Ethereum transaction volumes see year-high amid SEC staking drama

-

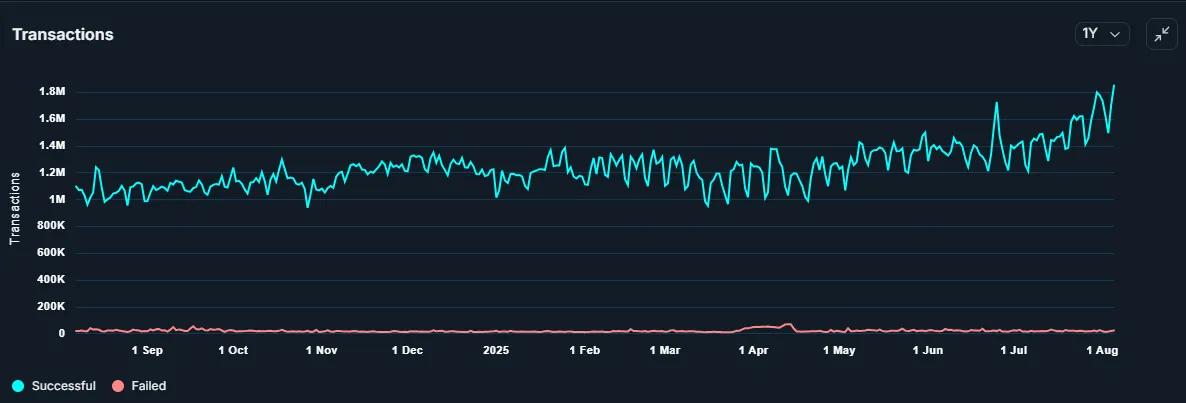

Transactions on the Ethereum network have hit yearly highs as the SEC deliberates on how to classify liquid staking protocols.

216

Ethereum transaction volumes see year-high amid SEC staking drama

Analysis

COINTELEGRAPH IN YOUR SOCIAL FEED

Subscribe on

Follow ourTransactions on the Ethereum network have reached a one-year high as the US Securities and Exchange Commission issues new guidance on staking.

This comes amid historical highs in Ether staked on the network; according to Dune Analytics, over 36 million Ether

ETH$3,600

is now staked on Ethereum, representing nearly 30% of the total token supply.A large number of tokens locked into smart contracts indicates that Ether holders are hunkering down, preferring to render their ETH unsellable for the time being in exchange for staking rewards.

The increased network activity follows guidance from the SEC and an additional commission statement that liquid staking may be exempt from securities laws; however, commentary from one commissioner suggests that it may not be that simple.

One-year chart of transactions on the Ethereum network. Source: Nansen

Liquid staking on Ethereum in “muddy waters”On Tuesday, the SEC’s Division of Corporation Finance released a “Statement on Certain Liquid Staking Activities.” In it, the division defined and explained its views on liquid staking.

Liquid staking is a form of staking that issues a token representing a user’s staked asset. It allows investors to continue using decentralized finance (DeFi) protocols while earning staking rewards.

The division said that liquid staking activities, as well as the offer and sale of “staking receipt tokens,” insofar as they are described in the SEC’s statement, do not “involve the offer and sale of securities” as defined by the 1933 Securities Act.

As such, entities issuing “staking receipt tokens,” so long as those tokens don’t constitute some form of investment contract, do not need to be registered with the SEC.

The DeFi industry was quick to hail the updated guidance as a victory.

“Institutions can now confidently integrate LSTs [liquid staking tokens] into their products, which is sure to drive new revenue streams, expand customer bases and enable the creation of secondary markets for staked assets,” Mara Schmiedt, CEO of blockchain developer company Alluvial, previously told Cointelegraph.

Advertisement

Start Your Crypto Journey with Coinbase! Join millions worldwide who trust Coinbase to invest, spend, save, and earn crypto securely. Buy Bitcoin, Ethereum, and more with ease!

Jito Labs CEO Lucas Bruder said the guidance “shows the same nuanced understanding of LST technology that the Crypto Task Force exhibited when we met with them on this topic back in February.”

However, not everyone at the SEC is convinced that the Division of Corporation Finance made the right move.

On Wednesday, Commissioner Caroline Crenshaw responded, saying that the division’s statement “stacks factual assumption on top of factual assumption on top of factual assumption, resulting in a wobbly wall of facts without an anchor in industry reality.” She said that their definition of staking “might not reflect prevailing conditions on the ground.”

