Investors Favor Tokenized Treasurys Over Stablecoins

-

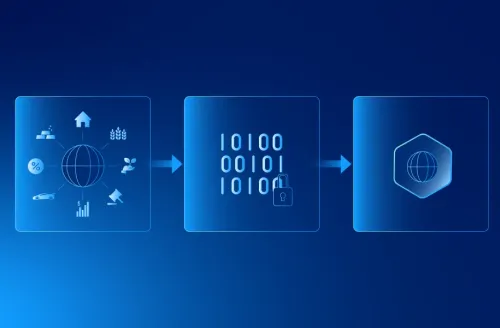

According to CoinShares, U.S. government debt-backed tokens are set to drive the next wave of RWA expansion in 2026.

While stablecoins still dominate for payments and reserves, investors prefer holding yield-bearing Treasurys when risk is similar. Settlement and issuance are now happening directly onchain, marking a real departure from legacy custodial processes.

CoinShares expects competition between networks to intensify as multiple chains fight for liquidity and market share. -

Tokenized treasurys offering real yield—no wonder investors prefer them.

-

Stablecoins losing ground as safer on-chain options emerge.