Fed Commentary Swings Market Odds, Boosts Bitcoin Mining Stocks

-

Volatility in prediction markets intensified this month as Fed officials issued mixed signals on monetary policy.

Chair Jerome Powell warned on Oct. 29 that a December cut was “not a foregone conclusion,” sending Polymarket odds plunging from 89% to 22% by Nov. 20.

Sentiment flipped again on Nov. 17 when Fed Governor Christopher Waller suggested cuts should be considered, citing weak labor conditions and cooling inflation.

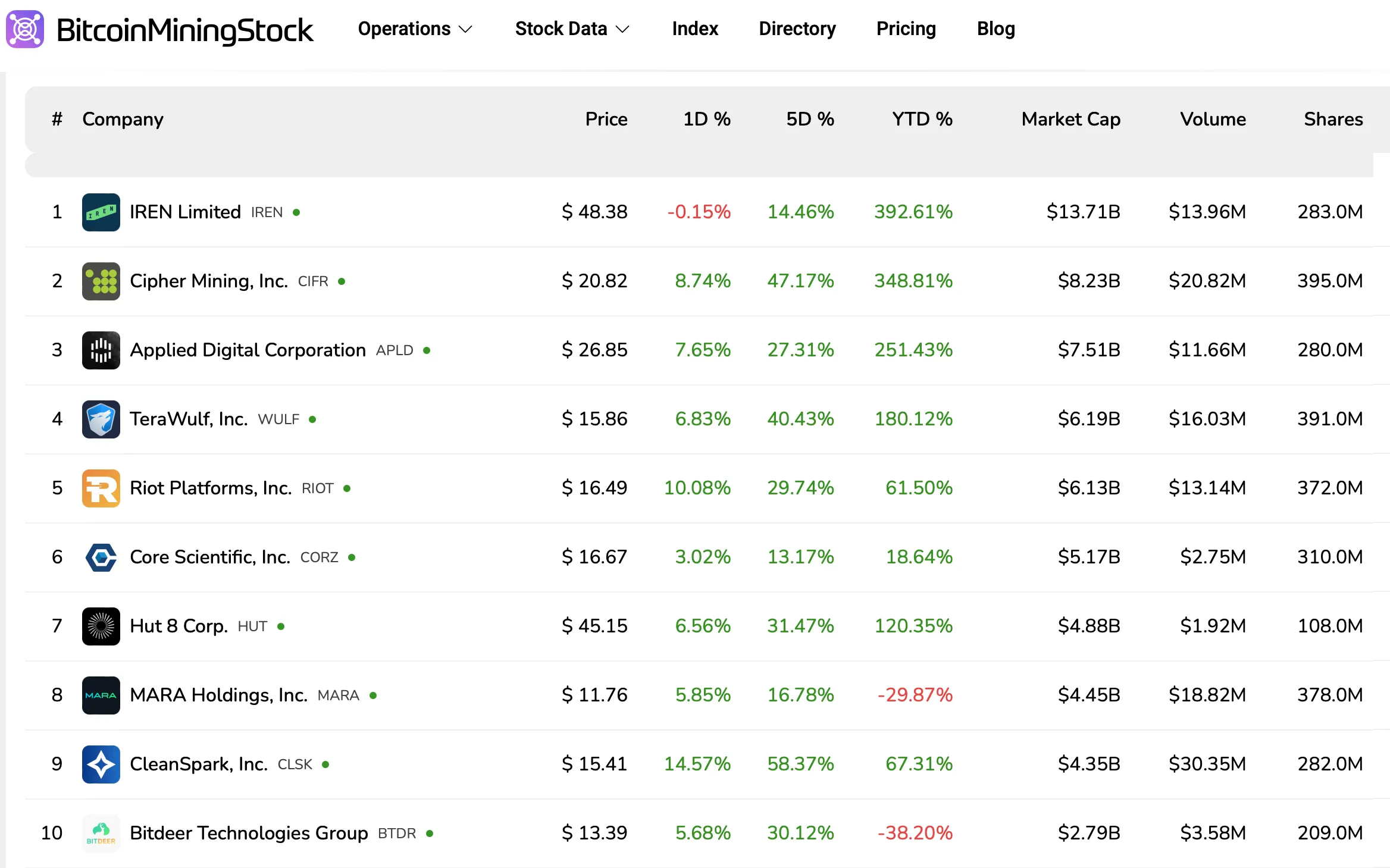

Bitcoin mining stocks quickly reacted, rallying as more traders priced in easing monetary policy. -

Mining stocks love macro relief—Fed tone always impacts risk assets.

-

Rate expectations shifting again, and miners are reacting quickly.