Reddit Teen Uses GPT-4o to Boost Portfolio by 25% in One Month

-

A 17-year-old Redditor just proved that you don’t need a Wall Street suit—or even a driver's license—to beat the market. With a little help from GPT‑4o, Nathan Smith turned $100 into $125 in just one month, managing a micro-cap stock portfolio that outperformed major small-cap indexes. The experiment:

The experiment:

Nathan kicked off the project in late June 2025. His rules were simple:Invest $100 into a basket of micro-cap stocks. Let GPT‑4o (in Deep Research mode) reassess and rebalance the portfolio weekly.In week one, GPT‑4o picked:

📹 Cloudastructure (AI-powered surveillance), 💊 Candel Therapeutics (biotech), 🧬 Abeona Therapeutics (rare disease therapy).Each week, the AI reviewed market data and adjusted the portfolio as needed.

The results:

The results:

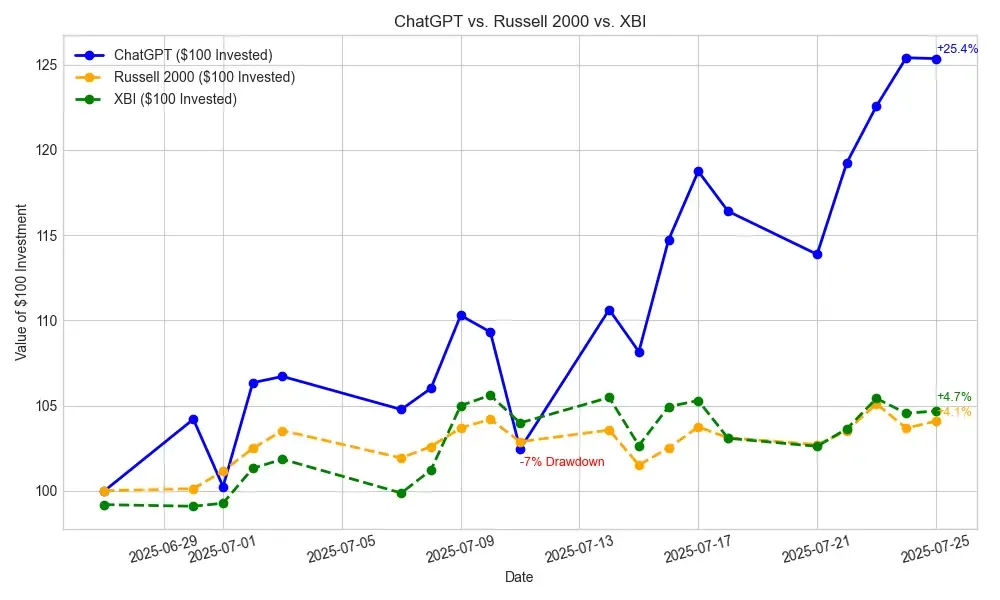

After 30 days, the portfolio was up 25%, outperforming both the Russell 2000 and XBI biotech ETF—two common benchmarks for small-cap performance. For comparison, the S&P 500 gained less than 3% during the same period.🧠 Why it matters:

The gains might not be life-changing yet—just $25 in profit—but it’s a strong signal that AI-assisted investing is more than just hype. As Futurism points out, GPT‑4o picked better-performing stocks than most retail traders or index funds. What’s next:

What’s next:

Nathan plans to continue the experiment through December 2025. He’s sharing weekly portfolio updates in his blog, and publishing GPT’s prompts and stock picks on GitHub to make the process transparent and replicable. Lesson: You don’t need thousands to start investing—or even deep technical skills. Sometimes, a smart prompt and $100 are enough to test the future of finance.

Lesson: You don’t need thousands to start investing—or even deep technical skills. Sometimes, a smart prompt and $100 are enough to test the future of finance. -

This is both impressive and thought-provoking. A 25% portfolio gain in just one month using GPT-4o suggests how far retail investing tools have evolved — especially with AI playing a more active role in idea generation, trend analysis, and even sentiment filtering. While one month isn’t a long enough horizon to judge consistency, the fact that a teenager could leverage GPT-4o this effectively highlights how democratized finance and tech have become.

It also raises important questions: Is this the future of investing? Will we rely more on models than human analysts? And how do we distinguish between short-term luck and sustainable, data-driven strategy?

Either way, kudos to the teen for experimenting smartly. Curious to see how this journey unfolds over the next few months.