Gold: Bullish Structure With Potential Liquidity Grab Below

-

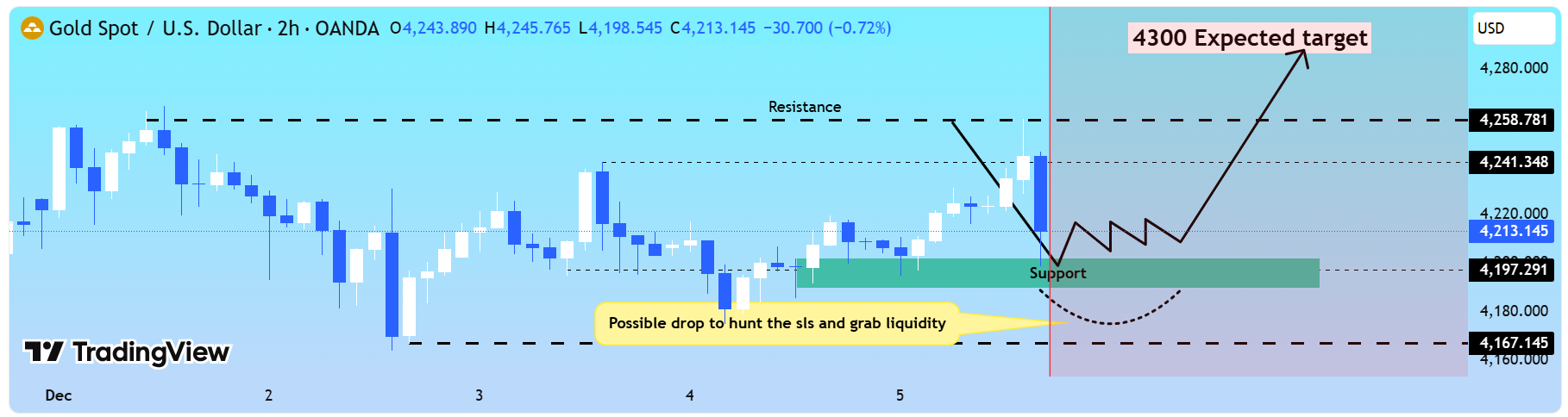

Gold tapped the 4259 resistance zone, where supply became active and caused a sharp rejection.

Gold tapped the 4259 resistance zone, where supply became active and caused a sharp rejection.

The move pulled price into the broader 4200 demand area, where buyers have previously shown efficiency.

From this zone, price can continue higher if demand holds and structure remains bullish.

There is also clean liquidity resting below recent lows around 4170.

A deeper move into 4170 may be used to sweep stops and grab liquidity before any continuation.

If a liquidity event occurs and demand stays strong, price may seek the 4300 area of interest next.

The 4300 zone aligns with previous structure points and unmitigated supply above.

Both scenarios remain valid within the current bullish context on higher timeframes.

Price action around 4200 and 4170 will offer clarity on the next leg.

This idea is based on structure, supply/demand and liquidity, not a prediction.

This is for educational and learning purposes not trading advice. -

Gold may dip to sweep liquidity before resuming bullish structure.

-

If the liquidity sweep completes, gold could resume its upward structure.