Why Investors Initially Panicked Over IREN’s Fundraise

Pulse of the market

3

Posts

3

Posters

15

Views

-

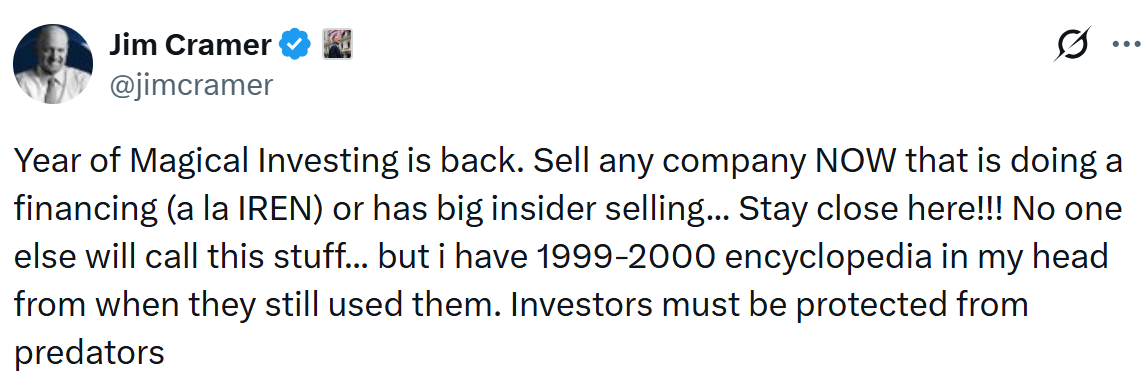

IREN is raising $2B in new convertible notes and $1.63B through a share sale—moves that often trigger dilution concerns.

Investor fear is normal: more shares = reduced value of existing holdings.

But IREN is using part of the new capital to repurchase existing notes and execute $174.8M in capped call transactions, reducing dilution and strengthening long-term balance sheet health. -

Initial panic was all about dilution fears, not fundamentals.

-

Investors often react first and analyze later.