USX Depeg Renews Debate Over Stablecoin Risks as Market Surges

-

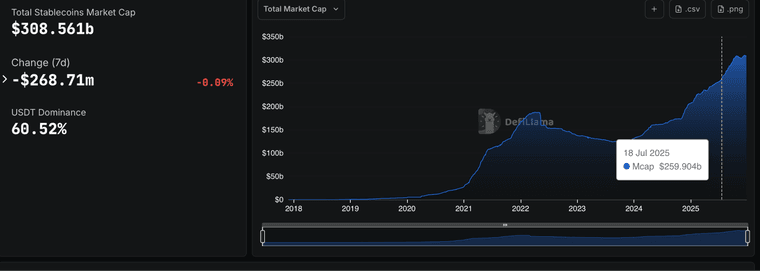

The USX incident comes amid rapid growth in the global stablecoin market, which has expanded to over $308 billion following new US regulation under the GENIUS Act. While adoption is accelerating, policymakers are increasingly warning about potential systemic risks.

European Central Bank officials have cautioned that instability in large stablecoins could trigger forced asset sales and amplify market stress. The IMF has also warned that fragmented global oversight and cross-chain stablecoin activity may introduce new financial vulnerabilities.

USX, with a market cap of roughly $284 million, has since stabilized—but the episode highlights how liquidity shocks can still challenge even overcollateralized stablecoins.

-

USX incident shows even overcollateralized coins aren’t immune