🚀 Bitcoin Eyes $120K — $18B in Shorts at Risk of Liquidation

-

Bitcoin bulls are circling for a massive short squeeze, and some traders are already calling for a run to all-time highs.

The Setup

The SetupOver the weekend, BTC/USD hit $118,760 on Bitstamp — the highest in August so far.

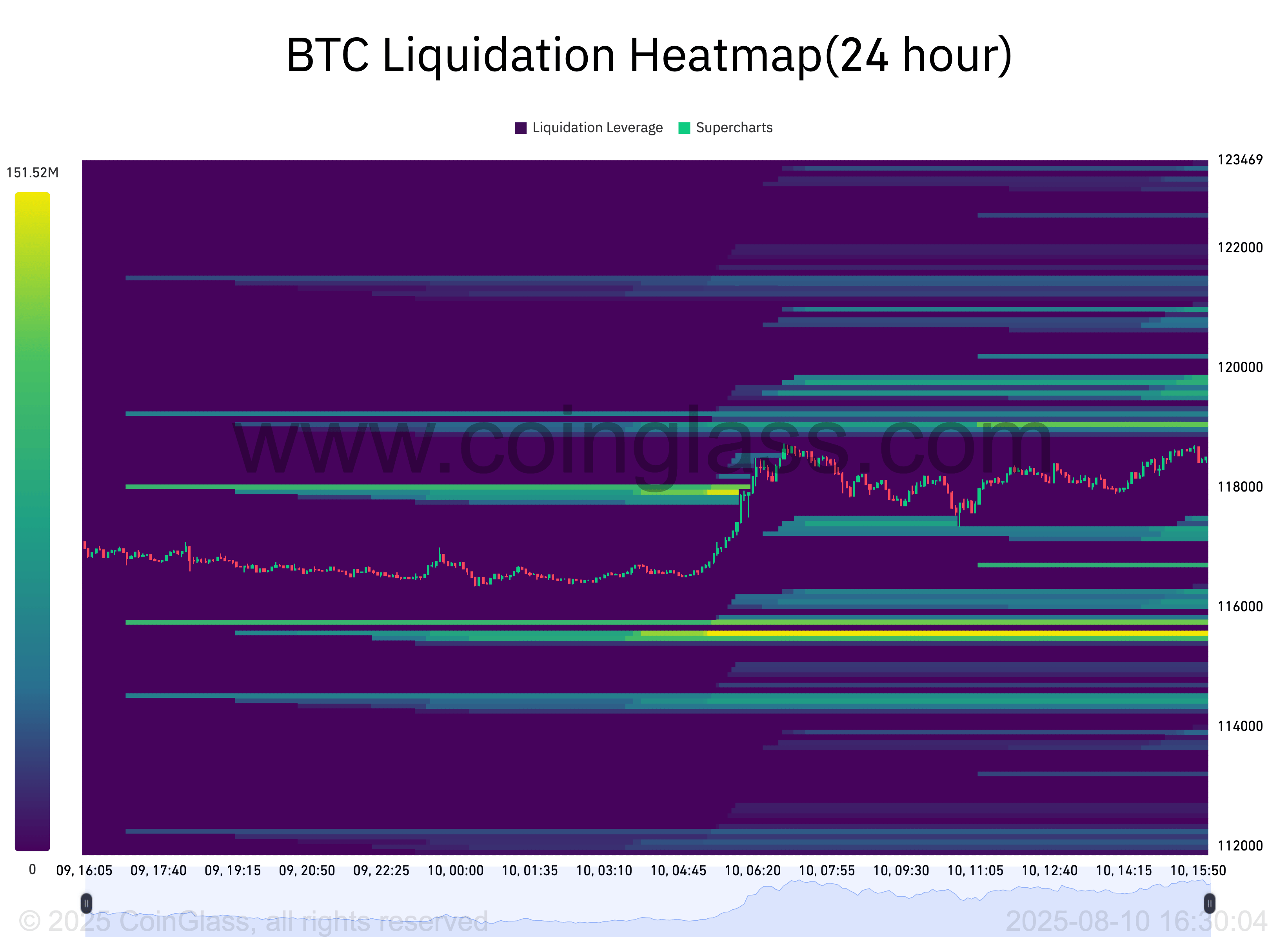

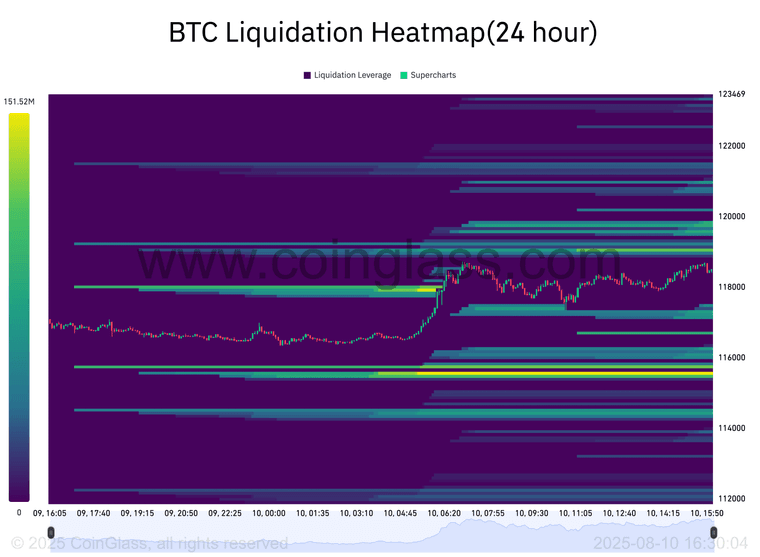

The move came during “out-of-hours” weekend trading, pushing $350M in crypto liquidations in just 24 hours (CoinGlass data).Key levels in play:

$117,200 → Potential weekly support reclaim (per Rekt Capital). $116,500 CME gap → Possible dip target before another leg up. $120K+ → The breakout zone everyone’s watching. Why Bulls Are Excited

Why Bulls Are ExcitedPopular trader BitBull points out:

“A 10% move higher will trigger $18B+ in short liquidations — big money is watching.”He adds that while Monday might see a small retrace as TradFi markets reopen, the path after could lead to $120,000+.

Trader Merlijn agrees — expecting a short squeeze to fuel the rally.

The CME Gap Factor

The CME Gap FactorCrypto investor Ted Pillows highlights a gap at $116.5K in the CME Bitcoin futures market:

Last week’s gap got filled after a $2K drop. This gap could see the same treatment before Bitcoin rallies toward a new ATH. ️ Caution from the Sidelines

️ Caution from the SidelinesNot everyone is calling it a clean breakout just yet.

Daan Crypto Trades describes the weekend’s BTC moves as “choppy” and notes ETH and altcoins have been stealing the show. He expects BTC to dominate attention again once it breaks $120K and nears ATH levels. TL;DR:

TL;DR:BTC is pushing August highs. $18B in shorts could get squeezed with just a 10% move. Watch $116.5K (CME gap) for a possible dip before the run. $120K is the line in the sand for full-blown hype mode.