Gold: Narrow-Range Oscillation Today

-

Gold is trading in a narrow-range oscillation overall with intense bull-bear confrontation. Influenced by a combination of fundamental and technical factors, the market is in a short-term consolidation phase, awaiting a clear directional breakout. Despite extremely stable intraday performance (volatility less than 0.3%), the backdrop features a high-stakes game with open interest surging to 450,000 contracts. Primarily, amid anticipation of the Fed’s policy announcement, market sentiment remains cautious, making a one-sided trend unlikely.

Gold is trading in a narrow-range oscillation overall with intense bull-bear confrontation. Influenced by a combination of fundamental and technical factors, the market is in a short-term consolidation phase, awaiting a clear directional breakout. Despite extremely stable intraday performance (volatility less than 0.3%), the backdrop features a high-stakes game with open interest surging to 450,000 contracts. Primarily, amid anticipation of the Fed’s policy announcement, market sentiment remains cautious, making a one-sided trend unlikely.

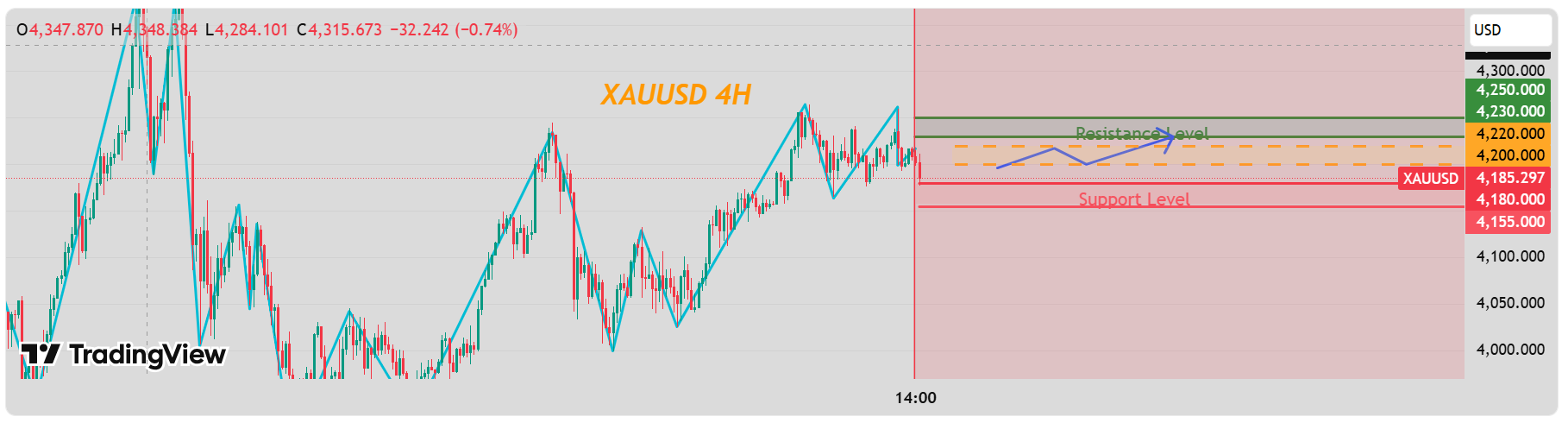

The Bollinger Bands are showing signs of contraction, and the moving average system is converging, this pattern further confirms gold’s current consolidation state.Key support and resistance levels are clearly defined:

Intraday Short-term Resistance: $4,225 – $4,230, a critical suppression level for short-term price action.

Strong Resistance: $4,250 – $4,260, a zone that has repelled multiple breakout attempts, accumulating significant profit-taking sell orders.Intraday Short-term Support: $4,190 – $4,200.

Strong Support: Around $4,175 – $4,180 that is a crucial watershed for bull-bear dynamics.Trading Strategy:

Buy 4195 - 4205

SL 4180

TP 4225 - 4235 - 4245Sell 4235 - 4225

SL 4245

TP 4210 - 4200 - 4190 -

Gold stuck in a tight range—waiting for volatility expansion.

-

Consolidation like this usually precedes a big move.