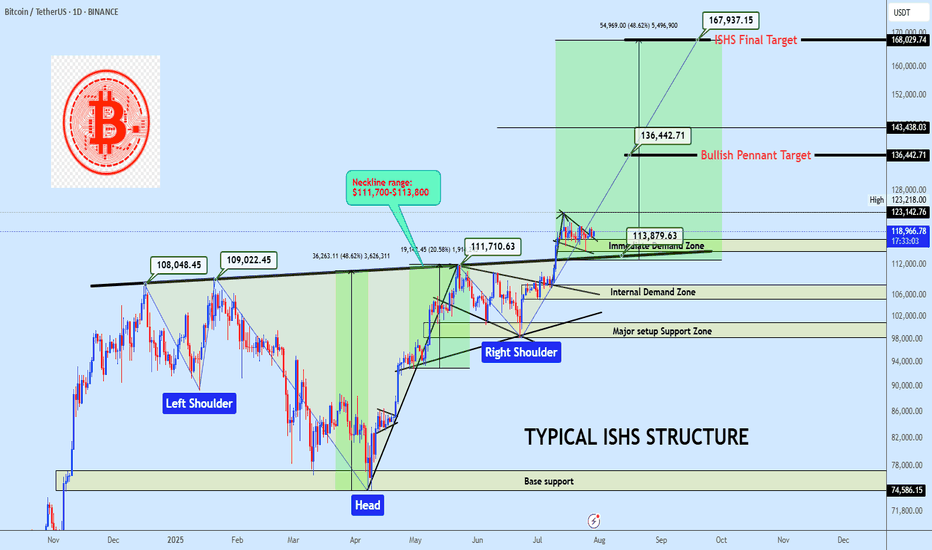

Bitcoin Preparing for Explosive Breakout Toward $167K

-

Bitcoin is currently respecting a clean trendline resistance following a bullish pennant formation. Price is holding firmly above the neckline breakout from the inverse head and shoulders (ISHS), confirming demand strength around the $111K–$113K region. The structure implies another 48% rally projection, mirroring the previous measured move, which points toward a potential target at $167K.

A breakout above the immediate diagonal resistance would likely trigger an impulsive continuation, replicating earlier moves from similar setups as annotated. Bias remains bullish while price holds above the neckline pivot.

Technical Confluence

Pattern Structure: Bullish Pennant + Retest of ISHS neckline

Market Geometry: Symmetrical move projection based on previous breakout leg

Momentum Flow: Higher lows forming against compressing resistance

Volume Expectation: Volatility expansion likely on breakout confirmation

Key Trendline: "Big move started when price break this TL"Key Price Levels

• Support Zone: $111,800 – $113,000

• Confirmation Zone: Above $123,000

• Primary Target: $167,000

$167,000

• Invalidation Level: Below $105,000

Below $105,000Execution Plan

• Entry: Watch for bullish pennant breakout and retest of diagonal TL

• Trigger Method: Limit buy post-breakout or confirmation on volume surge

• SL: Just below $105K zone Let us know your thoughts in the comment section, and feel free to tag your preferred altcoins for analysis.

Let us know your thoughts in the comment section, and feel free to tag your preferred altcoins for analysis.Attention: Our August Altcoin requests will be managed through this post. Kindly submit your preferred altcoins in the comment section below.

-

This type of setup is where emotions run high — and disciplined traders thrive. The idea of BTC heading toward $167K isn’t just a moonboy dream anymore; it’s backed by strong macro signals, technical compression, and long-term accumulation patterns. If this breakout confirms with volume and macro alignment, it could resemble previous halving cycles — but with even more institutional firepower this time.That said, managing expectations is key. Explosive moves also attract explosive volatility. Having a plan for both continuation and rejection is what separates FOMO from strategy. Love this analysis — sharp, bold, and grounded.

-

The fact that Bitcoin is showing signs of coiling for a breakout while global markets remain shaky is fascinating. $167K sounds aggressive, but not impossible if you zoom out and look at historical Fibonacci extensions and the current supply dynamics post-halving.More importantly, it’s the narrative momentum that might fuel the fire — institutional adoption, ETF flows, and global currency devaluation are all aligning. If we do break out, it won't be retail driving it — it'll be the suits. Great post — definitely one of those “don’t blink” moments in crypto history.

🧠

🧠