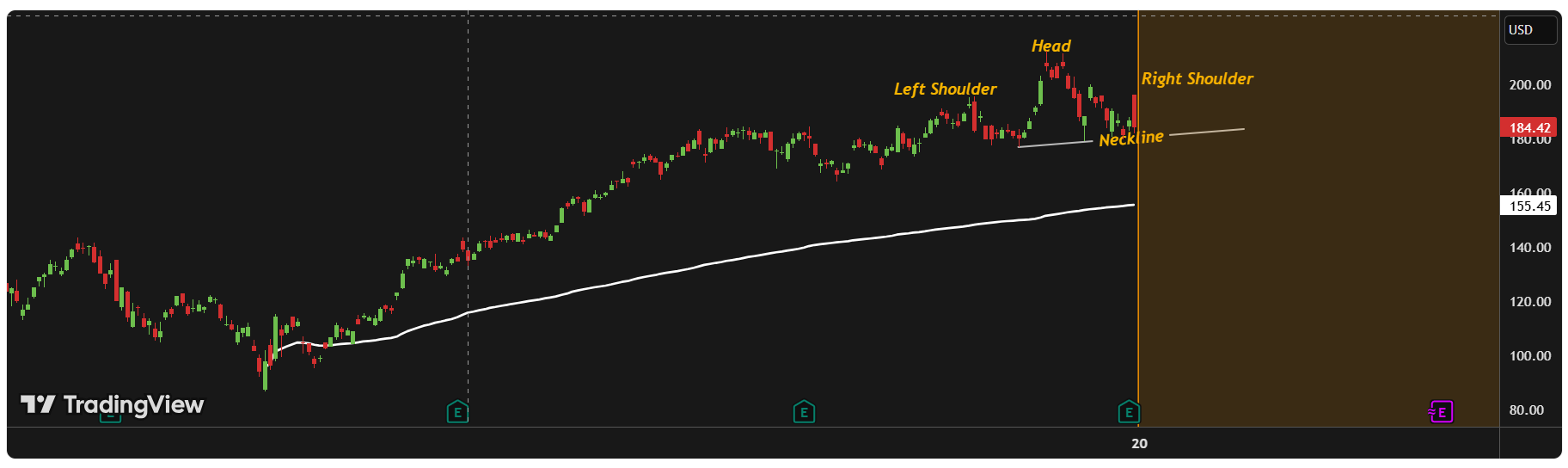

NVDA | Post-Earnings Exhaustion Near Recent Highs – What’s Next?

-

NVIDIA delivered another exceptional quarter, with revenue surging and demand for AI infrastructure remaining firm. Yet the market’s reaction was notably muted, signalling that expectations may already be stretched in the short term.

NVIDIA delivered another exceptional quarter, with revenue surging and demand for AI infrastructure remaining firm. Yet the market’s reaction was notably muted, signalling that expectations may already be stretched in the short term.Technical Lens:

The share price gapped higher after earnings but struggled to break above its recent peak. It slipped back toward the pre-announcement zone, which suggests fatigue after months of strong momentum. The anchored VWAP from the last significant swing remains an important reference point below current prices, acting as fair-value support throughout the year.

Scenarios:

• If the anchored VWAP continues to draw price lower, the shares may drift into that support zone before sentiment resets and buyers return.

• If the post-earnings gap is reclaimed and price pushes through prior highs, it would indicate that momentum is re-energising sooner than expected.

Catalysts:

Upcoming macro data, broader equity market sentiment, and any fresh commentary on AI demand or supply constraints may influence whether NVIDIA consolidates or attempts another move toward new highs.

Takeaway:

The fundamentals remain strong, but the technical picture hints at a near-term pause. The anchored VWAP zone sits as the key decision point for the next phase of the trend.

-

Post-earnings fatigue is normal — NVDA often consolidates before the next breakout leg.

-

If volume stabilizes, we might see another strong push toward new highs.