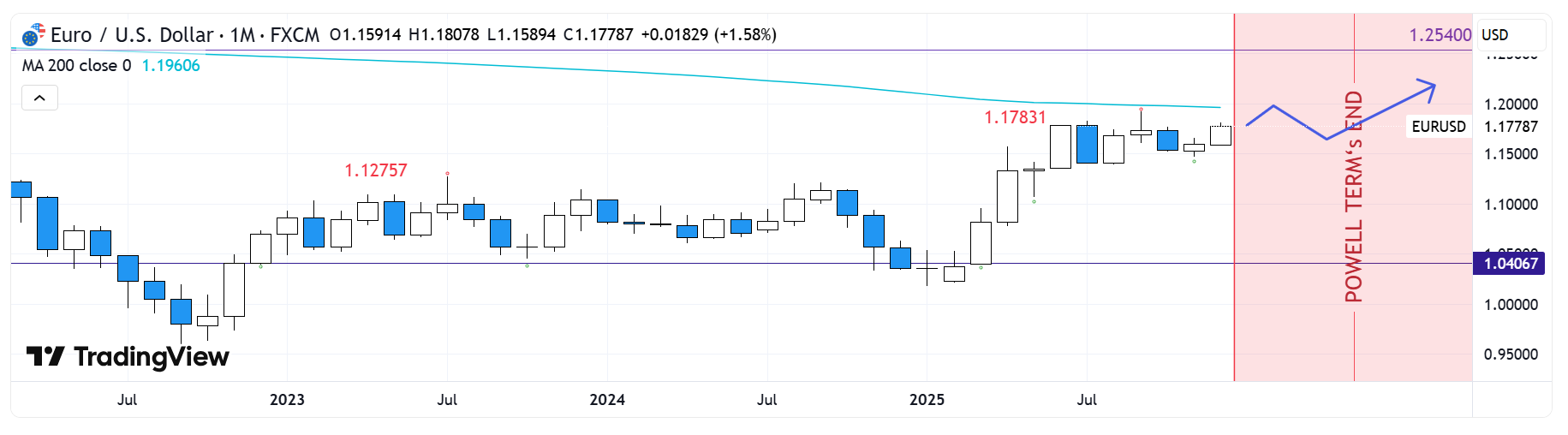

EURUSD – Monthly Structure & Macro Context

-

From a monthly (1M) perspective, EURUSD continues to present a constructive long-term structure.After price broke above 1.12757, this level successfully flipped from resistance into a strong structural support.

Subsequent pullbacks failed to break below it, confirming its validity on a higher timeframe basis.Since June 2025, the market has repeatedly tested the 1.17831 region.

Despite multiple attempts, monthly closes have not yet managed to accept above 1.17831, marking it as the most important long-term resistance level at this stage.This behavior suggests absorption rather than rejection, with price consolidating below resistance instead of reversing aggressively.

Macro Context

On the macro side, the Federal Reserve has maintained a progressively more dovish stance.

At the same time, Jerome Powell’s term as Fed Chair is set to end on May 15, 2026.Market discussions increasingly focus on the possibility of a more dovish successor, such as Kevin Hassett, particularly under a policy environment that favors continued accommodation.

If this macro trajectory remains intact, the probability of structural USD weakness into 2026 continues to rise.

Structural Interpretation (Not a Forecast)

With macro conditions aligning with the higher-timeframe structure, EURUSD remains structurally tilted to the upside.

The 1.17831 level appears less like a final ceiling and more like a time-dependent resistance, requiring further consolidation before resolution.

In that sense, the question is not if the level can be broken,

but when and under what market conditions confirmation occurs.Summary

1.12757: Confirmed long-term support

1.17831: Key monthly resistanceStructure remains intact unless proven otherwise

This is a structural and macro observation, not a trade signal.

As always, confirmation must come from price.It’s also important to note that this view is not limited to EURUSD.

A structurally weaker USD environment would naturally create tailwinds across most USD-denominated markets, shifting relative strength toward other currencies and financial assets. -

Forex is lame