Japan Moves to Close Crypto Safety Gaps With New Liability-Reserve Rule

-

Japan is preparing a sweeping update to its crypto regulations as the Financial Services Agency (FSA) pushes for new “liability reserves” that exchanges must hold to protect customer assets in the event of hacks or unauthorized transfers.

Even with Japan’s already strict rules — including cold-wallet storage, AML controls and full client-fund separation — there is currently no legal requirement for exchanges to maintain funds for rapid customer compensation after security breaches.

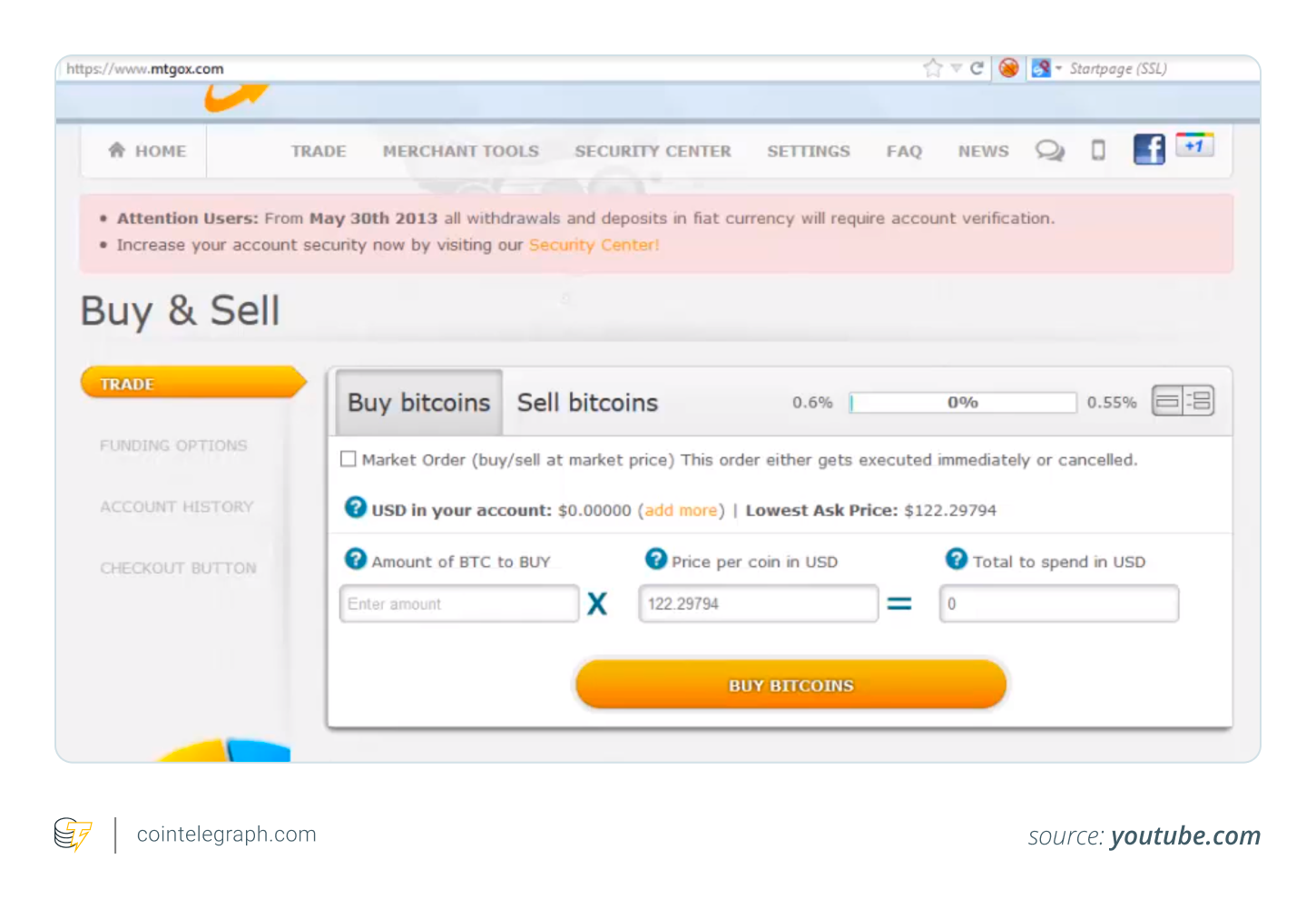

The proposal comes amid renewed attention to Mt. Gox repayments and fresh incidents like the May 2024 theft of 4,502.9 BTC from DMM Bitcoin, highlighting persistent vulnerabilities.

If approved, the new rules would bring crypto platforms closer to Japan’s securities industry standards and mark one of the most robust consumer-protection frameworks worldwide. -

A reserve requirement could prevent another major insolvency event.

-

Good step, but enforcement will be the real challenge.