Bitcoin Daily Analysis #145

-

Let’s get into Bitcoin analysis. Yesterday, Bitcoin was rejected from the zone I had mentioned, and today it will probably begin its new downward move. 4-Hour Timeframe

4-Hour Timeframe

In yesterday’s analysis, I told you that a pullback to SMA25 and the 0.5 Fibonacci zone was possible. That happened, and now, given the current candle, the probability of a corrective scenario has increased. ️ I still won’t open any position on Bitcoin and am waiting for it to exit the box between 110000 and 116000. But if certain conditions occur in the market, I might open a position inside this box as well.

️ I still won’t open any position on Bitcoin and am waiting for it to exit the box between 110000 and 116000. But if certain conditions occur in the market, I might open a position inside this box as well. First of all, Bitcoin is still above the 111747 support, which is a very important support zone. As the price reaches it, there’s a chance it gets stuck there again.

First of all, Bitcoin is still above the 111747 support, which is a very important support zone. As the price reaches it, there’s a chance it gets stuck there again. On the other hand, seller strength is very high, and as you can see, the RSI has been rejected from the 50 ceiling, and a red engulfing candle with very high volume is forming — all of which indicate the power of sellers.

On the other hand, seller strength is very high, and as you can see, the RSI has been rejected from the 50 ceiling, and a red engulfing candle with very high volume is forming — all of which indicate the power of sellers. I still stand by my opinion that as long as the price is above 110000, I won’t open a short position. But for a long position, we can move to the 1-Hour timeframe to review the trigger that has formed.

I still stand by my opinion that as long as the price is above 110000, I won’t open a short position. But for a long position, we can move to the 1-Hour timeframe to review the trigger that has formed.snapshot

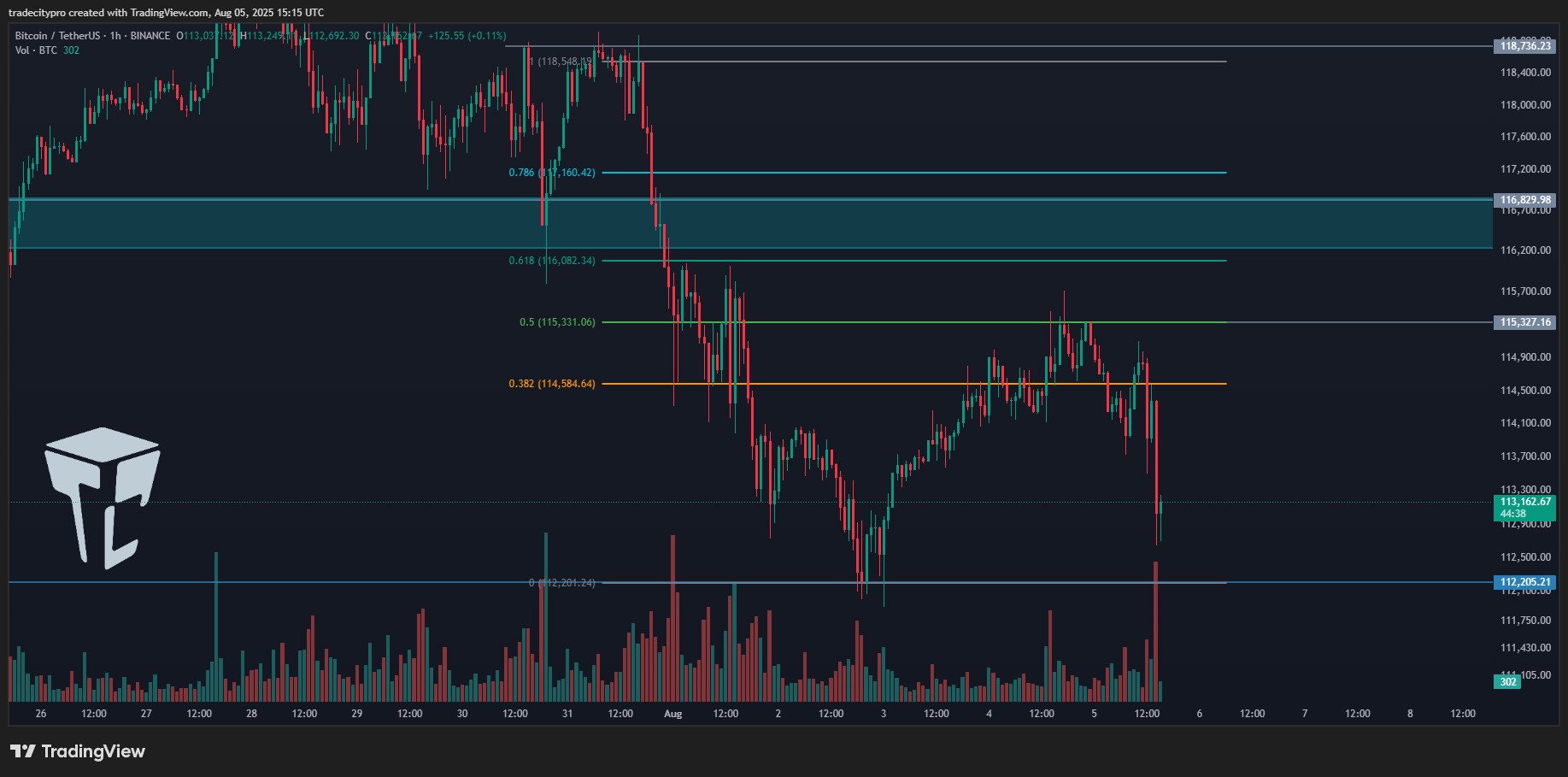

1-Hour Timeframe

1-Hour Timeframe

Before reviewing the triggers, there’s a very important point that explains why I currently prefer to remain without a position. Bitcoin in the HWC and MWC cycles has a very strong upward trend. Right now, in the LWC, it’s moving downward. So this Fibonacci drawn on the bearish leg doesn’t really mean much and won’t give us very strong and accurate resistances.

