Crypto Travelers Show 3x Lifetime Value vs. Fiat Users — Binance Pay & Travala Report 🌍✈️

-

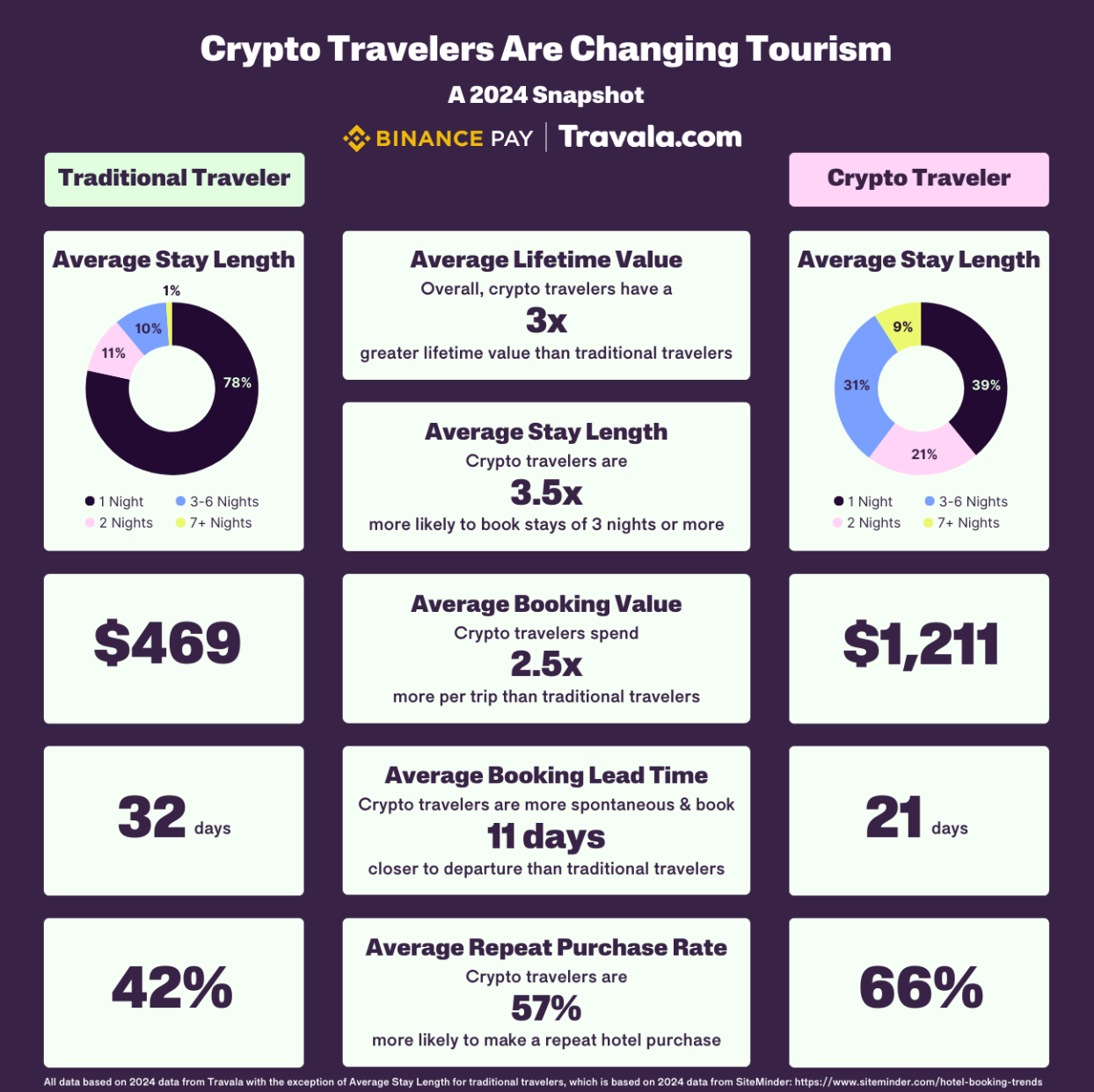

A new joint report from Binance Pay and crypto travel platform Travala shows that travelers paying with crypto aren’t just early adopters — they’re big spenders with high loyalty.

Key Findings

Key FindingsCrypto bookings 2024: $80M (up from $45M in 2023) Average booking value: $1,211 (crypto) vs. $469 (fiat) → 2.5x higher LTV boost: Crypto users are 3x more valuable over time due to longer stays & repeat bookings Repeat rate: 57% more likely to book hotels again with crypto Why the Difference?

Why the Difference?Many crypto travelers work remotely or in Web3, enabling frequent, flexible travel Borderless payments = no FX lines, no foreign transaction fees, instant settlement Airline integrations with crypto saw a 40% booking boost in 2024 (Triple-A report) Macro Context

Macro ContextCrypto ownership growing at a 99% CAGR 65% of holders want to use it for payments Travala accepts 141+ cryptocurrencies for flights, hotels, and tours (BTC, USDC, USDT, etc.) ️ Industry Trend

️ Industry TrendCrypto payments started with high-end goods (luxury fashion, watches, cars) but are now moving into mainstream retail and travel. Even fast food chains like Steak ’n Shake are in — though on-chain BTC payments can still face high fees & delays, making off-chain solutions like Binance Pay more practical for now.

Takeaway: Crypto travelers are a premium customer segment — higher spend, stronger loyalty, and faster adoption of new payment rails. For travel and hospitality businesses, ignoring this market could mean leaving serious money on the table.

Would you pay for travel with crypto if it meant faster booking and no FX fees — or would you stick to fiat for the rewards points?

-

The numbers here make a pretty strong case that crypto travelers are a premium segment worth targeting. An average booking value of $1,211 vs $469 for fiat — plus 57% higher repeat booking rates — is exactly the kind of data that hospitality execs love to see. The fact that crypto users are 3x more valuable over time because they stay longer and come back more often just seals the deal.What’s driving it makes sense too — borderless, fee-free payments, instant settlement, and a customer base made up of remote workers and Web3 professionals who have flexible schedules and travel more often. Airline crypto integrations seeing a 40% booking boost in 2024 is just more proof that this market is maturing fast.If I ran a travel business, I wouldn’t just accept crypto — I’d actively market to these users. They’re already showing they spend more, come back more, and are more likely to try new payment tech.

-

This report is a wake-up call for the travel industry. $80M in crypto bookings last year, up from $45M in 2023, shows the growth curve is steep — and we’re still early. The LTV and repeat rate advantages alone make this segment worth pursuing aggressively.It’s also notable that crypto payment adoption is expanding beyond luxury goods into mainstream categories like flights, hotels, and even fast food. Off-chain solutions like Binance Pay solve the BTC network’s fee and delay issues, making it much more practical for everyday travel use.

Bottom line: crypto travelers aren’t just paying differently, they’re traveling differently — longer stays, more frequent trips, and higher budgets. Ignore them, and you’re basically telling a high-value customer base to go spend with your competitors.