💥 Bitcoin Treasuries Buy Big While ETFs Bleed $300M — Who’s Right? 💰📉

-

While crypto Twitter panics and ETFs dump, corporate treasuries just added 630 BTC (~$72M) to their stash this week — the largest daily buy in August.

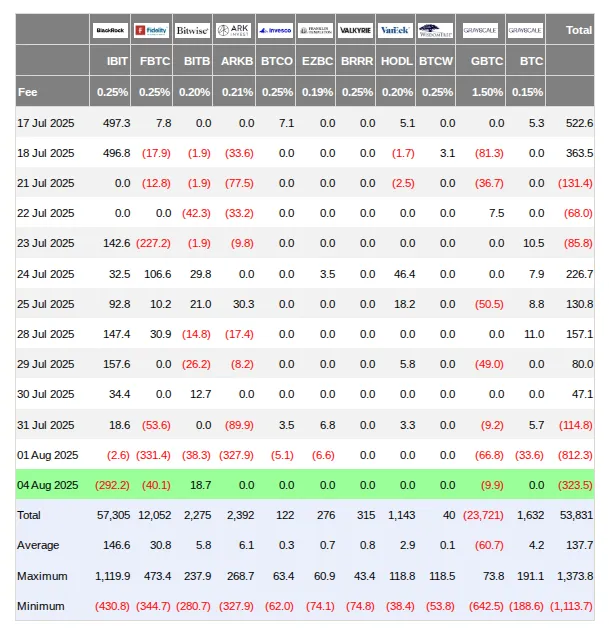

Meanwhile, spot Bitcoin ETFs lost $323.5M, with BlackRock’s iShares ETF (IBIT) alone offloading $292M — one of its biggest outflows of the year.

So who’s right?

According to Capriole Investments:

According to Capriole Investments:“Every time treasury sales exceed 1,500 BTC, it’s near a local bottom. Translation? Big buyers smell opportunity.”🧠 ETF expert @EricBalchunas says:

“Lots of dooming, but dip-buying has worked for decades.”Are whales buying the dip while retail shakes out again? Or is this just the calm before a deeper flush?

Would you follow treasuries or ETFs here?

Would you follow treasuries or ETFs here?

🟩 Buying the dip

🟥 Sitting it out

🟨 Waiting for $100K#Bitcoin #CryptoNews #BTC #ETF #Web3 #BuyTheDip #CryptoMarkets #CryptoStrategy #BTCprice #Investing

-

The fact that ETFs are seeing $300M outflows while treasuries are accumulating BTC is such a clear reminder that the market is layered. Institutions might be repositioning through ETFs for tactical reasons, but treasury-level buying indicates belief in long-term value.The big question is: will ETF outflows create enough short-term pressure to drag down price, or will treasury buys quietly absorb the sell-side and flip the trend? Either way, this post nails the core dilemma — and it's exactly what makes Bitcoin so unpredictable yet brilliant.

️

️

-

This divergence is fascinating — on one hand, ETFs are bleeding hundreds of millions, signaling short-term doubt or profit-taking. On the other hand, corporate treasuries are doubling down, which screams long-term conviction. These aren’t just two sides of the same coin — they reflect two completely different timeframes and mindsets.It’s possible both are “right” in their own context: ETFs cater to liquidity-driven traders, while treasuries are making decade-scale bets. But one thing’s for sure — when smart money buys the dip while the crowd exits, it usually tells you where the market’s really headed. 🧠