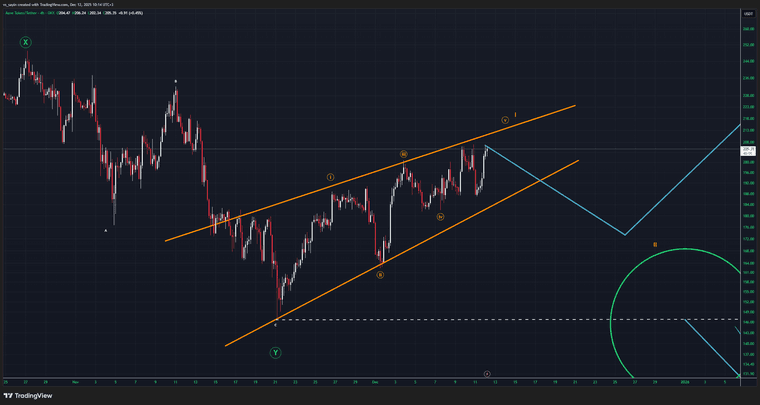

AAVE ANALYSIS (1D)

-

Hello everyone.

Hello everyone.

Today I'm going to examine AAVE.As you can see after a five upward impulsive wave, AAVE has faced a double Zig-Zag correction.

The reason why this pattern is a Double Zig-Zag is simply because the first A-B-C correction was not enough. Therefore another Zig-Zag correction was needed.

This kind of corrections only appears in the market when the main correction wave is not enough to balance the price according to the last impulsive wave.There are two scenarios comes forward;

First: If it's a double Zig-Zag correction, there is always another possibility that this pattern could turn itself into a triple Zig-Zag. In this case, the mini wedge pattern you see on the chart will break the last low and create a way deeper correction. Target of a possible triple Zig-Zag is marked on the chart.

Bullish scenario: If the double Zig-Zag has ended which is what I'm seeing at the moment, the 4H ascending wedge you see on the chart will create a leading diagonal and a higher high, which will be seen as wave 2 for another five wave upward impulsive move. That's the opportunity you can't afford to miss.

Fortunately, the risk management comes very easy when Elliott patterns are clear.

If you're looking for a swing long position in here your stop-loss should be last low, just below the Wave Y. To make it better, wait for a daily candle close below it, so you won't be hunted for liquidity grabs.

Target of the possible wave 3 is marked on the chart as well. -

AAVE respecting structure nicely on the daily timeframe.

-

Break above the recent swing high could shift momentum bullish.