Yoga Pants, Tariffs, and Upside: The $LULU Bet

-

Lululemon LULU - My Investment Thesis

Hey team,

I've been keeping an eye on LULU for a while, and I'm finally going to pull the trigger.

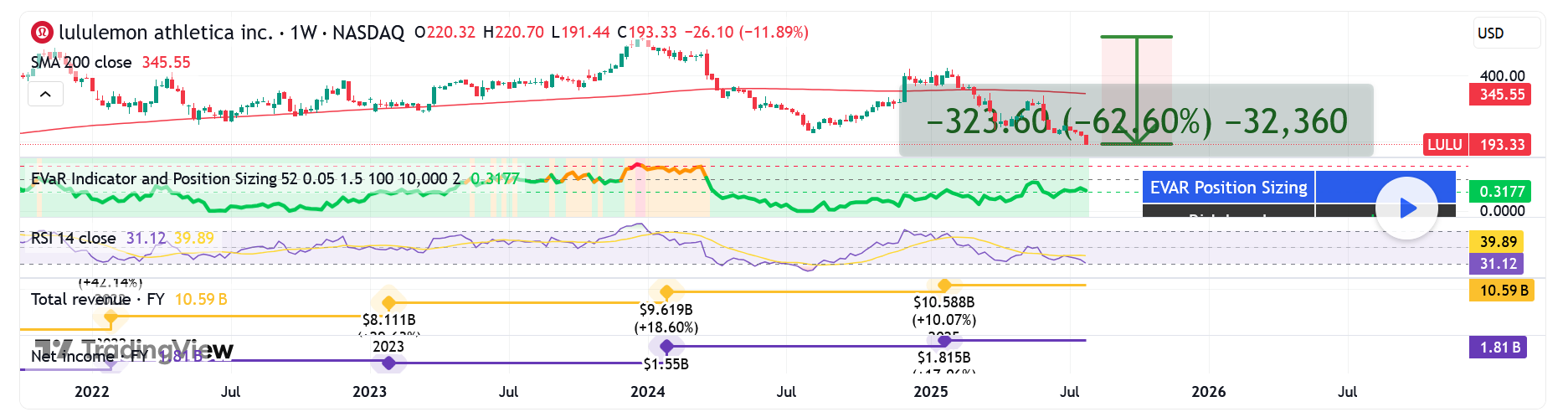

In this market of overhyped MAG 7 stocks, Lululemon dropped 62% since its high in Dec. 2023 until now.Here's why I'm into LULU:

Revenue has been growing every year for 5 years. Still, the stock is at its lowest in 5 years. Growth has been slower in the US but good in Asia. Net income has also been growing over the last 3 years. P/E ratio is at 13, the lowest in many years. Stock is also beat up because of the tariffs. Analysts at Morningstar put its fair value at $305 (now $193, giving it an upside of 58%). Product Innovation: New franchises like Daydrift, Shake It Out, and Align No Line have been well-received and will continue to drive sales. Lululemon recently announced an expansion into India for 2026, with plans to open a physical store and a partnership with Tata CLiQ, the e-commerce arm of India’s largest business conglomerate, Tata Group. India can be a huge market for Lulu. There's also intense competition and margin erosion. Saying this, I kinda see people around me less excited about Lululemon products.Technical Analysis:

My EVaR - Entropic Value at Risk - is in a low risk area. RSI is oversold. Price has been under the 200 MA for too long.I'm going to proceed with caution on this one, and allocate approximately. 0.5% of my portfolio into it.

Quick note: I'm just sharing my journey - not financial advice!

-

Really appreciate the detailed breakdown — especially the combo of fundamentals and technicals. The undervaluation case with that 13 P/E and upside to $305 is compelling. India expansion with Tata CLiQ sounds like a smart long-term move too. 0.5% allocation sounds cautious but calculated. Good luck with the position!

-

Interesting breakdown. The India expansion angle feels like a real catalyst if they execute well. Curious to see how competition impacts margins over the next few quarters.