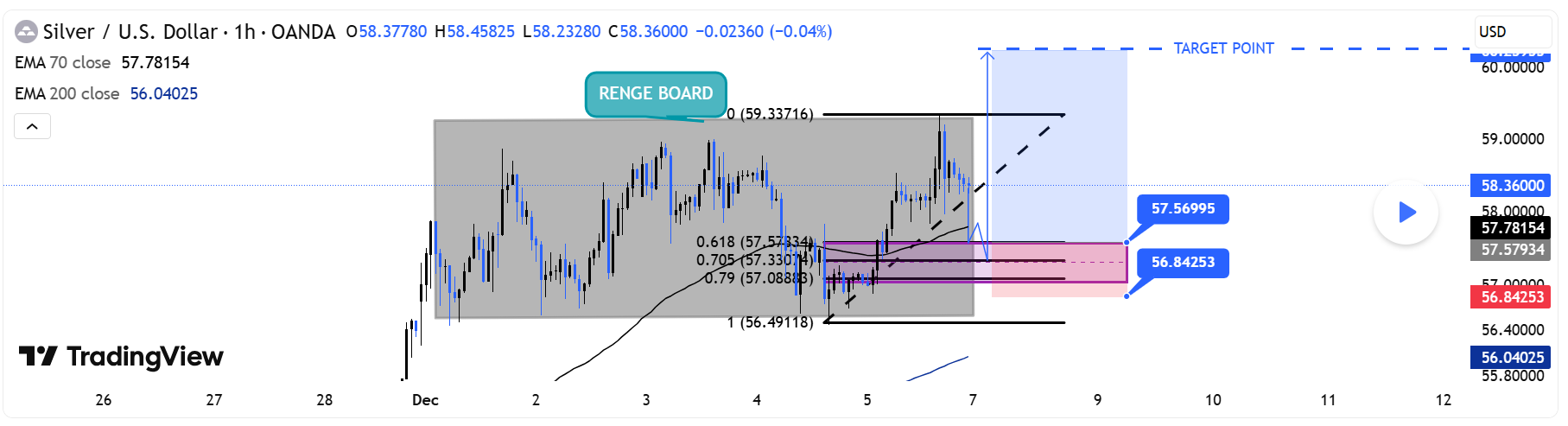

Bullish Breakout & Fibonacci Demand Zone Analysis on XAGUSD (1H)

-

Chart Analysis (XAGUSD – 1H)

Chart Analysis (XAGUSD – 1H)- Market Structure

Price recently broke out of a large range (gray box), signaling a shift from consolidation to a potential trend.

Breakout occurred to the upside, confirming bullish intent after multiple failed downside attempts.

- Fibonacci Retracement Zone

Price retraced into a high-probability buy zone:

0.618 – 0.79 fib levels (≈ 57.18 – 57.08)

This area aligns with:

Previous support inside the range

The rising short-term trendline

EMA confluence

This creates a strong demand zone (highlighted in pink).

- EMAs (Trend Confirmation)

EMA 70 > EMA 200, indicating a bullish market structure.

Price is currently above both EMAs → trend momentum favors buyers.

- Liquidity & Smart Money Concepts (SMC)

Liquidity above recent range highs was taken (stop hunt), then price retraced to fill imbalance.

Current demand zone appears to be a reaccumulation block, suggesting smart money may defend this zone.

- Entry, Stop & Target

Potential buy entry: 57.33 – 57.10 zone

Stop-loss: Below 56.84

Target: 60.23 – 60.25 (blue target zone)

This offers a favorable risk-to-reward based on breakout continuation.

- Momentum Outlook

Bullish continuation is likely if price holds above 57.10 and breaks minor structure highs.

A break below 56.84 invalidates bullish setup and may retest lower EMA or range midpoint.

Summary

Summary

The chart shows a bullish breakout from a long consolidation range, with price retracing into a strong demand/Fibonacci zone that aligns with trend indicators. If buyers defend the zone, price has room to rally toward 60.25, completing the projected bullish extension. -

Silver tapped the demand zone perfectly—fib levels lining up well.