🌏 China’s Stablecoin Play: Offshore Experiment or Dollar Challenger? 🌏

-

Reports from Reuters and FT hint that Beijing may greenlight a yuan-pegged stablecoin — but let’s get one thing straight: don’t expect it to circulate inside China’s Great Firewall. CNY vs. CNH

CNY vs. CNHThe onshore yuan (CNY) is under tight capital controls. A stablecoin pegged to it would undermine Beijing’s grip.

The offshore yuan (CNH), born in Hong Kong in 2010, is far more likely. It’s liquid enough for cross-border settlement but small enough to stay controllable.

Why Hong Kong Matters

Why Hong Kong Matters

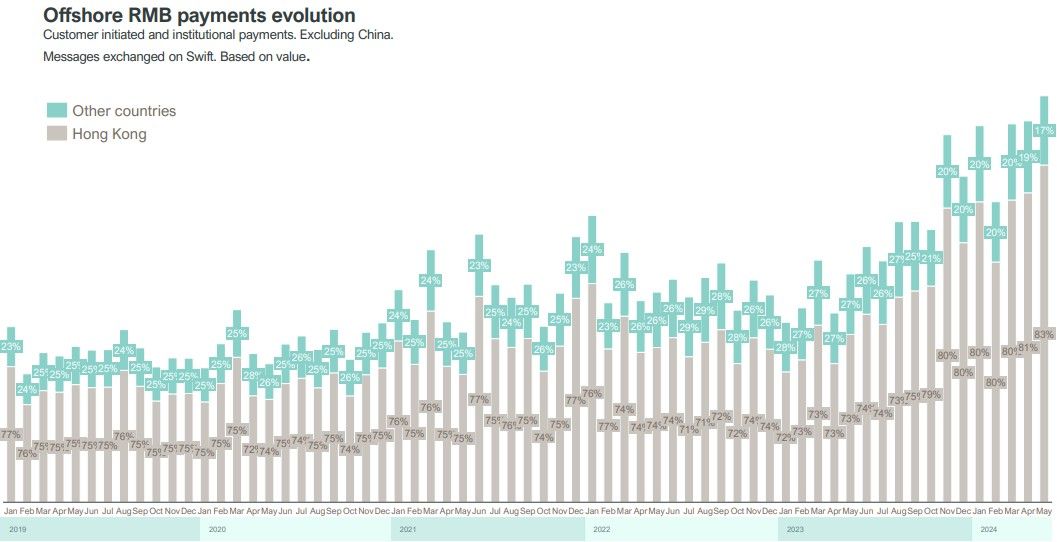

Hong Kong is the perfect testbed:Already the largest CNH liquidity hub.

Recently rolled out stablecoin licensing rules.

Acts as China’s “policy sandbox” to test internationalization without destabilizing the mainland.

The Strategic Lens

The Strategic LensDollar-backed stablecoins (USDT, USDC) = 98% of the market.

Chinese academics have openly warned this is a sovereignty risk.

A CNH stablecoin wouldn’t compete with USDT volumes (offshore yuan deposits = just 0.27% of China’s domestic money supply) — but it could chip away at dollar dominance in specific corridors like Belt & Road trade.

The Takeaway

The Takeaway

A CNH-backed stablecoin isn’t about onboarding crypto degens — it’s about currency geopolitics in the digital age. Beijing wants the yuan to travel further abroad without loosening its grip at home. Think less “China joins the stablecoin game” and more “China builds a digital Trojan horse to extend RMB reach globally.”

Think less “China joins the stablecoin game” and more “China builds a digital Trojan horse to extend RMB reach globally.”