Per Crenshaw, the legal conclusions of the statement (i.e., that LSTs are exempt from securities laws) “apply only if those many factual assumptions hold.”

Related: Spot Ether ETF staking could ‘dramatically reshape the market’

“To the extent that any particular liquid staking activity deviates from the numerous factual assumptions laid out in the Liquid Staking Statement, that activity is outside the statement’s scope.”She concluded that the statement reflects only the views of the singular division, not the whole commission, and said it should give “little comfort” to entities involved in staking.

The statement is not without allies in the SEC. So-called “Crypto Mom” Hester Peirce — an SEC commissioner who has advocated for more favorable regulations for the crypto industry over the years — released a statement of her own, saying that the division has clarified its view “that liquid staking activities in connection with protocol staking do not involve the offer and sale of securities.”

Chairman Paul Atkins said it was “a significant step forward in clarifying the staff’s view about crypto asset activities that do not fall within the SEC’s jurisdiction.”

Ethereum ascendent with DeFi still in a legal gray areaRegardless of the limitations of the division’s statement or the potential outcomes thereof, the Ethereum ecosystem is optimistic.

Pseudonymous CryptoQuant author Onchainschool noted in a Tuesday post that more than 500,000 ETH (worth approximately $1.8 billion at publishing time) was staked in the first half of June alone.

“This growth signals rising confidence and a continued drop in liquid supply,” they stated.

Furthermore, blockchain addresses with no selling history are also on the rise, holding nearly 23 million ETH (worth some $82.6 billion at current prices).

Ether staked and validators since November 2020. Source: Dune

Still, the DeFi industry, much of which is built on the framework of Ethereum, still lacks legal recognition or regulation in many jurisdictions.

In the case of the US SEC, the commission delayed its decision on Bitwise’s application to add staking to its Ether exchange-traded fund (ETF).

The CLARITY Act, which would establish some regulations for the DeFi industry, is still making its way through the halls of Congress. The bill would exempt DeFi protocols from some of the standards it creates for other crypto-related entities and allow them to launch and sell native tokens.

The European Union’s Markets in Crypto-Assets regulation does not contain provisions for the DeFi industry; however, this will reportedly become a priority for the bloc’s lawmakers in 2026.

Sooner or later, it appears that DeFi regulations are coming and ecosystems critical for the industry, like Ethereum, are getting ready.

-

Ethereum hitting a year-high in transaction volume during SEC staking-related uncertainty says a lot about its resilience. When network activity increases during regulatory tension, it often reflects a shift in investor behavior — either panic exits or strategic accumulation.

Ethereum hitting a year-high in transaction volume during SEC staking-related uncertainty says a lot about its resilience. When network activity increases during regulatory tension, it often reflects a shift in investor behavior — either panic exits or strategic accumulation.

The spike in volume could be due to whales redistributing assets across wallets, or large-scale movements in DeFi protocols adjusting to possible staking restrictions. Either way, this level of on-chain activity is rarely random.

The spike in volume could be due to whales redistributing assets across wallets, or large-scale movements in DeFi protocols adjusting to possible staking restrictions. Either way, this level of on-chain activity is rarely random.

️ Price may stay choppy in the short term, but high transaction throughput usually precedes major moves. Watch how the market reacts to SEC’s next steps — any clarity (positive or negative) could drive ETH hard in either direction.

️ Price may stay choppy in the short term, but high transaction throughput usually precedes major moves. Watch how the market reacts to SEC’s next steps — any clarity (positive or negative) could drive ETH hard in either direction. -

Ethereum's surging transaction volume amid SEC’s staking pressure reveals how alive the network truly is. Rather than freezing up in fear, the ETH ecosystem seems to be adapting fast — whether through increased DeFi interactions, wallet shuffling, or staking strategy pivots.

Ethereum's surging transaction volume amid SEC’s staking pressure reveals how alive the network truly is. Rather than freezing up in fear, the ETH ecosystem seems to be adapting fast — whether through increased DeFi interactions, wallet shuffling, or staking strategy pivots.

It’s also worth noting that heavy volume in a time of uncertainty often signals that institutions or big players are repositioning. This isn’t just retail panic — it’s smart money movement.

It’s also worth noting that heavy volume in a time of uncertainty often signals that institutions or big players are repositioning. This isn’t just retail panic — it’s smart money movement.

🧠 Traders should keep an eye on both on-chain data and regulatory headlines. A breakout in either direction could be swift — and heavily backed by momentum already building under the surface.