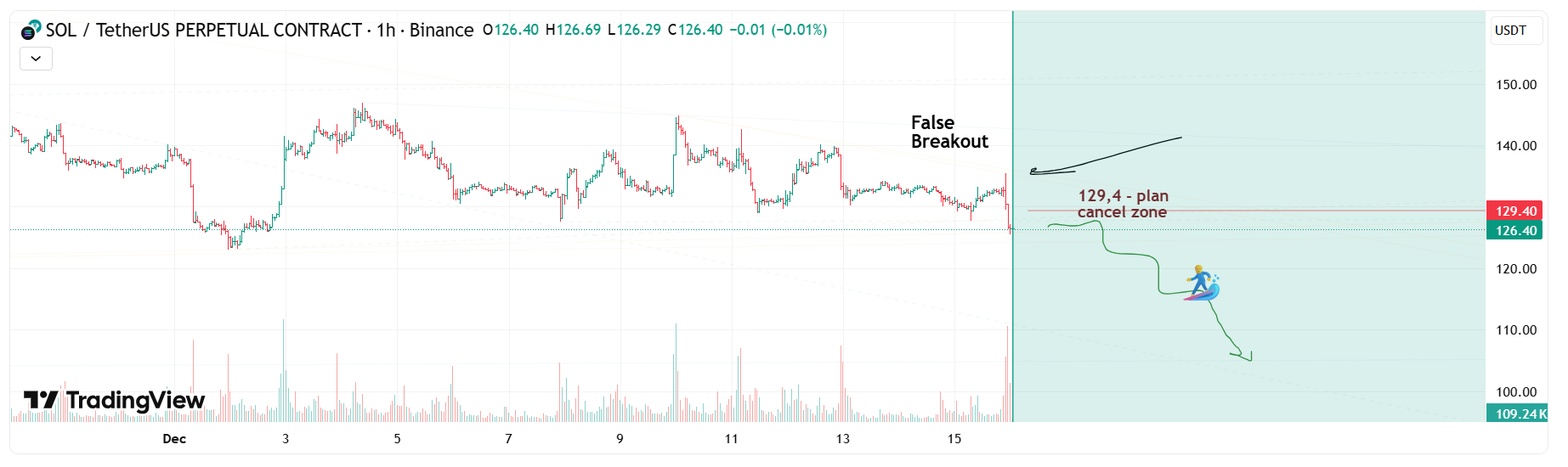

Solana Fakeout: Bulls Caught, Bears in Control

-

Market Context

Market Context

In my previous publication about Solana, I clearly defined an Invalidation Level for the bearish setup. Price has now swept buy-side liquidity above that level, forming a false breakout with strong rejection.This move appears to be a stop hunt, not genuine acceptance above resistance.

Structure & Intent

The long bullish candle above the invalidation level failed to hold, signaling lack of follow-through and confirming distribution at premium prices.

This behavior reinforces the expectation of further downside expansion.Scenarios Recap

Previously, two downside scenarios were outlined:• Scenario 1: mitigation toward 116–118, followed by potential stabilization

• Scenario 2: continuation toward 108 and belowThe recent liquidity grab confirms Scenario 2 activation.

Execution Plan

Bias: Bearish

Bias: Bearish

Primary Target: 106

Primary Target: 106

🧲 Intermediate liquidity: 116 Invalidation: 129.4

Invalidation: 129.4

Any acceptance or touch above this level invalidates the bearish thesis and opens the door for bullish continuation.Conclusion

As long as price remains below the invalidation zone, Solana is expected to expand lower in search of sell-side liquidity. -

Fakeouts hurt late bulls the most — classic market behavior.

-

Bears clearly took advantage of weak confirmation.