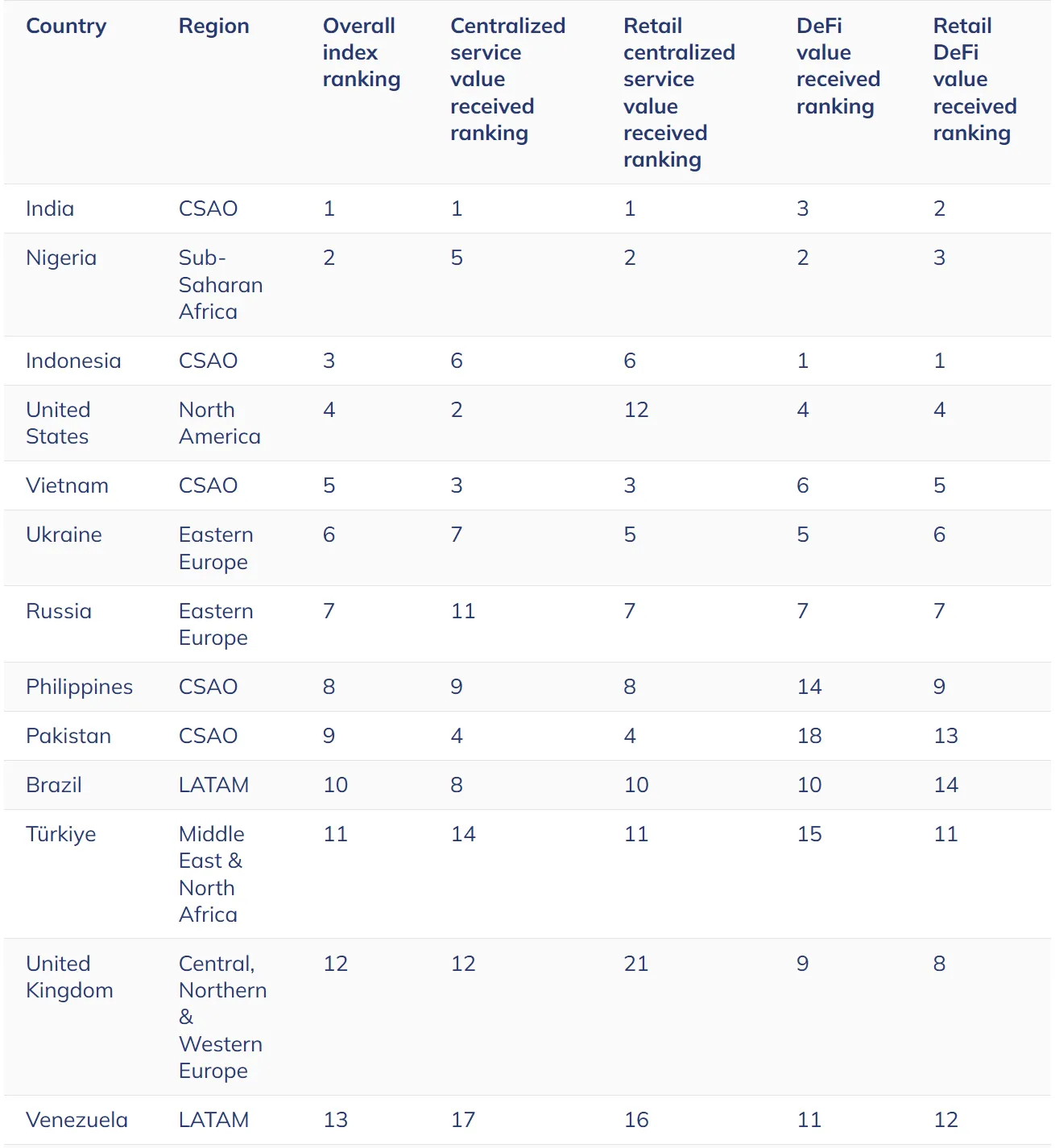

Adoption RankingsVenezuela ranks 13th globally for crypto adoption (Chainalysis 2024 Index).

Usage surged +110% YoY.

Why Crypto?

Why Crypto?Bolívar collapse: Since October, the currency lost 70% of its value.

Inflation: Hit 229% in May (OVF).

Barriers: Low wages, dollar shortages, sanctions → banks harder to access.

Crypto offers a parallel financial system for survival.

Economist Aarón Olmos:

“Venezuelans started using cryptocurrencies out of necessity.”

️ Friction & Risks

️ Friction & RisksUS sanctions → Binance restricts accounts tied to sanctioned banks/individuals.

Connectivity issues limit access.

Government stance: erratic.

Launched the Petro in 2018 (collapsed in 2024).

Main exchange regulator shut down in 2023 after corruption scandals.

Remittances in Crypto

Remittances in Crypto2023: Crypto made up 9% of $5.4B remittances → ~$461M.

Families increasingly prefer digital assets over Western Union (slower, costlier, FX issues).

️ Political & Geopolitical Backdrop

️ Political & Geopolitical BackdropVenezuela–US tensions heating up:

Venezuela deployed navy + drones in the Caribbean.

US sent 3 warships + missile cruiser + nuclear submarine to the region.

Trump admin accused Maduro of working with cartels.

Reward for capture: $50M (Maduro), $25M (Cabello).

Takeaway

TakeawayCrypto in Venezuela isn’t speculation — it’s economic survival tech.

Citizens use stablecoins to escape inflation.

Merchants adopt crypto to stay connected to global liquidity.

Families rely on it for cross-border remittances.

While politics and sanctions complicate access, crypto’s role as a lifeline in collapsing economies has never been clearer.

-