Analysts Call Bitcoin’s Drop a Healthy Bull Market Reset

-

Despite U.S.-led selling pressure, experts say Bitcoin’s recent decline fits classic bull-market behavior.

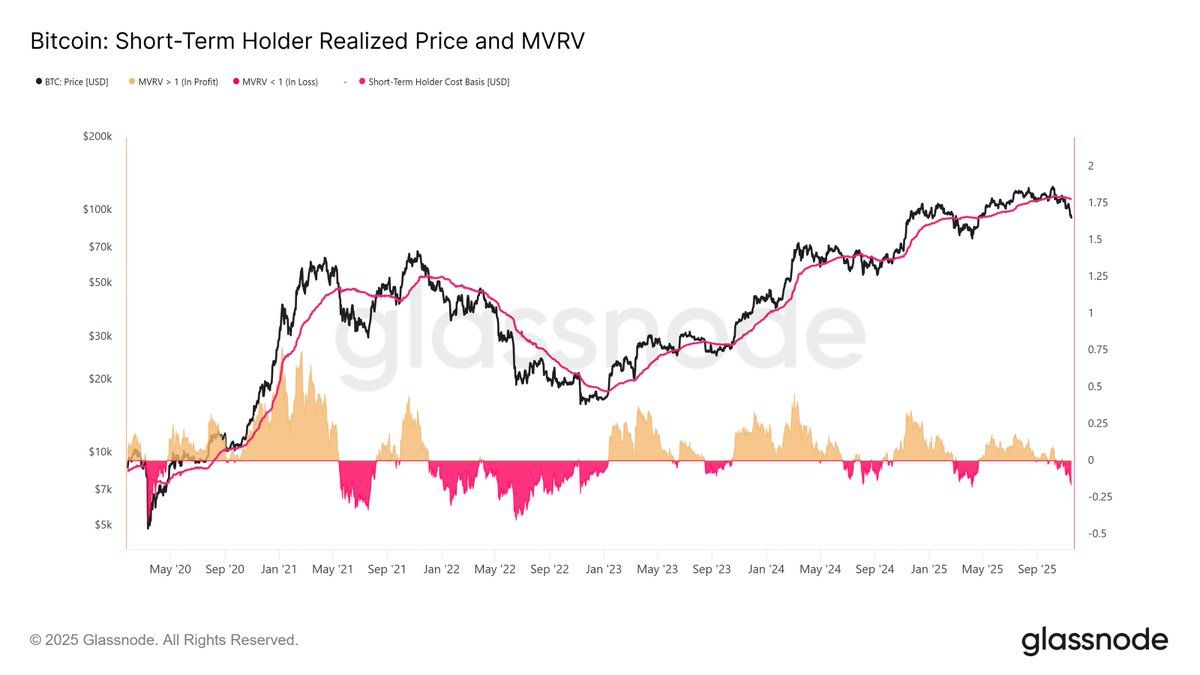

Fidelity’s Chris Kuiper points to on-chain metrics like the short-term holder MVRV ratio, which mirrors past corrections that fueled later rallies. There’s no major negative event driving the pullback — just profit-taking and leverage flushing after Bitcoin’s run toward $100K.With Asian markets buying dips and no major regulatory or macro shocks, analysts see this phase as a reset of short-term speculation, not the end of the cycle.

The question now:

Will improving U.S. sentiment align with Asia’s optimism — or will this regional split define the next phase of the bull market? -

A cooling phase like this often strengthens the next leg of the bull run.

️

️

-

Corrections aren’t weakness — they’re fuel for long-term momentum.

-

With Asian markets buying dips and no major regulatory or macro shocks, analysts see this phase as a reset of short-term speculation, not the end of the cycle.