💴💴 Japan, China, and Hong Kong: The Asian Front in the Stablecoin Wars 💴💴

-

The U.S. may have fired the first shot with July’s GENIUS Act — a federal framework that cements dollar-backed stablecoins as the standard — but Asia isn’t sitting idle. Three of its biggest financial hubs are ramping up their own stablecoin plays: Japan: Yen Enters the Chat

Japan: Yen Enters the ChatJPYC, a fintech startup, is preparing the country’s first yen-pegged stablecoin.

Backed by liquid assets like government bonds.

Target issuance: ¥1 trillion ($6.8B) in the next 3 years.

Regulator-approved and wrapped in Japan’s famously conservative compliance culture — meaning this isn’t a degen play, but a deliberate move to build trust in yen digital rails.

China: Offshore RMB in Focus

China: Offshore RMB in FocusReuters reports Beijing is reviewing a roadmap that includes yuan-denominated stablecoins.

But — expect them offshore (CNH), not on the mainland (CNY). Capital controls remain untouchable.

The logic: extend the RMB’s international reach without loosening its domestic grip.

Key venue: Hong Kong, where new stablecoin licensing rules already allow compliant issuers (including Chinese tech giants) to experiment.

Hong Kong: The Bridge Market

Hong Kong: The Bridge MarketStablecoin regulations officially live.

Positioned as both Beijing’s sandbox and an international hub.

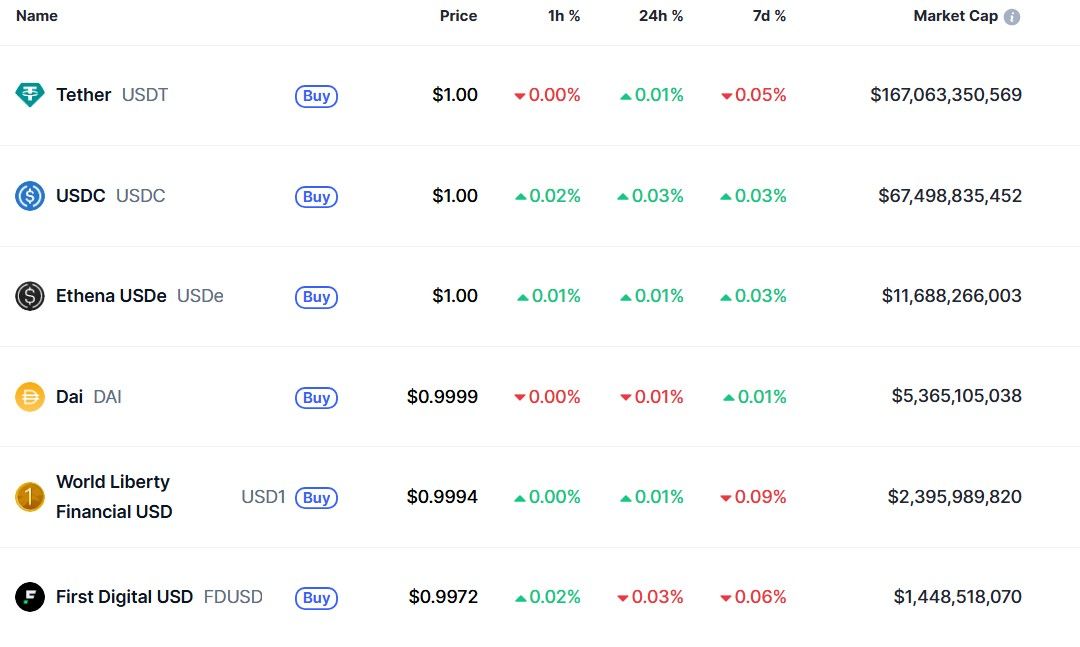

Analysts call it the “policy bridge” where CNH-backed tokens could challenge the 98% market dominance of dollar stablecoins (USDT + USDC).

The Bigger Picture

The Bigger PictureThe U.S. is doubling down on dollar supremacy by requiring stablecoin reserves in U.S. Treasuries — literally tying global digital money to U.S. debt markets.

Asian economies, especially China, see this as financial overreach.

Yen and offshore yuan stablecoins aren’t about beating Tether’s liquidity tomorrow — they’re about carving out strategic lanes in trade, settlements, and geopolitical influence.

️ Stablecoins are no longer just “crypto plumbing.” They’re becoming tools of currency competition.

️ Stablecoins are no longer just “crypto plumbing.” They’re becoming tools of currency competition.