🕵️ Coinbase Hacker Buys $8M in Solana — Already in the Red

-

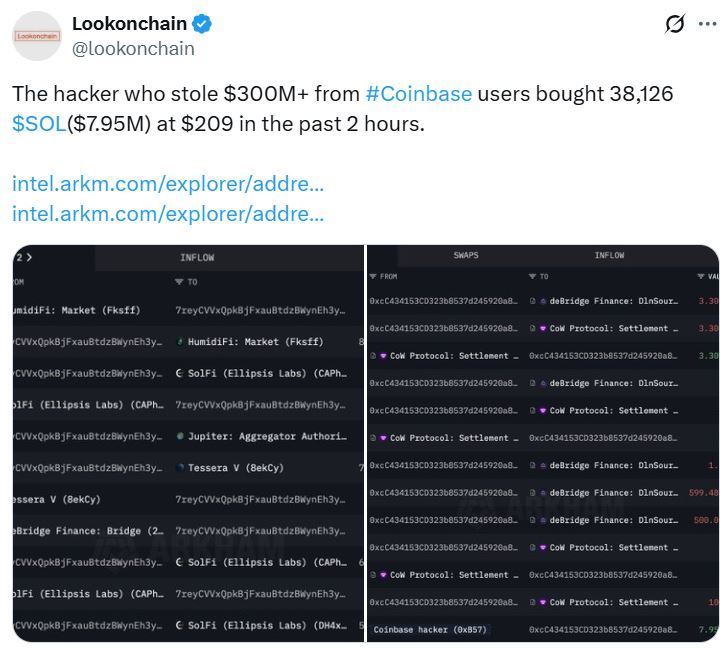

Blockchain sleuths have spotted the so-called “Coinbase hacker” making some big moves this weekend — but not necessarily smart ones.

The $8M Solana Buy

The $8M Solana BuyConverted DAI → USDC → bridged to Solana

Bought 38,126 SOL around $209 each

Current price: $202.15 → already a paper loss

Arkham tagged the wallet as linked to the $300M Coinbase hack, and Lookonchain is tracking the trades.

Hacker’s Trading History

Hacker’s Trading HistoryThis isn’t their first rodeo:

July: Sold 26,762 ETH for ~$69.25M

July 7: Bought 4,863 ETH (~$12.55M)

July 19: Bought 649 ETH (~$2.3M at $3,562 each)**

Basically, this wallet has been splashing around millions in ETH for months.

The Radiant Capital Hacker — Winning Big

The Radiant Capital Hacker — Winning BigNot all hackers are bad traders. The Radiant Capital exploiter turned a $49.5M stash into over $105M (a 114% increase):

Bought 4,913 ETH last week

Sold 4,131 ETH for $2.7M profit

Still holding 21,957 ETH ($103M)

That hack hit $58M in October 2024 across BNB Chain and Arbitrum.

Hacker Trading Fails

Hacker Trading FailsOthers haven’t been so “lucky”:

One wallet panic-sold 12,282 ETH → rebought higher → lost $6.9M

Same wallet later panic-sold 4,958 ETH during another dip → this time profited $9.75M

As Lookonchain summed it up:

“Hackers are not good at trading.”

Takeaway

TakeawayEven hackers with $300M+ war chests can fumble trades.

Some are accidentally turning stolen funds into huge stacks (Radiant case).

Others are literally losing millions in panic trades.

Do you think these moves are actual trading strategies… or just clumsy attempts to launder stolen funds that sometimes look like wins/losses?

Do you think these moves are actual trading strategies… or just clumsy attempts to launder stolen funds that sometimes look like wins/losses? -

Really interesting breakdown — and I’d lean toward these being clumsy laundering attempts rather than intentional “alpha trading.” Think about it: when you’re sitting on hundreds of millions in stolen crypto, your #1 priority isn’t efficient portfolio growth, it’s obfuscating the trail. Bridging from DAI → USDC → Solana is a classic laundering tactic because you’re hitting multiple chains, liquidity pools, and token types to blur provenance. The problem? On-chain sleuths like Arkham and Lookonchain track those hops in near-real time, so the laundering narrative becomes public — and the market punishes the trade execution (buying size at bad levels, taking instant paper losses). That’s why we see hacks often followed by sloppy entries and exits: they’re not trading, they’re scrambling to hide funds.

-

The Radiant Capital case is a perfect counterexample: that exploiter doubled their ETH stash, which looks like savvy trading… but again, is it strategy or just luck on timing? Holding 20K+ ETH through a bull trend will naturally inflate balances, even if execution was average. Meanwhile, the so-called Coinbase hacker looks like they’re actively bleeding value with rushed swaps — losing millions that could’ve been “safe parked” in stables or BTC. To me, this reinforces two things: (1) Not all hackers are sophisticated traders; many are just devs or insiders with weak market skills. (2) Blockchain transparency is brutal. Every fumble, panic sell, and poor bridge is tracked and memed instantly. That visibility might actually be the best deterrent we have, because even when hacks succeed, sloppy laundering can still drain their war chest over time.

$300M+ and still making rookie mistakes… proof that money can’t buy trading skills.

$300M+ and still making rookie mistakes… proof that money can’t buy trading skills.