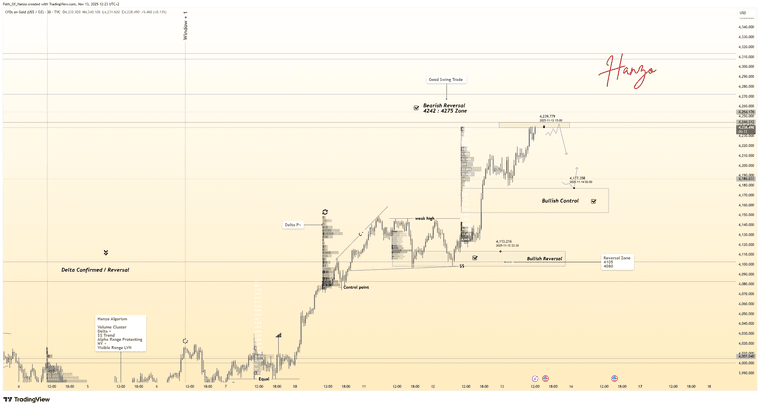

Gold 30-Min — Volume Buy & Sell Reversals Triggered

-

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

️ Technical Reasons

️ Technical Reasons

/ Direction — LONG / Reversal 4178 ️Bullish momentum confirmed through strong candle body.

️Bullish momentum confirmed through strong candle body.

️Structure shifted with higher-low near key demand base.

️Structure shifted with higher-low near key demand base.

️Volume expanding confirms order-flow alignment upward.

️Volume expanding confirms order-flow alignment upward.

️Buyers reclaimed imbalance with sustained clean break.

️Buyers reclaimed imbalance with sustained clean break.

️Algorithm detects rising momentum under low liquidity.

️Algorithm detects rising momentum under low liquidity. ️ Technical Reasons

️ Technical Reasons

/ Direction — SHORT / Reversal 4242 ️Bearish rejection confirmed through sharp candle body.

️Bearish rejection confirmed through sharp candle body.

️Lower-high forming beneath resistance supply region.

️Lower-high forming beneath resistance supply region.

️Volume decreasing confirms exhaustion in price rally.

️Volume decreasing confirms exhaustion in price rally.

️Sellers regained imbalance with heavy top rejection.

️Sellers regained imbalance with heavy top rejection.

️Algorithm detects fading demand and shift to control.

️Algorithm detects fading demand and shift to control. ️ Hanzo Alpha Trading Protocol

️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins. ️ Hanzo Volume Window / Map

️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones. ️ Hanzo Delta Window / Pulse

️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable. -

Reversal signals firing back-to-back — volatility is heating up.

-

Volume spikes on both sides usually mean a bigger move is brewing.