A Divided Fed Sends Mixed Signals for 2026

-

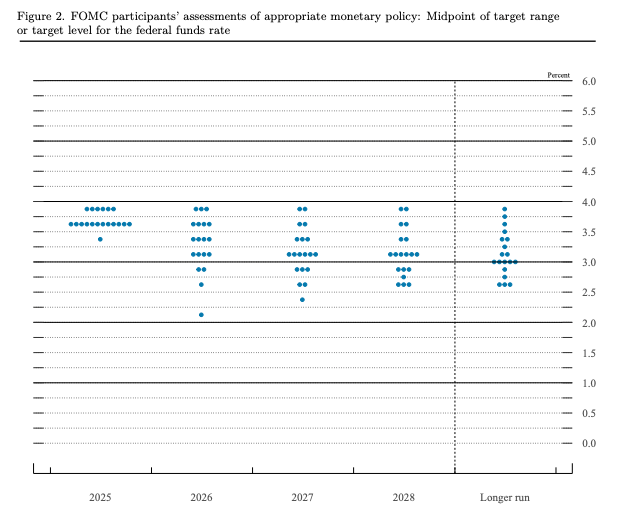

Inside the Federal Reserve, consensus is clearly fraying. The December FOMC meeting revealed sharp internal divisions, with policymakers split between holding rates steady, cutting modestly, or pushing for aggressive easing. While the median projection suggests just one cut in 2026, a significant bloc sees no cuts at all, underscoring the uncertainty ahead.

Hawkish voices argue that policy remains “slightly restrictive” for a reason: inflation risks have not fully receded. This internal split explains why markets continue to challenge the Fed’s guidance—traders see a central bank that may pivot quickly if growth slows or political pressure intensifies.