🚀 Can ChatGPT Help You Spot the Next Altcoin Pump?

-

Everyone in crypto dreams the same dream: finding the next small-cap coin that suddenly skyrockets 200%+ while the rest of Twitter is still asleep. But here’s the reality — pumps are messy. Some are organic, others are pure manipulation, and most retail buyers end up holding the bag.

That said, tools like ChatGPT can actually make the hunt smarter — if you know how to use them.

What Exactly Is an Altcoin Pump?

What Exactly Is an Altcoin Pump?An altcoin pump is basically a sharp, rapid price spike in any non-Bitcoin coin. It can happen because:

Traders coordinate big buys in pump groups.

Social media hype or influencer chatter takes off.

A new listing, burn, or partnership gets announced.

Or… it’s just manipulation (pump-and-dump).

Your job as a trader isn’t to chase every green candle — it’s to filter the real growth stories from the noise.

Where ChatGPT Actually Helps

Where ChatGPT Actually HelpsNo, ChatGPT doesn’t predict the future. It can’t tell you “X coin will 10x tomorrow.” What it can do:

Break down fundamentals (team, tokenomics, use case).

Summarize community sentiment from Reddit, X, YouTube.

Recognize patterns from past pumps.

Generate watchlists based on your criteria.

Flag possible red flags like anonymous teams or too-good-to-be-true claims.

Think of it less as a fortune teller, more like a crypto research assistant on steroids.

️ How to Use It Step-by-Step

️ How to Use It Step-by-StepPick your angle → Do you want micro-caps under $50M? Coins trending on social? Upcoming events like burns or listings?

