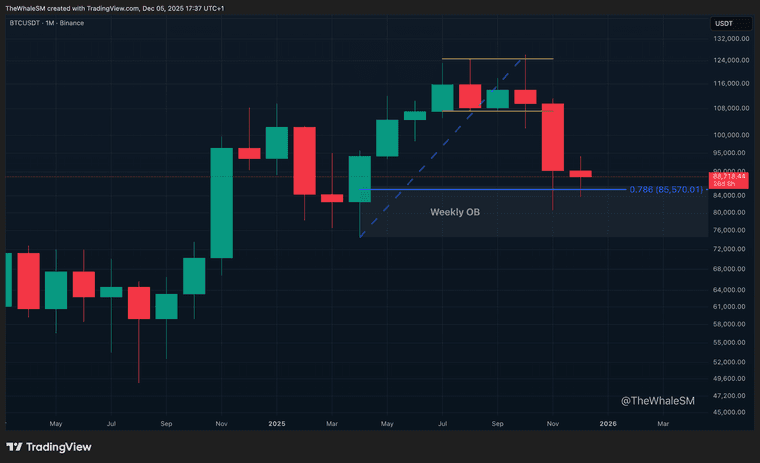

BTC Pullback: Buying 50-78.6% Discount Levels

-

After the aggressive internal liquidity grab on December 1st, which subsequently manifested as a Daily Bullish Order Block, Bitcoin continued its local bullish structure from the global 78.6% level, which I analyzed in my global overview: Bitcoin: The ATH Was a Trap. Here's the Real Roadmap.

After the aggressive internal liquidity grab on December 1st, which subsequently manifested as a Daily Bullish Order Block, Bitcoin continued its local bullish structure from the global 78.6% level, which I analyzed in my global overview: Bitcoin: The ATH Was a Trap. Here's the Real Roadmap.Currently, the asset is correcting on the 4H structure and has reached the top of the Order Block. However, to obtain a better Risk/Reward (RR) in the trade and for general entry feasibility, I always wait for a more favorable price in the Discount Zone, which is located below the 50% Fib level.

No one can know exactly how deep Smart Money needs to return the asset into the manipulation zone to close losing positions used to execute this aggressive liquidity grab. Therefore, I will consider a reversal reaction from each level: 50%, 61.8%, and 78.6%.

Entry Conditions:

Entry Conditions:

The condition for entry will be reaching one of these levels, price finding acceptance above it, and the initiation of bullish order flow on a lower timeframe (1m-5m). Invalidation:

Invalidation:

The invalidation of the long scenario will be a break of the local 78.6% level. In that case, the Bitcoin reversal from the global 78.6% level in continuation of the global uptrend will be in question, though still possible, as this is a level from the highest timeframe, and the second monthly candle could also close with its body above this level. Target:

Target:

The minimum target in case of a long setup formation from the Discount Zone will be the SUPPLY zone. To confirm that the bull cycle is not over and the asset can potentially form a new ATH, it will first have to overcome this resistance zone.The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇 P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart. -

BTC retracements into discount zones often attract fresh demand.

-

Those Fibonacci discount zones always attract smart-money entries.