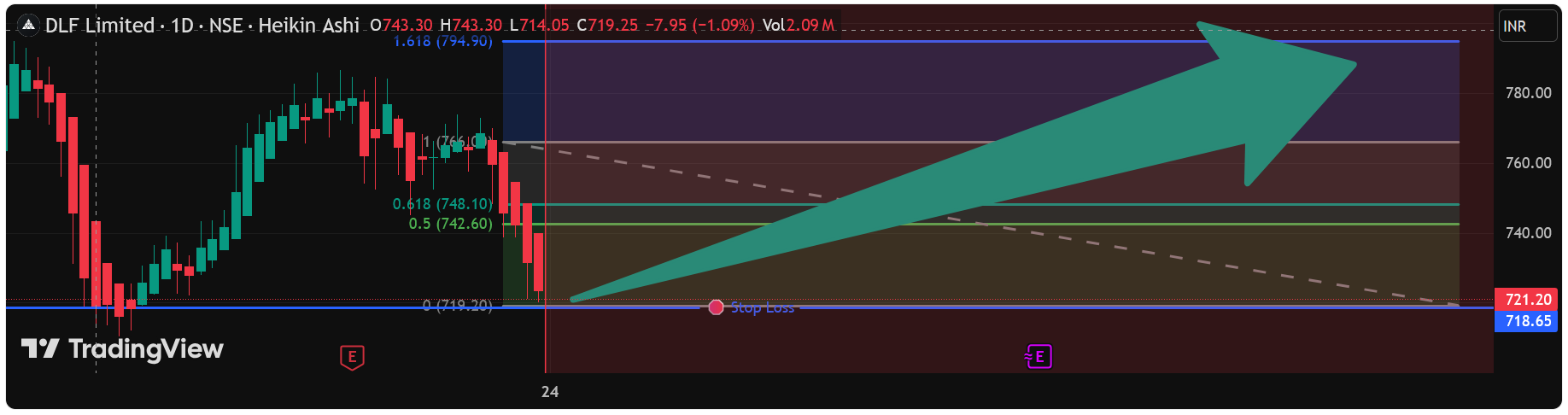

DLF Forms Bullish 'W' Pattern | Strategy Levels Marked

-

5

5

STRATEGY SNAP: CLASSIC 'W' BOTTOM PATTERN IN ACTION

STRATEGY SNAP: CLASSIC 'W' BOTTOM PATTERN IN ACTIONCHART SETUP:

Stock: DLF (India)

Timeframe: Daily - Ideal for swing identification

Pattern: Bullish 'W' Formation (Double Bottom)

Key Feature: Right-side breakout above neckline

STRATEGY EXECUTION PLAN:

STRATEGY EXECUTION PLAN:ENTRY ZONE: ₹723 - ₹725

Optimal area for position initiation

Confirmation above pattern neckline

RISK MANAGEMENT:

Stop Loss: ₹715 (Below pattern support)

Risk Per Trade: ~1.4% from entry

Position Sizing: Standard 1-2% portfolio risk

PROFIT TARGETS:

Target 1: ₹740 (+2.1% return)

Target 2: ₹760 (+4.8% return)

Risk-Reward Ratio: 1:2.1 (Very favorable)

PATTERN EDUCATION - THE 'W' BOTTOM:

PATTERN EDUCATION - THE 'W' BOTTOM:Why This Pattern Works:

Double Support Confirmation: Price tested ₹715 level twice and held

Neckline Break: Signal triggers above the W's peak

Volume Confirmation: Ideally should see increasing volume on breakout

Measured Move Projection: Pattern height suggests ₹760 target

Pattern Psychology:

First bottom: Sellers exhaust at support

Middle peak: Bulls attempt recovery

Second bottom: Final test of support confirms reversal

Breakout: Bulls take control above resistance

MY STRATEGY CRITERIA MET:

MY STRATEGY CRITERIA MET:

Clear chart pattern identified

Clear chart pattern identified

Defined entry with confirmation

Defined entry with confirmation

Specific risk management levels

Specific risk management levels

Favorable risk-reward ratio

Favorable risk-reward ratio

Logical target projections

Logical target projectionsTRADE MANAGEMENT SUGGESTIONS:

Consider partial profit booking at Target 1

Trail stop loss to breakeven at Target 1

Let remaining position ride to Target 2

FOLLOW FOR MORE CHART PATTERN STRATEGIES!

FOLLOW FOR MORE CHART PATTERN STRATEGIES! -

A clean W-formation — looks like buyers are stepping back in.

-

A clean W-formation — looks like buyers are stepping back in.

-

If it breaks the neckline, momentum could get strong fast.

-

Timeframe: Daily - Ideal for swing identification