Structure of the Double Top Pattern

-

Structure of the Double Top Pattern

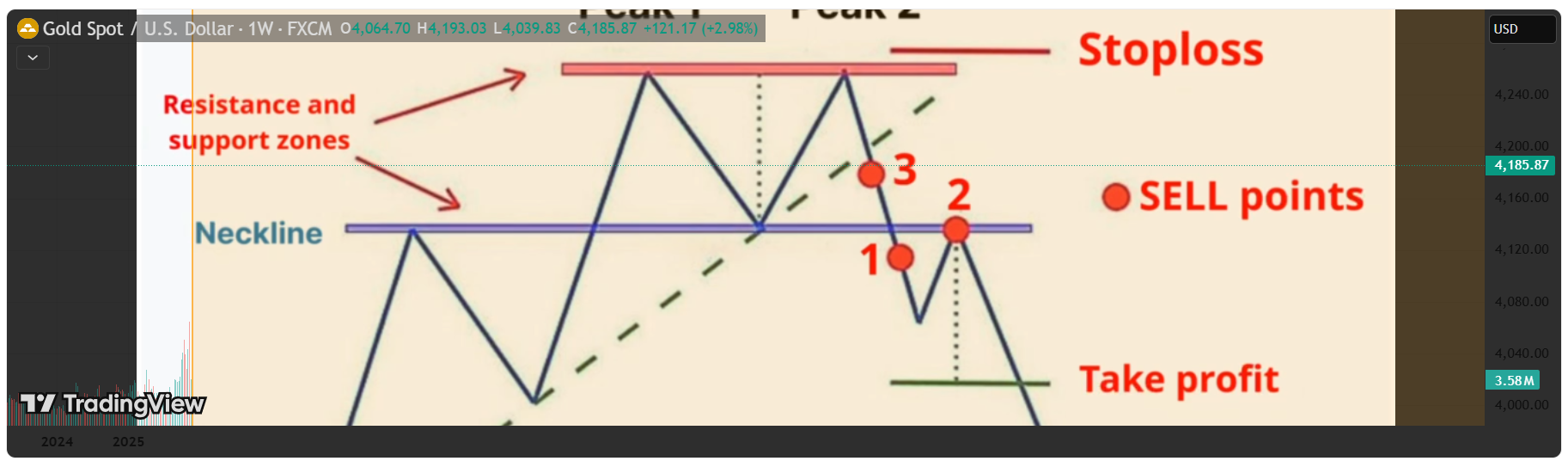

Structure of the Double Top PatternThe Double Top consists of three main components:

- First Top

- Price rises strongly and forms the first peak.

- Then price pulls back → creating the middle low (neckline).

- Second Top

- Price rallies again but fails to break above the first top.

- This indicates weakening bullish pressure.

- Neckline Breakout

- When price breaks below the neckline, the pattern is confirmed.

- This is the safest SELL entry.

Meaning of the Double Top Pattern

- Buying pressure weakens after the second top is formed.

- Sellers begin to dominate.

- Once the neckline is broken → a new downtrend begins.

- It is considered a strong and reliable reversal pattern when it forms after a clear uptrend.

Conditions for a Valid & High-Quality Double Top

️ The prior trend must be strongly bullish

️ The prior trend must be strongly bullish

️ Both tops should be approximately equal in height

️ Both tops should be approximately equal in height

️ Volume is usually higher on the first top and lower on the second

️ Volume is usually higher on the first top and lower on the second

️ A strong neckline break with high volume → solid confirmation

️ A strong neckline break with high volume → solid confirmationHow to Trade the Double Top Pattern

-

SELL Entry

Enter when price breaks the neckline and retests it.

️ The safest entry: SELL on the neckline retest → higher probability.

️ The safest entry: SELL on the neckline retest → higher probability. -

Stop Loss Placement

- Place SL slightly above the second top (or the first top).

- SL should be placed outside the structure to avoid false breakouts.

- Take Profit (TP)

- How to estimate the target:

- Measure the distance from the top to the neckline, then project it downward.

Tips to Avoid Getting Trapped by a Double Top

- Do NOT SELL just because price forms the second top → not confirmed yet

- Only SELL when the neckline is clearly broken

- Check volume or candle strength to increase accuracy

- Combine with RSI, FVG, Trendline, Liquidity concepts for higher probability

Don’t forget to like and share your thoughts in the comments!

️

️ ️

️ ️

️ -

Classic double top—watch the neckline; that’s where momentum shifts.

-

Confirmation only comes from a clean breakdown, otherwise it's just noise.