🇯🇵 Japan’s New Crypto Tax Plan: What’s Changing, and Why It Matters

-

Crypto investors in Japan could soon catch a much-needed break. On June 24, 2025, Japan’s Financial Services Agency (FSA) proposed a major reclassification of crypto assets — treating them like traditional financial instruments (e.g., stocks and bonds) under the Financial Instruments and Exchange Act (FIEA).

If approved, this new regime will go live in 2026, and it’s shaping up to be one of the most investor-friendly tax systems in the world of crypto.

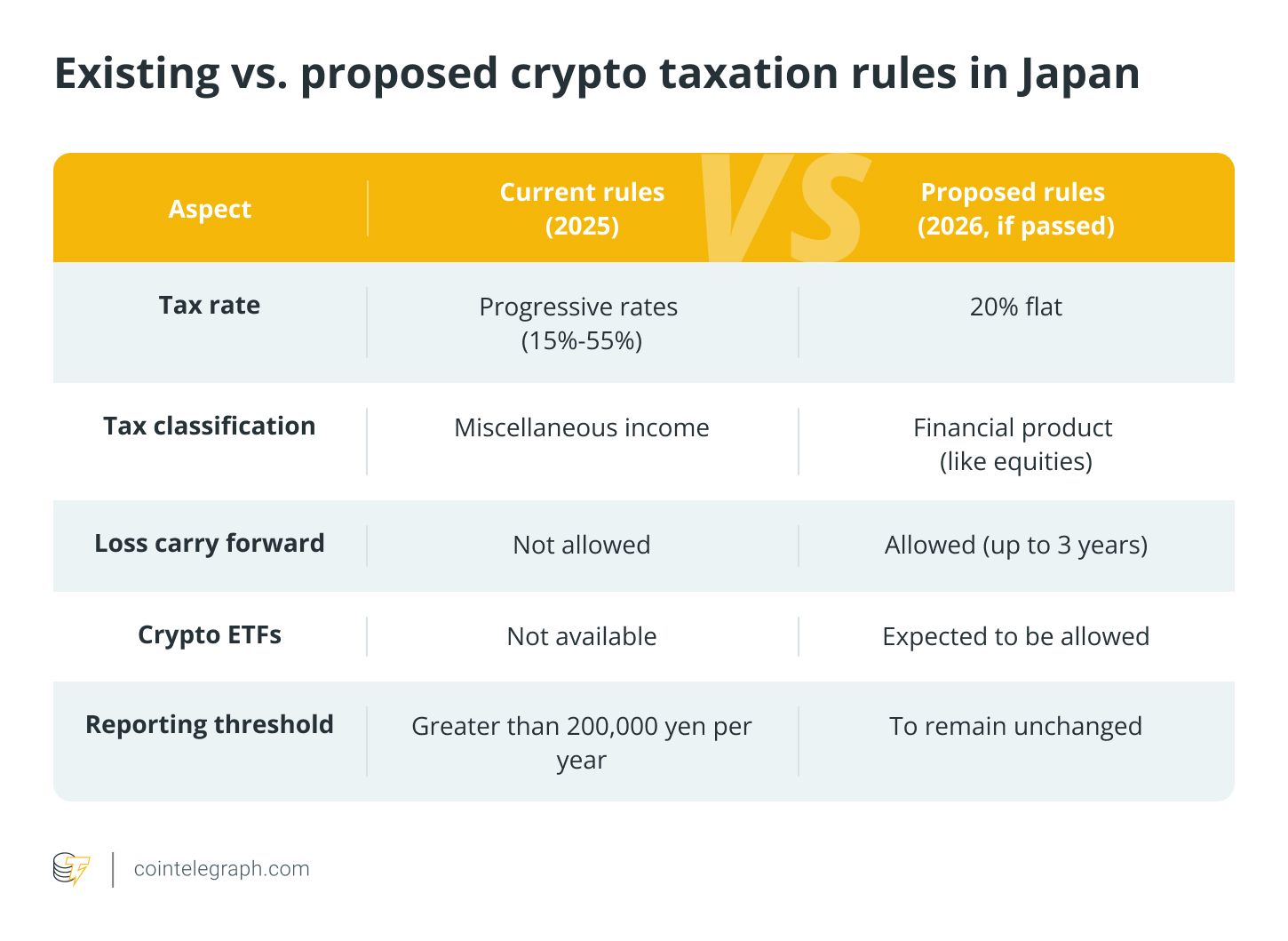

Current vs. Proposed Tax Structure in Japan

Current vs. Proposed Tax Structure in JapanCurrent (as of 2025):

Crypto profits are classified as miscellaneous income. Taxed on a progressive scale from 5% up to 55% (including local taxes). No loss carry forward — losses cannot be offset against future gains. High burden for frequent traders and high-income earners.Proposed (2026 onward):

Crypto profits taxed like capital gains from stocks and bonds. Lower, flat tax rate (still to be confirmed, but likely under 20%). Loss carry forward for up to 3 years, giving flexibility during market downturns. Applies under a unified legal framework (FIEA), bringing more clarity and investor protections. Why This Matters

Why This MattersThe move is part of Japan’s broader “New Capitalism” initiative, which seeks to drive investment-led growth. By giving crypto similar treatment to stocks and bonds, Japan signals it’s ready to compete globally as a digital asset hub.

The shift comes as other major economies tighten regulation, while Japan looks to attract innovation and capital with clearer, fairer tax rules.

What Triggers Tax Under the New Regime?

What Triggers Tax Under the New Regime?You’ll still need to pay tax when you:

Sell crypto for fiat (e.g., JPY or USD) Swap one crypto for another Use crypto to pay for goods or services Earn crypto via mining, staking, airdrops, etc.🧠 Pro Tip

Keep detailed records of every crypto transaction — trades, swaps, staking rewards, and transfers — including wallet-to-wallet activity. When the new rules go into effect, you’ll want clean books for any carryforward losses or tax reporting.

Japan’s Crypto Regulation Timeline (Highlights)

Japan’s Crypto Regulation Timeline (Highlights)2014: Mt. Gox collapse triggers first major regulations. 2017: Bitcoin recognized as legal payment method. 2020: Custody rules and investor protections added. 2022: Japan becomes first major economy to regulate stablecoins. 2025: FSA proposes full crypto reclassification as securities.🧠 Did You Know?

Japanese firm Metaplanet is now the fifth-largest public Bitcoin holder, with 15,555 BTC on its books (average price ~$99,985/BTC). They’re even planning to leverage it for digital banking plays — a major signal of long-term confidence in BTC.

Final Thoughts

Final ThoughtsJapan has long been strict on crypto taxes. But 2026 may flip the script.

If this new structure passes, Japan could go from “high-tax headache” to “investor paradise” — setting the stage for a fresh crypto boom in Asia.

Whether you're trading, holding, or building in Web3, this shift could be a game changer.

Stay updated, log everything, and prep for opportunity. Japan’s new tax rules may reward the early movers.

Stay updated, log everything, and prep for opportunity. Japan’s new tax rules may reward the early movers.Want a breakdown of how this affects staking, DeFi, or DAOs in Japan? Drop a comment and let’s dive deeper.

-

This is a major step in the right direction. Treating crypto like stocks under FIEA adds clarity and reduces compliance stress. Loss carryforward is especially big for active traders who’ve been hammered in past cycles. Now, let’s see how they handle DeFi staking and NFT income...

-

Japan is positioning itself smartly. While the U.S. clamps down and the EU gets bogged in MiCA complexity, Japan might just become the most builder-friendly destination in Asia. Between clearer rules and lower taxes, this could kick off serious Web3 migration.