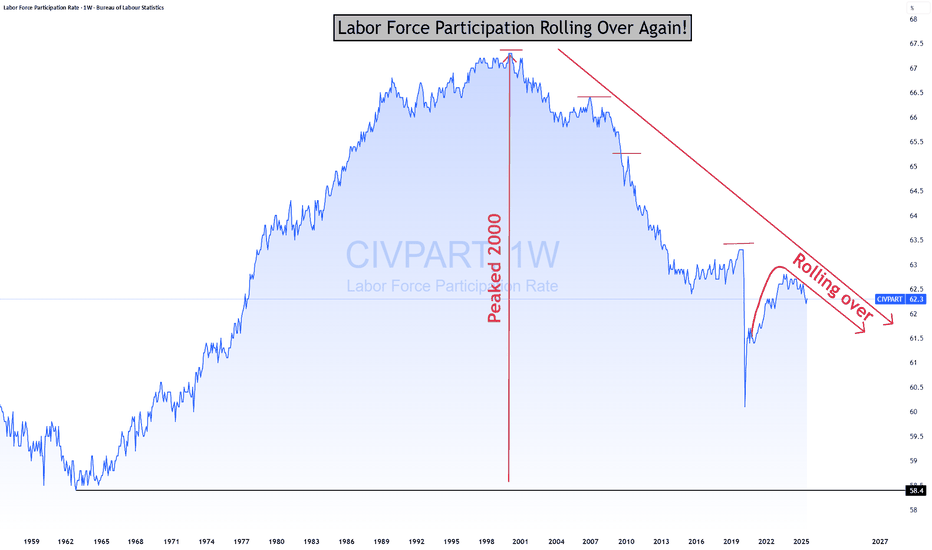

Velocity Of Money Rolling Over Again!

-

The Real Interpretation

This chart is telling one story:Money supply growth has massively outpaced real output for decades.

It lines up perfectly with:

Falling real productivity

Stagnant wages

Declining borrower quality

Rising debt-to-GDP

Asset inflation decoupling from fundamentals

The economy shifting from productive borrowing → consumption and asset speculationYou don't fix this with “policy choices.”

You fix it with real wealth creation, which requires creditworthy borrowers — not printing.Forward-Looking View

Unless:Productivity rises

Real output accelerates

Borrowers gain real income strength

Capital flows into productive sectors instead of financial games…this ratio won’t materially rise.That means:

Every new dollar is buying less GDP

Long-term growth potential is fading

More money chasing fewer productive opportunities

More fragility in the credit systemIt’s a classic late-cycle fiat symptom.

If you want to push someone to accept this reality, here are questions to ask:

If “money creation” creates growth, why is GDP-per-dollar collapsing?

Why did 40 years of money expansion not produce proportional GDP?

If borrowers create loans, where are the new productive borrowers?

Why did QE cause asset inflation but no sustainable GDP boost?

If the system is “fine,” why does each new dollar buy less real output?Perma Bulls, MMTers, Politicians etc.. can’t answer those without admitting the private-sector engine is weakening.

The less productive output per $ while the markets keep rising & rising will only produce less and less profit per share over time. No matter how much lipstick they put on that pig. Eventually, the economy & markets will CRASH! They always correct themselves in the end.Perma Bulls have no exit strategy and will go down with the boat!

MMTers will want Gov to borrow and spend EVEN MORE! despite the empirical self-evident fact that print and play doesn't work!

Politicians will borrow and spend even more, claiming they will "STIMULATE THE ECONOMY"

I got all that from just one chart? NO! The entire spectrum of data.

Here is one

-

A slowdown in velocity usually signals broader market hesitation.

-

When money stops moving, volatility often follows soon after.