Bitcoin in the HWC and MWC cycles has a very strong upward trend. Right now, in the LWC, it’s moving downward. So this Fibonacci drawn on the bearish leg doesn’t really mean much and won’t give us very strong and accurate resistances. On the other hand, the LWC is moving against the higher cycles — meaning the higher cycles are stronger. That’s why shorting doesn’t make sense, since it’s against the main market cycle.

On the other hand, the LWC is moving against the higher cycles — meaning the higher cycles are stronger. That’s why shorting doesn’t make sense, since it’s against the main market cycle. But also, since LWC has gained downward momentum, long positions — if not set with wide stop-losses — will likely get stopped out, because this momentum may cause small downward legs that hit stop-losses.

But also, since LWC has gained downward momentum, long positions — if not set with wide stop-losses — will likely get stopped out, because this momentum may cause small downward legs that hit stop-losses. So opening a long position is also difficult right now, and that’s why I say it’s better to wait for the price to move out of the 110000 to 116000 range, and then enter a position more comfortably.

So opening a long position is also difficult right now, and that’s why I say it’s better to wait for the price to move out of the 110000 to 116000 range, and then enter a position more comfortably. If the price goes below 110000, we’ll receive the first sign of a trend reversal in the MWC, and then we can open short positions. And if it goes above 116000, LWC becomes bullish again and the continuation of the uptrend can begin.

If the price goes below 110000, we’ll receive the first sign of a trend reversal in the MWC, and then we can open short positions. And if it goes above 116000, LWC becomes bullish again and the continuation of the uptrend can begin.Let’s now go to the triggers:

The trigger we have for a long position is 115327 — an important ceiling that overlaps with the 0.5 Fibonacci level and has been touched several times.

The trigger we have for a long position is 115327 — an important ceiling that overlaps with the 0.5 Fibonacci level and has been touched several times. ️ If we get another touch to this level, I myself will likely try to open a long position, and I think it’s a good entry point that’s worth the risk to anticipate a breakout of 116000.

️ If we get another touch to this level, I myself will likely try to open a long position, and I think it’s a good entry point that’s worth the risk to anticipate a breakout of 116000. For a short position, a break below the 112205 low will start the continuation of the correction. I won’t open this position myself, but if you believe Bitcoin wants to reverse its trend, this is a very good trigger in terms of price level and you can open the position.

For a short position, a break below the 112205 low will start the continuation of the correction. I won’t open this position myself, but if you believe Bitcoin wants to reverse its trend, this is a very good trigger in terms of price level and you can open the position. Disclaimer

Disclaimer

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

-

BTC is currently in a delicate zone where short-term optimism is meeting strong macro resistance. While the recent recovery has brought price above key EMAs, the lack of strong volume suggests this move may not be sustainable without new catalysts.

BTC is currently in a delicate zone where short-term optimism is meeting strong macro resistance. While the recent recovery has brought price above key EMAs, the lack of strong volume suggests this move may not be sustainable without new catalysts.

🧭 For bulls, reclaiming and holding above the $61.2k–$62k range is critical. This zone acts as both structural resistance and a liquidity trap for shorts. If it breaks cleanly, BTC could push toward $64k+. But any rejection here, especially with bearish divergence on RSI or MACD flattening, could trigger a quick pullback toward $58k or even $56.5k.

️ Traders should be cautious of fakeouts—watch for volume confirmation and candle closes on higher timeframes before committing to a direction.

️ Traders should be cautious of fakeouts—watch for volume confirmation and candle closes on higher timeframes before committing to a direction. -

Bitcoin is showing signs of indecision with price consolidating just below key resistance. This kind of chop is often a precursor to a breakout — but direction still remains uncertain. The recent higher lows hint at bullish structure, but without volume and momentum, it’s vulnerable.

Bitcoin is showing signs of indecision with price consolidating just below key resistance. This kind of chop is often a precursor to a breakout — but direction still remains uncertain. The recent higher lows hint at bullish structure, but without volume and momentum, it’s vulnerable.

If the market sweeps the local highs near $62k and fails to hold, it could indicate a liquidity grab before a deeper correction. On the flip side, if price forms a strong 4H or daily close above that level, it could ignite a bullish continuation move.

If the market sweeps the local highs near $62k and fails to hold, it could indicate a liquidity grab before a deeper correction. On the flip side, if price forms a strong 4H or daily close above that level, it could ignite a bullish continuation move.

🧠 Smart traders will avoid chasing price and instead let the structure develop. Patience pays more than prediction in this kind of range-bound market.