Tokenized Assets and Wall Street Integration

-

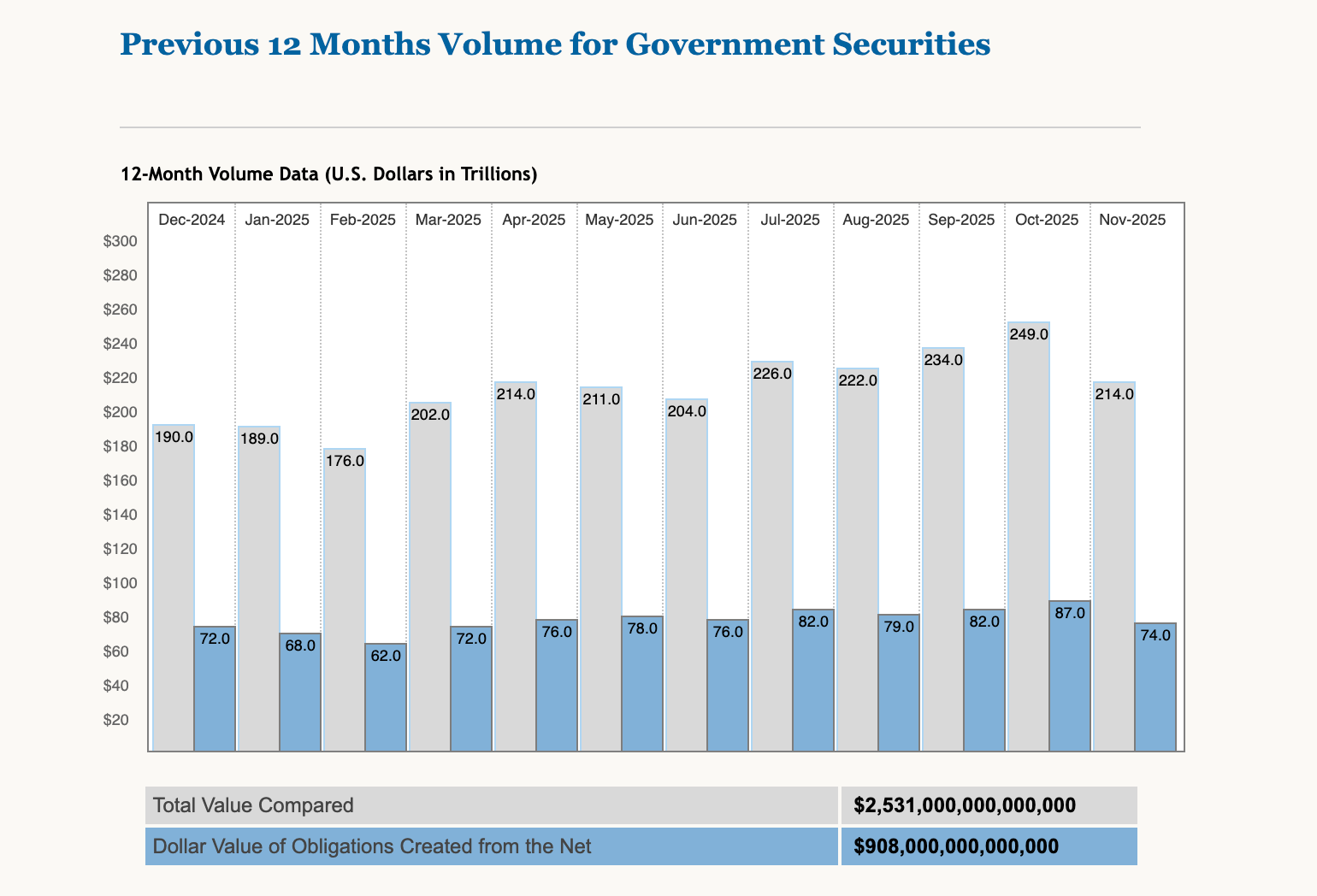

Volume of 12-month government securities settled using the DTCC’s infrastructure. Source: DTCCThe ICE-MoonPay deal highlights a broader push by traditional financial institutions into blockchain and digital assets. ICE has explored integrating Circle’s USDC stablecoin and its onchain yield product US Yield Coin into clearing and settlement services, while the DTCC is preparing to offer tokenized bonds and stocks via the Canton Network in 2026.

Real-world asset (RWA) tokenization allows faster settlement, cross-border transactions, and the use of traditional assets as collateral in decentralized finance. These developments suggest Wall Street is increasingly embracing blockchain not just as an investment, but as a core infrastructure upgrade, blurring the lines between traditional finance and crypto.

-

Wall Street embracing tokenization was inevitable at some point.