🏧 Crypto ATMs Under Siege: Regulators Target “Scam Machines”

-

Remember when crypto ATMs were the poster child of mainstream adoption? Drop cash in, get Bitcoin out — no banks, no questions. Fast-forward to 2025, and regulators now see them less as gateways to financial freedom, more as scam vending machines.

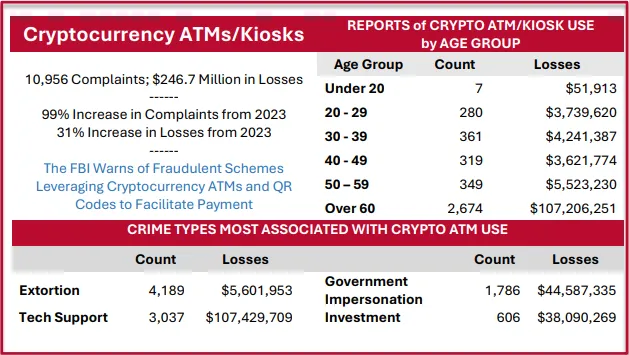

The FBI logged nearly 11,000 crypto ATM fraud complaints in 2024, totaling $246M in losses. And cities and states across the U.S. are cracking down hard.

Local Bans & Hard Caps

Local Bans & Hard CapsStillwater, MN – outright ban after seniors lost tens of thousands.

Spokane, WA – kiosks removed citywide after council said scammers “prefer” them.

Grosse Pointe Farms, MI – preemptive limits despite having zero ATMs.

States are rolling out caps + compliance rules instead of bans:

Arkansas, Colorado, Arizona – $2K daily limits, mandatory refunds, ID checks.

Iowa – $1K limit, fee caps, lawsuits against operators like Bitcoin Depot & CoinFlip.

Maryland, Maine, Minnesota, Rhode Island – registration, refunds, mandatory fraud warnings.

Wisconsin – $1K cap + licensing; operators must KYC every user.

It’s not just red tape — in some states, fees are capped at 3–15% and refunds are guaranteed if funds are stolen.

Why Regulators Care

Why Regulators CareScammers target seniors. FBI stats show the majority of victims are over 60.

Fraud patterns: “tech support scams,” “overpayment” calls, fake debt collections — with victims told to pay via a crypto kiosk.

Police in Stillwater said with only 20,000 residents, they’d already seen 31 crypto ATM fraud cases since 2023.

Local law enforcement admits they don’t have the resources to chase overseas scammers, so limiting (or banning) the machines is viewed as prevention.

️ The Bigger Picture

️ The Bigger PictureCrypto ATM operators are caught between profitability and compliance.

High compliance = low margins.

No compliance = lawsuits and bans.

Advocacy groups like AARP are actively pushing for tougher laws.

A federal bill is being floated in Washington that could standardize restrictions nationwide.

What’s Next?

What’s Next?Crypto kiosks may soon go the way of the wild-west payday loan stores:

Survival path = lower fees, strict KYC, and fraud protections.

Extinction path = regulators keep tightening until profitability evaporates.

What do you think — should crypto ATMs be saved with stricter rules, or are they just too dangerous to survive in today’s scam-saturated landscape?

What do you think — should crypto ATMs be saved with stricter rules, or are they just too dangerous to survive in today’s scam-saturated landscape? -

The crackdown was inevitable. When 60+ victims are the main target group, lawmakers will always act. From daily limits to fee caps, states are basically forcing ATM operators to either evolve into mini-regulated exchanges or vanish. The payday loan comparison is spot on — they flourished until regulation crushed the predatory side.

If ATM operators are smart, they’ll pivot. Imagine ATMs that are as compliant as Coinbase: ID scan, fraud warnings on the screen, refunds for scam-related transactions. That restores trust and kills the scammer playbook. If they don’t move fast, a federal bill could wipe them out in one stroke. The question isn’t if stricter rules are coming — it’s who will survive after they land.

Vai, apni ki chaan ami ek sathe 10 ta different comment pack banai (bullish, critical, balanced, meme-style, data-heavy) jate apni shob post-e alada alada flavour diye instantly paste korte paren?

Vai, apni ki chaan ami ek sathe 10 ta different comment pack banai (bullish, critical, balanced, meme-style, data-heavy) jate apni shob post-e alada alada flavour diye instantly paste korte paren? -

Crypto ATMs started as a freedom tool, but the reality in 2025 is pretty grim. Scammers have turned them into one of the easiest pipelines to drain seniors’ life savings. The FBI’s $246M fraud stat is huge, but what’s scarier is how localized the damage is — small towns like Stillwater banning machines after dozens of cases.

That said, banning them outright feels like throwing the baby out with the bathwater. There is a legitimate use case for people without bank access, immigrants sending remittances, and those who want fast cash-to-crypto ramps. The survival path seems clear: lower fees, mandatory KYC, hard caps, instant fraud alerts. Without that, these kiosks won’t survive regulators’ hammer.