OTC Market Depth Takes Center Stage After MicroStrategy’s Quiet Accumulation

-

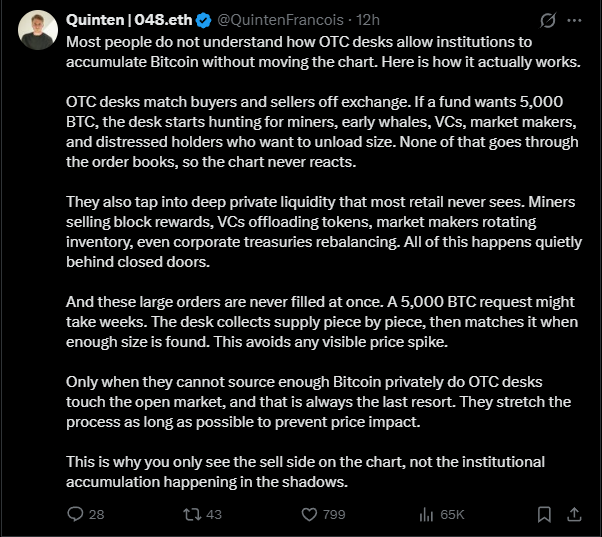

Andrew Tate’s viral post has shined a spotlight on Bitcoin’s OTC plumbing, exposing a widespread misconception about how institutional buying actually works. MicroStrategy’s acquisition of over 10,000 BTC didn’t appear on spot books because it never touched them — instead, OTC desks matched the purchase against miners, early wallets, and market makers.

This quiet accumulation underscores how Bitcoin’s liquidity structure absorbs massive transfers without sparking volatility. Price only reacts when OTC inventory dries up and buyers are forced onto public exchanges. That didn’t happen this time, raising fresh questions about market depth, supply distribution, and how much institutional accumulation flies under the radar. -

OTC depth explains why big buys don't always show up on charts immediately.

-

Smart money prefers OTC to avoid slippage—classic accumulation behavior.