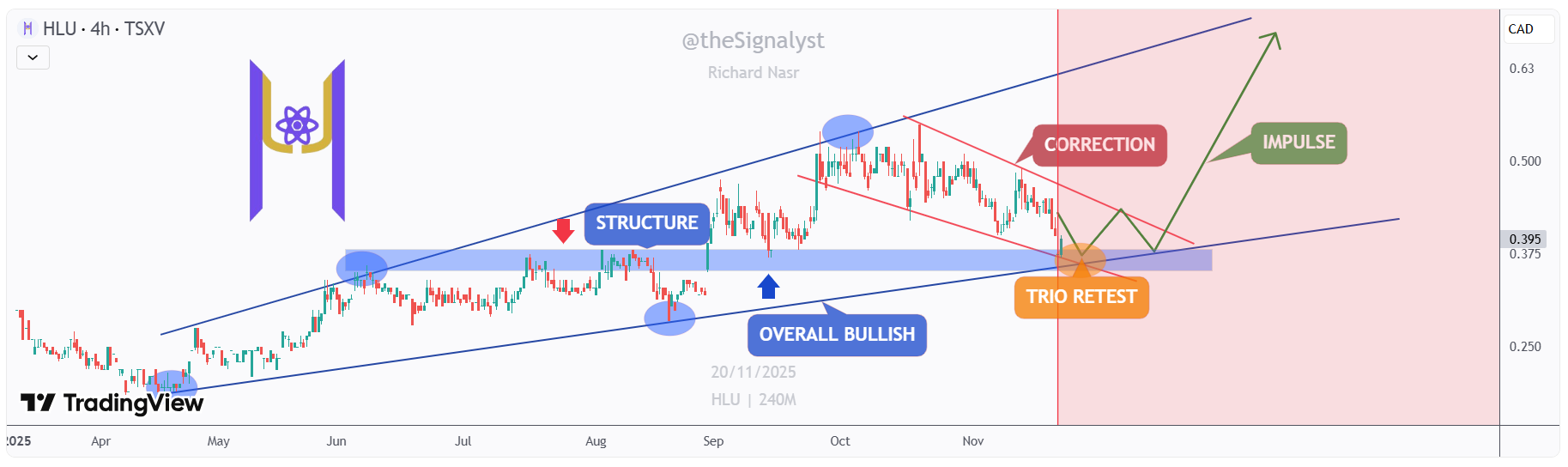

HLU - Trio Retest: Where Structure Meets Opportunity!

-

Homeland Uranium

Homeland Uranium

HLU

just secured a long-forgotten 35-million-pound uranium deposit in Colorado, originally discovered in 1979 and abandoned when the nuclear industry collapsed.With uranium prices up 141% in four years, and global demand expected to jump another 28% by 2030, Homeland is positioning itself inside a powerful multi-year commodity cycle few investors are watching.

Add AI-driven power demand, national security concerns, and new U.S. policies fast-tracking domestic uranium, and HLU becomes a high-conviction asymmetric energy play.

Technical Analysis

Technical AnalysisAfter surging by over 160%, HLU has been in a healthy correction phase, trading within the falling channel marked in red.

However, from a long-term perspective, HLU remains overall bullish, trading within the rising broadening wedge pattern.

The orange circle represents a massive rejection point, the intersection of three confluences, what I call a TRIO RETEST:

- The lower bound of the rising wedge pattern

- The lower bound of the falling channel, acting as an oversold zone

- The structure marked in blue

As HLU approaches the orange zone, we will be looking for trend-following longs.

For the bulls to confirm long-term control and kickstart the next big impulse upward, a break above the falling red channel is needed. Bigger Picture

Bigger PictureHere’s why the fundamentals add fuel to the technical setup:

-

A $2.7B uranium prize reclaimed for pennies: Homeland acquired a 35-million-pound U.S. uranium deposit for just $0.15/lb, material now worth nearly $80/lb.

-

Trump’s Day-One energy orders: New executive actions prioritize U.S. nuclear power and domestic uranium production. Homeland controls a rare U.S.-based asset right as the policy tide shifts.

-

AI is outgrowing the grid: Microsoft, Google, and Oracle are moving toward nuclear due to soaring power needs. Homeland owns the fuel they’ll need.

-

National security tailwind: The U.S. imports 98% of its uranium. Russia banned exports. China is hoarding supply. Homeland’s American deposit is uniquely strategic.

Bottom line

Bottom lineHLU is sitting at a key technical zone while the macro, political, and energy narratives align in its favor. If the TRIO retest holds, the next bullish impulse could unfold from a position of both structural and fundamental strength.

Always do your own research and consult your financial advisor before investing.

Always do your own research and consult your financial advisor before investing. Stick to your trading plan, entry, risk management, and execution.

Stick to your trading plan, entry, risk management, and execution. -

Clean structure, clean retest — this setup looks promising.

-

Opportunity usually hides in zones like this. Looks solid.

-

After surging by over 160%, HLU has been in a healthy correction phase, trading within the falling channel marked in red.