The US Moves Closer to Joining Global Crypto Tax-Sharing Network

-

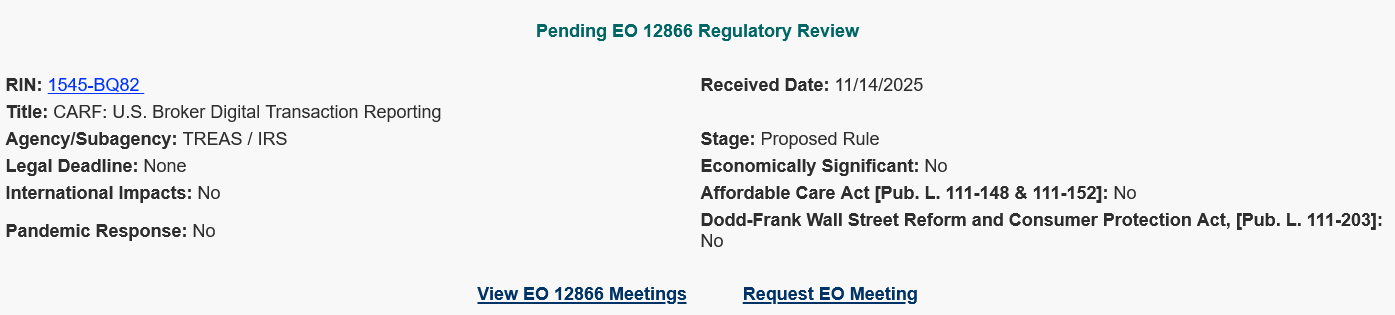

The White House is officially reviewing the IRS’s proposal for the United States to join the global Crypto-Asset Reporting Framework (CARF) — a system that would give the IRS access to Americans’ foreign crypto account data.

If approved, the Broker Digital Transaction Reporting rule would align the U.S. with 72 other countries that plan to roll out CARF by 2028.

For crypto users, this means one thing:

️ Much stricter reporting requirements for capital gains from foreign exchanges.

️ Much stricter reporting requirements for capital gains from foreign exchanges.The White House previously argued that CARF would help prevent Americans from shifting assets offshore to avoid tax — and ensure U.S. exchanges aren’t at a competitive disadvantage.

-

The U.S. joining this network will create a massive shift in reporting standards.

-

Global coordination around crypto taxation is accelerating fast.