Crypto and Fintech Leaders Urge Trump to Block Bank Data Access Fees

-

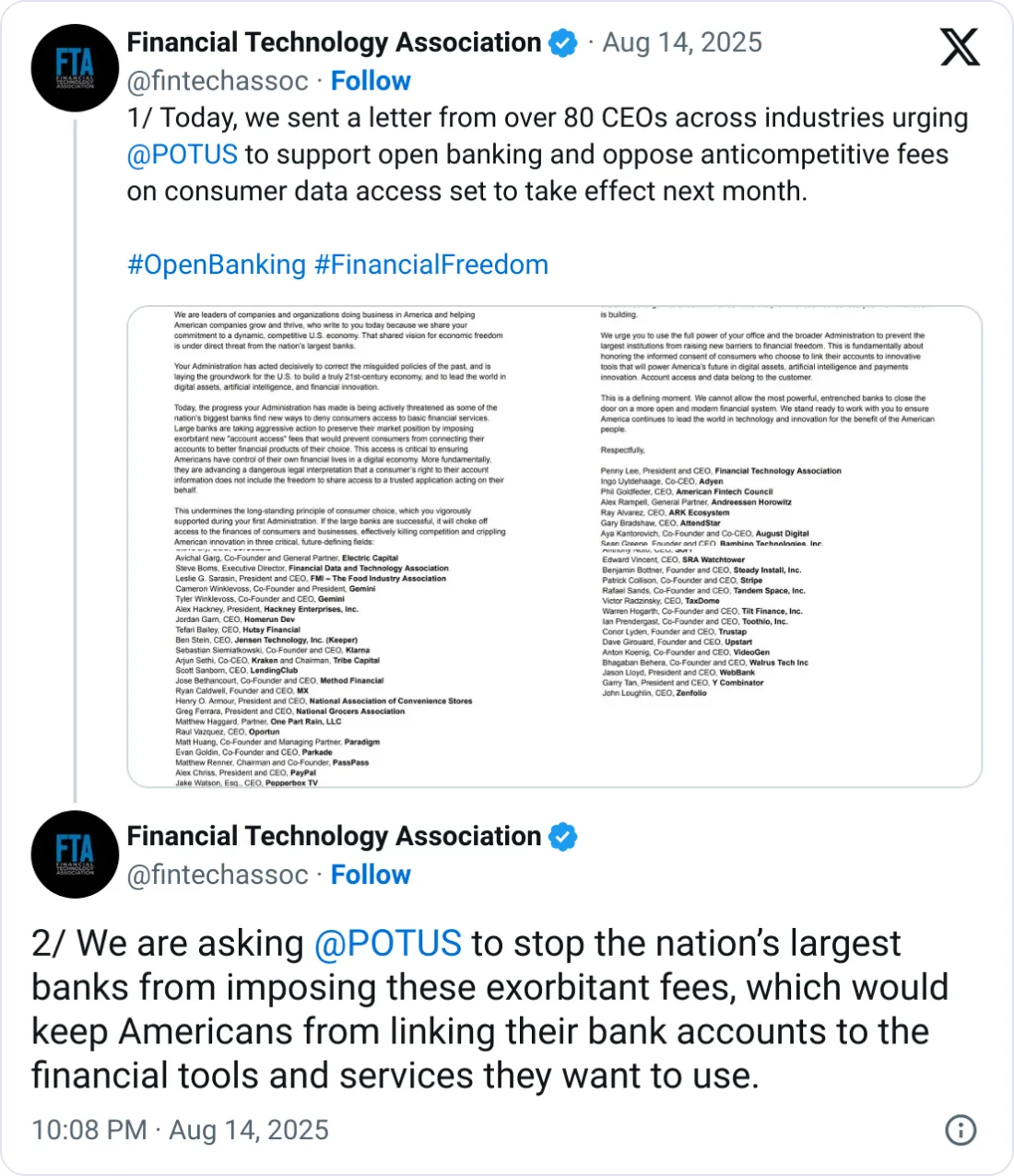

More than 80 crypto and fintech executives are pressing U.S. President Donald Trump to stop banks from charging “account access” fees for sharing customer data, warning the move could undermine the nation’s competitive edge in digital finance.In a letter sent Wednesday, the group accused major banks of seeking to “preserve their market position” by imposing exorbitant new fees that would prevent consumers from connecting their accounts to alternative financial products.

Signatories include Gemini, Robinhood, the Crypto Council for Innovation, and the Blockchain Association. They claim the fees could cripple U.S. leadership in crypto, AI, and digital payments.

Background: Open Banking Rule in the Crosshairs

The dispute traces back to the Consumer Financial Protection Bureau’s open banking rule, finalized in October 2024 under former President Biden. The rule allows customers to share their bank data with fintechs at no cost.

Banks strongly opposed the rule and sued the regulator. Trump initially sided with banks to repeal it but reversed course in late July, leaving the rule in place temporarily under pressure from the crypto lobby. The administration says it will keep the rule while drafting a new version.

Why Crypto Firms Care

Crypto exchanges and platforms rely on seamless bank data access to link users’ bank accounts for fiat-to-crypto transfers. The letter warns that bank-imposed fees could:

Shut down innovative products

Undercut Trump’s stated goal of making the U.S. a “crypto superpower”

Push innovation offshore and weaken U.S. influence in digital assets

“America’s ability to lead in the responsible development of digital assets depends on safe, reliable on-ramps connecting our banking system to the new ecosystem,” the letter states.

Banking Sector Pushback

Banking groups, led by the American Bankers Association (ABA), blasted the letter, calling it an attempt to “undermine free markets and engage in government price fixing.”

The ABA argued that fintechs want to charge for their services while demanding that banks provide equivalent services for free, labeling it “a double standard”.

Banks also accused the signatories of being “middlemen” trying to profit from Biden-era policies and “free ride” on the investments banks have made in data security and consumer protection.

Wider Context: Crypto vs. Banks on Multiple Fronts

This clash comes amid broader tension between the banking and crypto industries. Just this week, banking groups urged Congress to close a perceived loophole allowing stablecoin issuers to pay yields via affiliates — a practice banks argue creates unfair competition.

Bottom line: The outcome of this battle over bank data fees could set the tone for U.S. open banking policy and shape the on-ramps between traditional finance and the crypto ecosystem. For Trump, it’s a political balancing act between supporting an industry that heavily backed his campaign and protecting the banking sector’s commercial interests.

-

This is more than just a fee dispute — it’s about who controls the rails of the financial future. If banks succeed in charging “account access” fees, they effectively get to decide which fintechs and crypto platforms survive. That’s not innovation, that’s gatekeeping. The whole point of the open banking rule was to empower consumers to use their own data as they wish, not to let legacy players tax every connection. If the U.S. wants to be the “crypto superpower” Trump talks about, this fight is the first real test.

-

Banks calling fintechs “middlemen” is a bit rich, considering they’ve acted as the ultimate middlemen for centuries. What’s really happening here is fear — fear of losing transaction fees, fear of losing data dominance, and fear of becoming utilities instead of power brokers. Meanwhile, crypto firms are right: seamless bank-to-crypto access is essential for adoption. If the U.S. kneecaps that with extra fees, it won’t stop innovation — it’ll just drive it to Europe or Asia where open banking is already standard.

-

Framing this as a “kids-first” policy is smart politics, but let’s be real — this is another cash grab dressed up as social good. The irony is that New York benefits from being a crypto hub (Circle, Paxos, Gemini, Chainalysis are all here), yet keeps piling on more costs. If Washington and Texas are cutting taxes to attract Web3, and New York is adding new ones, we all know where the next wave of builders will move.