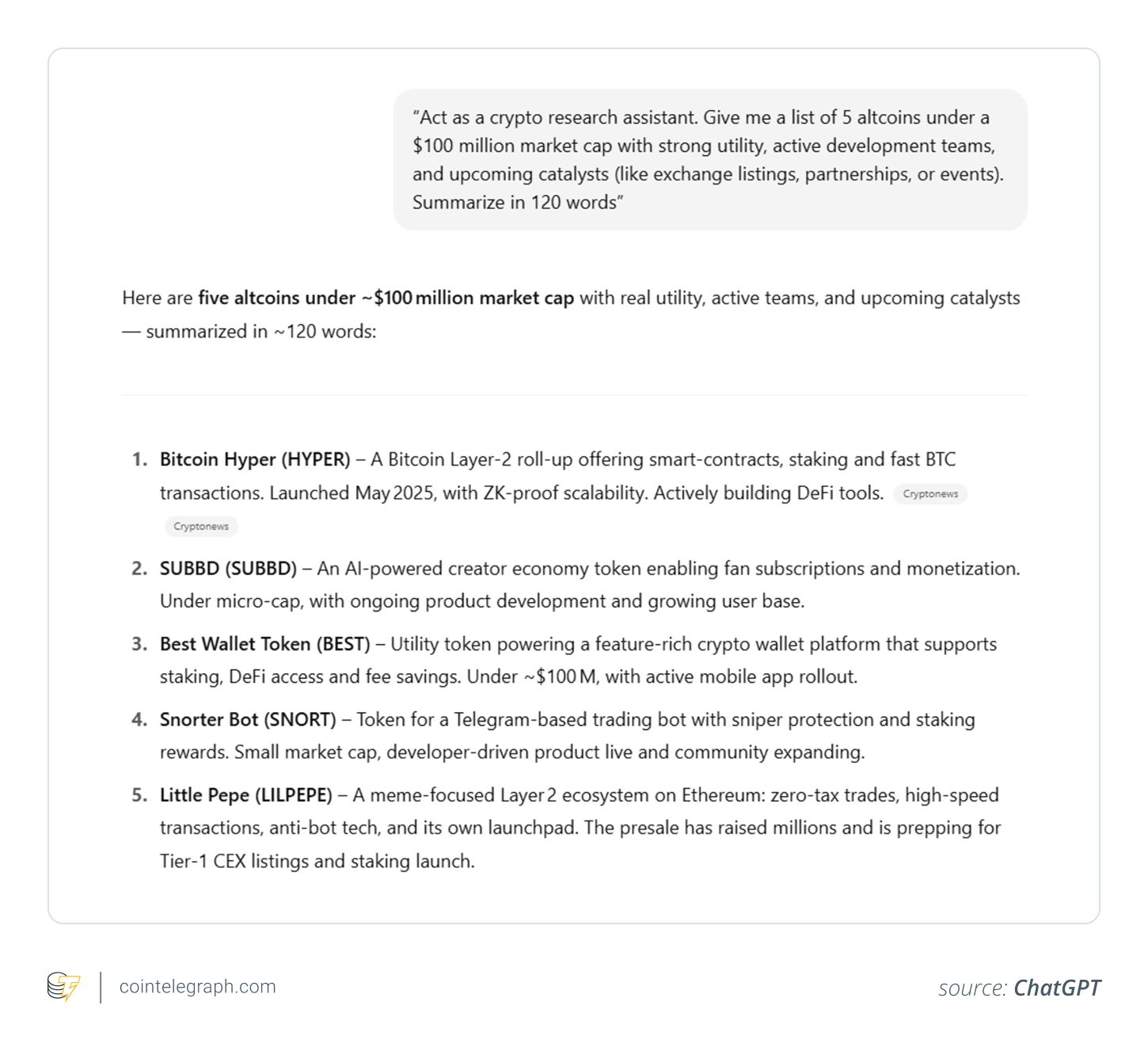

Use smart prompts → Example:

“Act as a crypto analyst. List 5 altcoins under $100M with active dev teams, strong utility, and upcoming catalysts. Summarize in 100 words.”

“Analyze which altcoins are spiking in mentions on X, Reddit, YouTube over the past 7 days. Summarize the top 3.”

Cross-check with real data → Use CoinGecko, LunarCrush, DEXTools, and good old-fashioned on-chain data to verify.

Watch for red flags → Anonymous teams, low liquidity, overhyped Telegram groups — big warning signs.

️ Caution: Don’t Chase Every Pump

️ Caution: Don’t Chase Every PumpAltcoin pumps are thrilling but dangerous. Many vanish in hours. Remember:

Big promises of 10x overnight usually mean scam.

No whitepaper, no transparency = bad sign.

Low liquidity means you can’t sell when you need to.

Organized pump groups exist to dump on newcomers.

DYOR will always beat FOMO.

Final Takeaway

Final TakeawayChatGPT can’t magically make you rich, but it can sharpen your research game. Use it to filter noise, spot trends, and generate ideas — then validate everything with hard data. In the end, patience and discipline usually outperform hype.

Because in crypto, being early is good… but being smart is better.

-

This is

— I love how you framed ChatGPT not as a “crystal ball” but as a research amplifier. Too many people think AI = instant alpha, when really it’s about processing more info faster. I’ve been using ChatGPT to scan tokenomics, whitepapers, and even summarize AMAs on Telegram, and it saves HOURS of digging.

— I love how you framed ChatGPT not as a “crystal ball” but as a research amplifier. Too many people think AI = instant alpha, when really it’s about processing more info faster. I’ve been using ChatGPT to scan tokenomics, whitepapers, and even summarize AMAs on Telegram, and it saves HOURS of digging.That said, the key point you made is spot on: cross-check everything. AI might highlight trends, but CoinGecko, on-chain scanners, and CEX/DEX volume data tell the real story. Most pumps I’ve seen collapse are just Telegram hype + thin liquidity. Without liquidity + dev activity + a real use case, the “moon mission” usually turns into a crater.

-

Totally agree with the “don’t chase every pump” warning. 90% of new traders blow up accounts because they FOMO into green candles. Personally, I use ChatGPT to build shortlists of small-caps with upcoming catalysts (partnerships, listings, burns) — then I track their social mentions on LunarCrush to see if hype is building.

Another trick: I ask ChatGPT to summarize past pump patterns (like DOGE, SHIB, PEPE) and compare them to current sentiment. Sometimes the similarities are scary accurate. Still, I treat AI as a second brain, not a signals group. Pumps are only profitable if you exit before the dump — and that’s where discipline matters more than any tool.