🚨 Meet the “Beacon Network” — Crypto’s New Crime-Fighting Alliance

-

Imagine if Coinbase, Binance, Kraken, Robinhood, PayPal, Ripple and even on-chain sleuths like ZachXBT all teamed up with global law enforcement to stop scammers before they cash out. That’s exactly what’s happening.

TRM Labs just announced the launch of the Beacon Network — a real-time, cross-industry “crypto crime response system” designed to track, flag, and freeze stolen funds within minutes, not days.

Why This Matters

Why This MattersSince 2023, at least $47 billion in crypto has been sent to fraud-related wallets (and that’s likely undercounted).

Historically, law enforcement and exchanges worked in silos → by the time anyone reacted, stolen funds had already bounced through thousands of transactions.

With Beacon, that window narrows: detection → tracing → freezing happens in minutes.

️ How Beacon Works

️ How Beacon WorksFlagging → Verified members (exchanges, security researchers, law enforcement) tag suspicious wallets.

Tracking → Funds are followed on-chain across multiple networks.

Action → If flagged funds hit a participating exchange, alerts fire instantly, giving the exchange the chance to freeze assets before they disappear.

Think of it as the first “kill chain” for illicit crypto transactions.

Already in Action

Already in ActionInvestigators traced $1.5M tied to a global scam → address blacklisted → funds blocked when sent to an exchange.

Another case saw $800K in scam deposits flagged & frozen at a major exchange.

Who’s in the Crosshairs?

Who’s in the Crosshairs?North Korean IT worker groups scamming crypto firms.

Hackers and rug-pull artists.

Terror financing networks.

Major scam rings siphoning billions.

But What About Abuse?

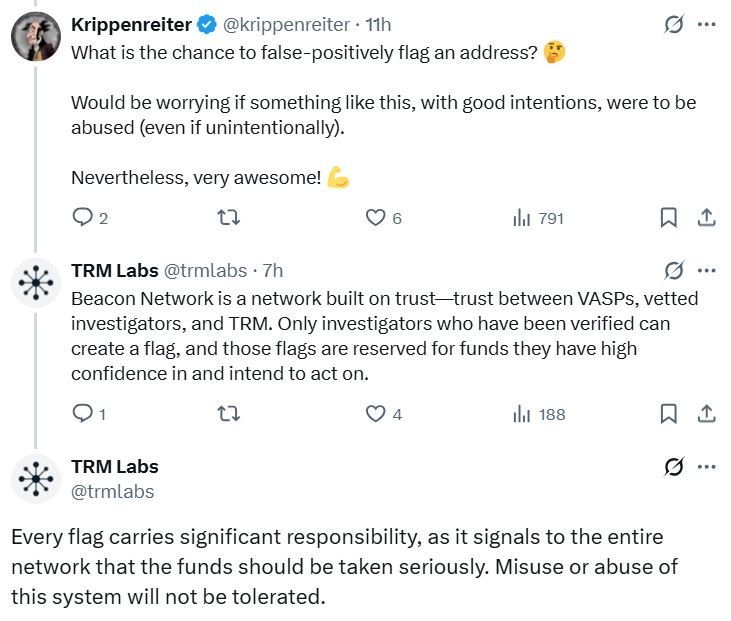

But What About Abuse?Only verified investigators can flag wallets. TRM Labs stresses:

“Every flag carries significant responsibility… misuse will not be tolerated.”

Big Picture

Big PictureThis isn’t just “another consortium.” It’s a shift:

TradFi + DeFi + Law Enforcement + Researchers all pulling in the same direction.

Victims stand a real chance of seeing funds recovered instead of vanished.

And for bad actors? That “exit liquidity” might be gone for good.

What do you think: will Beacon actually make crypto safer, or will criminals just evolve faster with new tricks?

What do you think: will Beacon actually make crypto safer, or will criminals just evolve faster with new tricks? -

Honestly, this feels like one of the most important milestones in crypto security since Chainalysis went mainstream. For years we’ve had the same frustrating cycle: scams hit → victims scream on Twitter → funds get laundered through 20 wallets → exchanges shrug and say “too late.” Beacon flips that script. If exchanges, law enforcement, AND researchers are finally sharing data in real time, the cost of scamming just went way up. It’s not perfect — criminals will adapt — but the idea of freezing funds minutes after the scam instead of months later could save billions. To me, this is how crypto matures: by showing regulators and the public that the industry can police itself while still being decentralized at its core.

-

Beacon is promising, but we have to be realistic: scammers are professional shape-shifters. The same playbook we saw with mixers, privacy coins, and cross-chain bridges will show up here too. As soon as Beacon flags get fast, criminals will pivot to P2P swaps, smaller DEX pools, and private liquidity channels. Plus, there’s always the risk of overreach — a few bad flags from “verified” investigators and suddenly innocent wallets could be frozen without due process. For crypto to stay true to its roots, Beacon has to balance speed with transparency and accountability. Otherwise, we trade decentralization for a new kind of centralized choke point.