Liquidity Support or Quiet Warning? Inside the Repo Market Debate

-

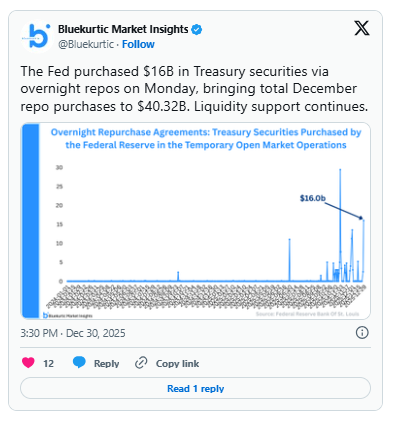

Large repo operations often look technical, but they can reveal deeper issues. When private lending tightens, banks and institutions turn to the Fed’s overnight repo facility to exchange Treasuries for cash, ensuring obligations tied to collateral and commodities are met without disrupting rates.

Many analysts believe December’s elevated demand reflects year-end reporting pressures rather than systemic danger. Still, sustained use of central bank facilities tends to raise eyebrows: it may signal growing risk aversion among counterparties or mismatches beneath the surface. In calm periods, markets rarely need this much support — which is why the scale itself has become the story.

-

markets always look calm right up until they dont, thats why this stuff gets side eyed